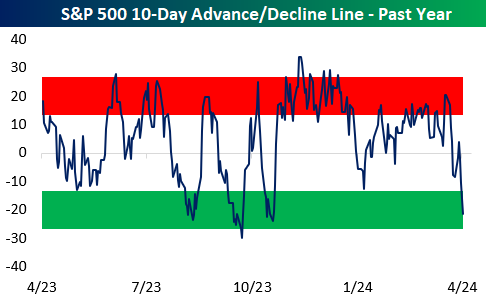

The Bear Market Rally Of Oct22-Mar24 Is Over

The bear market rally which began on October 13, 2022 with an intraday low of 3,492 topped on March 28, 2024 with an intrday high of 5,265. From top to bottom the S&P rallied about 50%. It has been well…

The bear market rally which began on October 13, 2022 with an intraday low of 3,492 topped on March 28, 2024 with an intrday high of 5,265. From top to bottom the S&P rallied about 50%. It has been well…

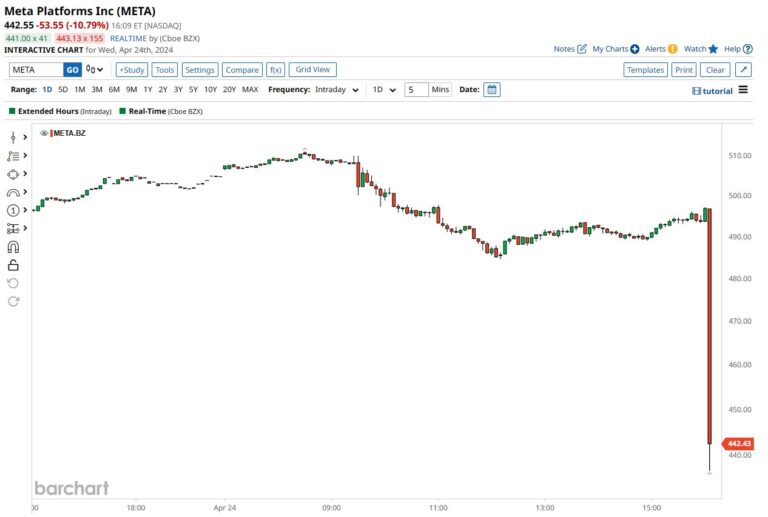

Facebook (META) just reported an excellent 1Q24 – but the stock is off 12% in the after hours. Revenue was +27% and EPS +114% to $4.71 compared to the year ago quarter. Operating margin of 37.9% compares to 25.2% a…

It’s all part of the puzzle – Warriors General Manager Mike Dunleavy (quoted in “Can team fit familiar 3 pieces together?” [SUBSCRIPTION REQUIRED], Ann Killion, SF Chronicle B1, Sunday 4/21 After the Warriors unceremonious loss to the Sacramento Kings last…

