Amusing Ourselves To Death

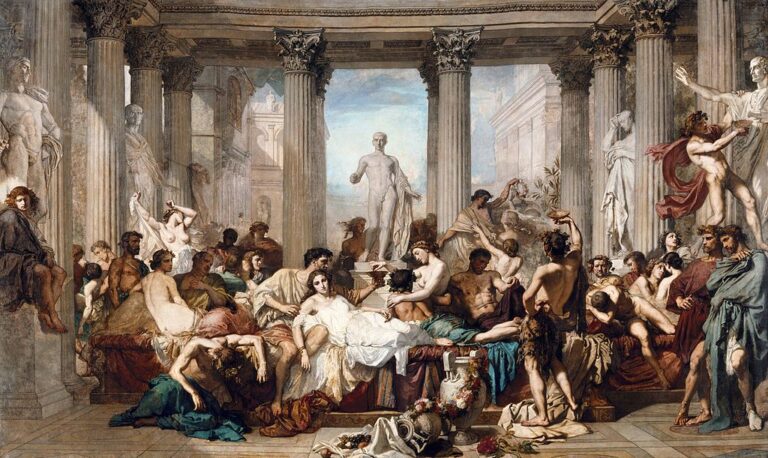

Give them bread and circuses and they will never revolt – Juvenal, Roman poet The decline of Rome was the natural and inevitable effect of immoderate greatness. Prosperity ripened the principle of decay; the cause of the destruction multiplied with…