Is The Commodity Rally A Head Fake?

China’s strategic stockpiling and replacement of lower-quality domestic production with higher-quality imports have supported the recent rally in prices for many base metals, but we will not see a sustainable turnaround in demand until the major economies of the U.S., Europe, and Japan recover.

– Terry Famous, Moody’s Investor Services

The past two weeks have been nuts and, rather than cheering this sudden comeback of the dry bulk market, I do have a considerable amount of concern that we are seeing the same bubble again. And like that past bubble, it’s not going to sustain.

– Kenneth Koo, Chairman and Chief Executive of the Tai Chong Cheang Steamship Company, a big Hong Kong shipping line

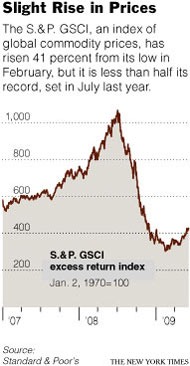

Along with the stock market, commodities have been going bonkers over the last few months. Oil has almost doubled to $72 a barrel. Copper is up to $2.50 from around $1.50. Bulls interpret this as a sign of a recovering global economy. But there is reason to think it’s just a head fake – and that it will end the same way last year’s commodities bubble did (For what it’s worth, I was all over that one last year: “The Current Leaders Will Be Taken Out Back And Shot Before It’s Over”, Top Gun FP, July 8, 2008).

An interesting article in today’s New York Times suggests a lot of this rally could have to do with stockpiling by China – and not with a recovering global economy: “China’s Commodity Buying Spree”, The New York Times, June 11.

Read the article and pay special attention to the perspectives of the shipping and commodity trading executives. These guys are on the ground and they know what’s going on.

Disclosure: Top Gun is short Freeport McMoran (FCX) and Brazil ETF (EWZ).