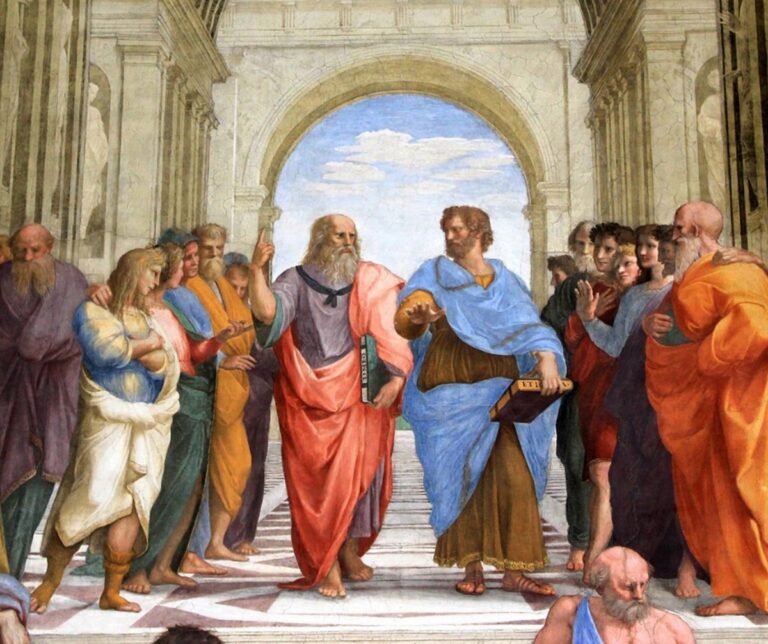

Give them bread and circuses and they will never revolt – Juvenal, Roman poet The decline of Rome was the natural and inevitable effect of immoderate greatness. Prosperity ripened the principle of decay; the cause of the destruction multiplied with…

I was born on April 4, 1977 at Stanford Hospital in Palo Alto, CA. My parents – Robert and Diane – were the first generation children of Jewish mother immigrants from Europe. My grandmother on my father’s side, Ethel, came…

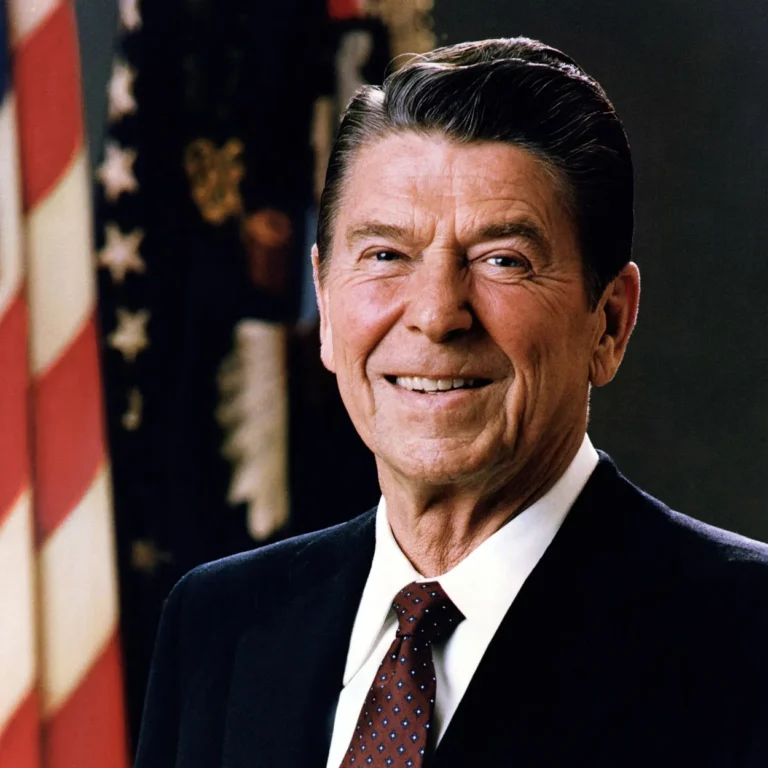

In his seminal 1994 talk at USC’s Business School, Charlie Munger – the greatest mind ever to apply himself to investing – started by saying “the art of stock picking [is] a subdivision of the art of worldly wisdom”. Munger…

Early Saturday morning – even before Iran fired missiles at Israel – I wrote that the bear market was on the cusp of being resumed. In fact, I literally guaranteed it at the end of the accompanying YouTube video I…

The Golden State Warriors of the last 15 years – led by Steph Curry, Klay Thompson and Draymond Green – are one of the greatest dynasties in the history of the game. They rank right up there with the Magic/Worthy/Kareem…

Painting: The Romans In Their Decadence (1847), Thomas Couture There will be wars the like of which have never yet been seen on earth – Nietzsche, Ecce Homo (1888) Rome was not destroyed by external enemies, but by internal strife. The empire…

I wouldn’t be taking as big of a risk because of valuations. It’s terrifying how narrow the rally has been. You need growth to surprise to the upside. If not, high multiples can get compressed, and that can happen quickly….