NOTE: Every week or two I write a Client Note for my clients. For a limited time, I am allowing non-clients to sign up and receive it at the same time as my clients. You can sign up at the top right hand corner of the website. I will also be posting the notes on my blog with a time delay from time to time.

Originally sent to clients Tuesday, December 6.

*****

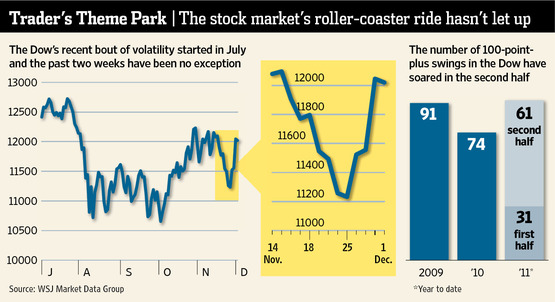

The wild swings continued the last two weeks with the S&P dropping 4.7% Thanksgiving week on concerns about Europe but reversing course last week (+7.4%) on hopes for a European solution.

December is historically one of the best months for the stock market. The main reason for this is Wall Street’s desire to post a good year for customers. With news flow light and many on vacation for the holidays, the big banks and hedge funds also have greater capacity to move the market and shape perception. Obviously the news flow out of Europe this year is anything but light.

This week everybody is looking forward to the European Summit on Thursday and Friday (Dec 8 and 9). The expectation appears to be an agreement for stronger budget rules for EU members in exchange for increased bond market purchases by the ECB. Of course, the agreement is implicit because the ECB is supposed to be above politics.

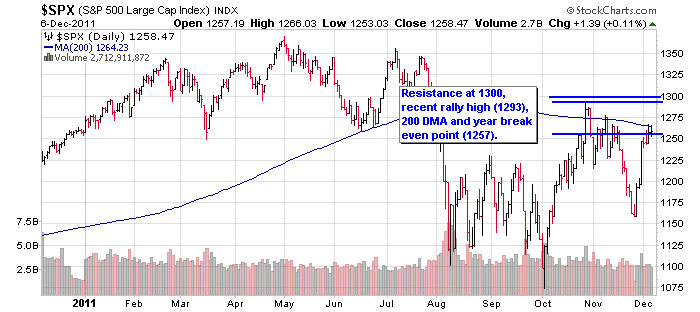

Counteracting positive seasonality is a good deal of technical resistance. The market is trading not far from the recent rally highs (1293), 200 DMA (1264) and year break even point (1257).

Imagine a bunch of helium balloons in a room. The balloons rise up to the ceiling where they remain until the helium starts to leak out. The helium is seasonality and the ceiling is technical resistance.

*****

November returns were as follows:

Top Gun: +4.28%

S&P: -0.51%

DJ Total: -0.65%

YTD (through November 30th) returns are as follows:

Top Gun: +5.12%

S&P: -0.85%

DJ Total: -1.89%

NOW IS THE TIME TO INVEST WITH TOP GUN OR ADD FUNDS IF YOU ARE ALREADY A CLIENT.

CALL OR E-MAIL ME TO GET THINGS STARTED!

Greg Feirman

Founder & CEO

A Registered Investment Advisor

9700 Village Center Dr. #50H

Granite Bay CA 95746

(916) 224-0113