NOTE: Every week or two I write a Client Note for my clients. For a limited time, I am allowing non-clients to sign up and receive it at the same time as my clients. You can sign up at the top right hand corner of the website. I will also be posting the notes on my blog with a time delay from time to time.

Originally sent to clients Tuesday March 8.

*****

I’m bi-winning. I win here and I win there.

– Charlie Sheen

Fueled by tiger blood and Adonis DNA, the market was bi-winning for the 12 weeks starting December 1st through February 18th.

But the tone has changed over the last two and a half weeks. The market now seems bi-polar. Whereas the previous 12 weeks were a steady drift higher, the last 11 trading days have been characterized by erratic swings in both directions.

Technically, the stage is set for a move one way or the other. The S&P is trading in a tight range defined by the Feb 18th highs of 1343 and recent support at 1300. Notably, 1300 also happens to be the 50 DMA which has provided support during the six-month rally.

Most of the attention is on Libya and oil prices. Indeed, it cost me more than $70 to fill up my car on Saturday night at $3.899/gallon.

*****

Investors should view June 30th, 2011 not as political historians view November 11th, 1918 (Armistice Day – a day of reconciliation and healing) but more like June 6th, 1944 (D-Day).

Washington, Main Street, Wall Street await the outcome. Because QE has affected not only interest rates but stock prices and all risk spreads, the withdrawal of nearly $1.5 trillion in annualized check writing may have dramatic consequences in the reverse direction.

But soon the markets focus will also turn to the upcoming Fed Meeting next Tuesday (March 15). The recent 6-month rally has neatly coincided with expectations for – starting at the end of August – and the realization of – in November – QE2.

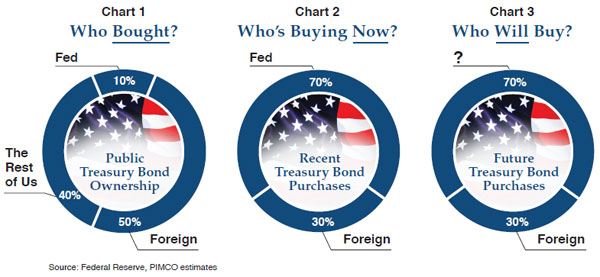

QE2 is set to expire on June 30, 2011. In his piece, Bill Gross provided three charts. The first one breaks down ownership of the $9 trillion in publically held Treasury notes and bonds. The second one shows who has been buying them over the last year. The third one raises the question:

Who will buy Treasuries when the Fed doesn’t?

Not too long from now, the market will start pricing in its expected answer to that question. That answer will hold the key to the financial markets and economy going forward.

NOW IS THE TIME TO INVEST WITH TOP GUN: If you have been thinking about investing with Top Gun, now is a good time to give me a call or shoot me an e-mail.

Greg Feirman

Founder & CEO

A Registered Investment Advisor

9700 Village Center Dr. #50H

Granite Bay CA 95746

(916) 224-0113

CALL NOW FOR A FREE CONSULTATION BY PHONE OR IN PERSON!