NOTE: Every week or two I write a Client Note for my clients. For a limited time, I am allowing non-clients to sign up and receive it at the same time as my clients. You can sign up at the top right hand corner of the website. I will also be posting the notes on my blog with a time delay from time to time.

Originally sent to clients Wednesday March 16.

*****

The tsunami that hit Japan last Friday – including the damage done to a nuclear facility – is dominating markets this week. I pray that the worst is past and wish the Japanese people a speedy recovery.

All of the stock market’s 2011 gains have been wiped out. What took 34 trading days to build have been erased in 17:

CLOSING PRICE

Index 12/31/10 3/16/11 % Change

S&P 1257.64 1256.88 -0.06%

Dow 11,577.51 11,613.30 +0.31%

Nasdaq 2652.87 2616.82 -1.36%

Russell 783.65 781.90 -0.22%

In addition to worries about Japan’s nuclear facility, two major analyst downgrades played a role in today’s selloff. JPM Securities analyst Alex Guana

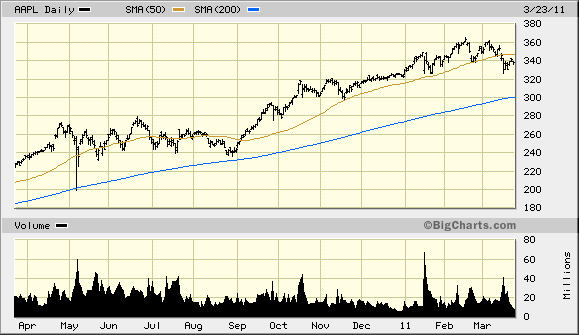

downgraded Apple from Buy to Hold based on a deceleration in data he tracks. Apple lost more than $15 (4.5%) on strong volume today. Bernstein analyst Tony Sacconaghi

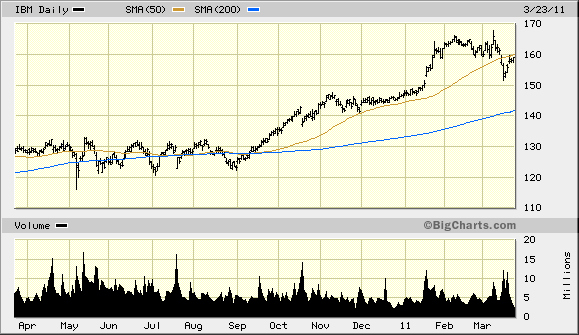

downgraded IBM from Buy to Hold saying that the stock is “approaching fair value”. IBM lost $6 (3.8%) also on strong volume.

Both of these stocks are market leaders and have an outsized impact on their respective indexes. With a market cap over $300 billion, Apple leads the market-cap weighted Nasdaq. At $153, IBM leads the price-weighted Dow. In fact, IBM accounted for 45 of the Dow’s 242 point drop today (19% of the total).

Charts of both stocks show topping formations and about 10% downside before any real support at their 200 DMAs. A chart of the S&P 500 looks similar with room to run down to its 200 DMA rising towards 1200.

NOW IS THE TIME TO INVEST WITH TOP GUN: If you have been thinking about investing with Top Gun, now is a good time to give me a call or shoot me an e-mail. Current client references are available.

Greg Feirman

Founder & CEO

A Registered Investment Advisor

9700 Village Center Dr. #50H

Granite Bay CA 95746

(916) 224-0113

CALL NOW FOR A FREE CONSULTATION BY PHONE OR IN PERSON!