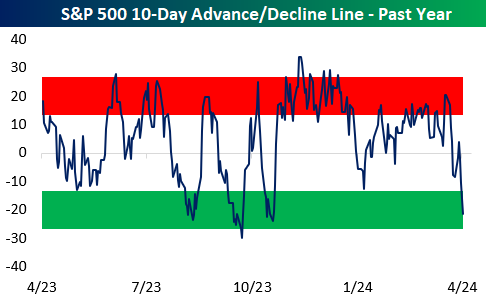

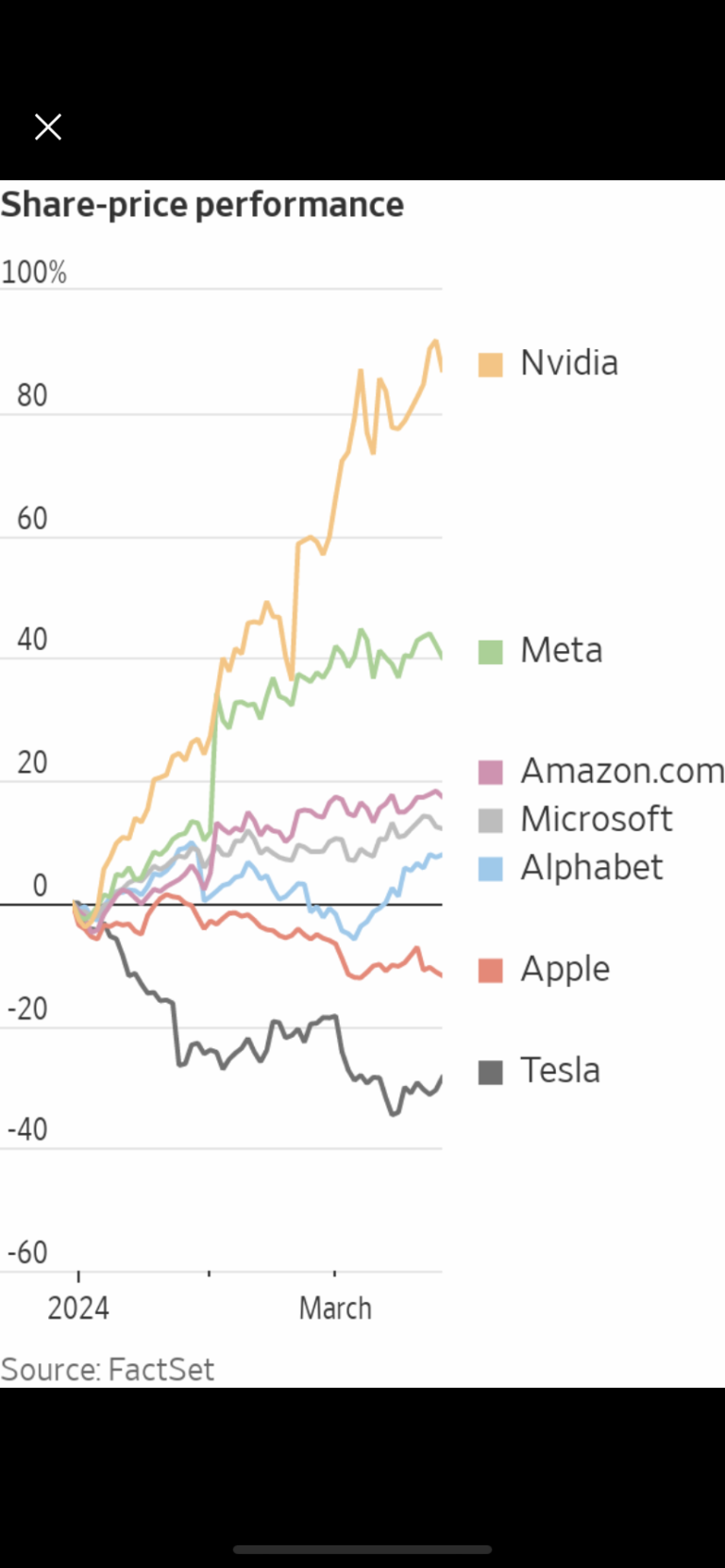

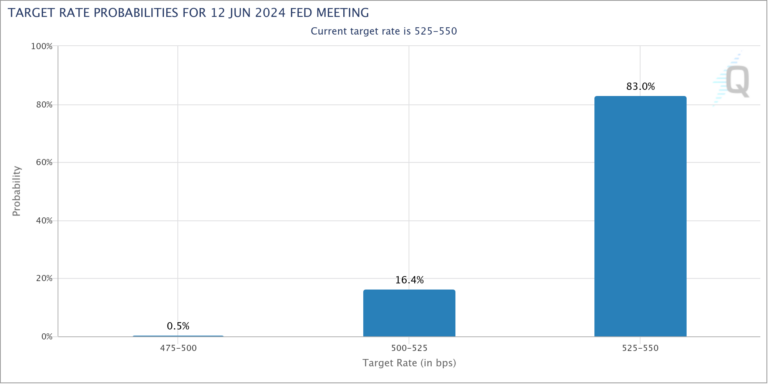

Return Of The Bear, The Magnificent 7 Are Next, TLT $115

Early Saturday morning – even before Iran fired missiles at Israel – I wrote that the bear market was on the cusp of being resumed. In fact, I literally guaranteed it at the end of the accompanying YouTube video I…