A Close Read of Crescat’s March Letter “A Collision of Macro Narratives”

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

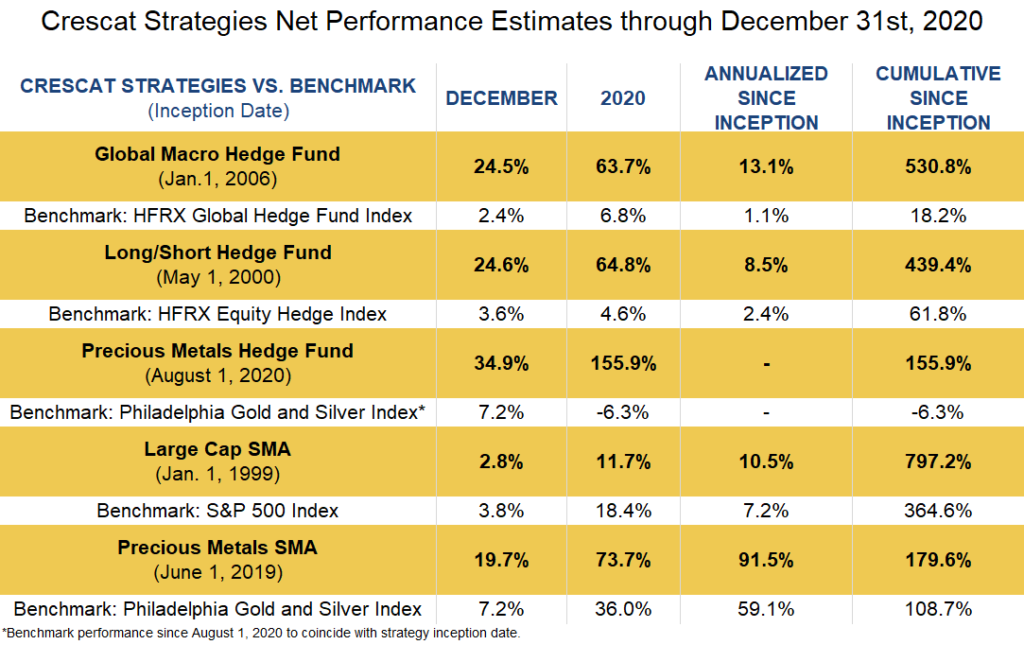

Crescat Capital is a small, 10 person, $200 million hedge fund based in Denver, CO headed by Kevin Smith that I discovered last year and believe to be the best money manager in the world today. That’s because their macro perspective is far better than anybody’s else’s out there that I’ve seen. Despite an overriding macro theme long precious metals and short stocks, Crescat was able to return 60%-plus in 2020 in its Global Macro and Long/Short hedge funds.

I thought their March Letter, “A Collision of Macro Narratives”, especially good and want to review it here in detail. They begin the letter by contrasting the two main “macro narratives” out there. The first is the “Reflationary Thesis” in which the reopening of the economy as COVID is contained leads to an early 1920s type boom. This is the bulls’ narrative and the one dictating financial market prices at the moment.

They characterize the opposite “macro narrative”, the bearish one, as Deflationist. “The Deflationistas” believe the stock market is a bubble that will implode shortly leading to a deflationary melt down:

In a deflationary reset, the debt burden tends to suck the liquidity out of the financial system causing a stock market crash, rising unemployment, and depressed consumer prices while money velocity collapses.

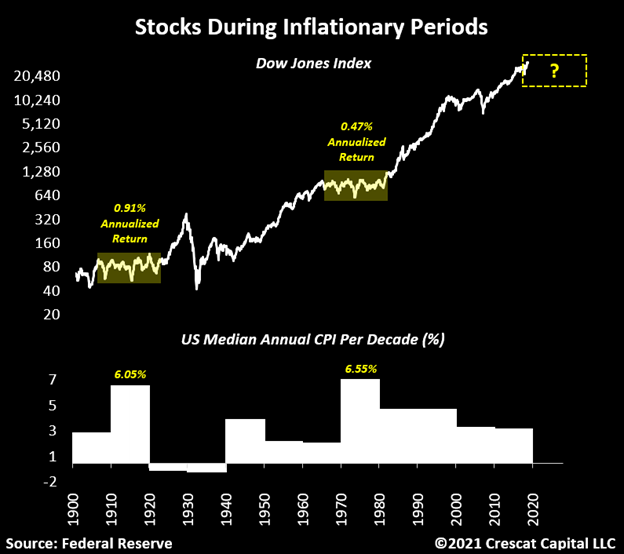

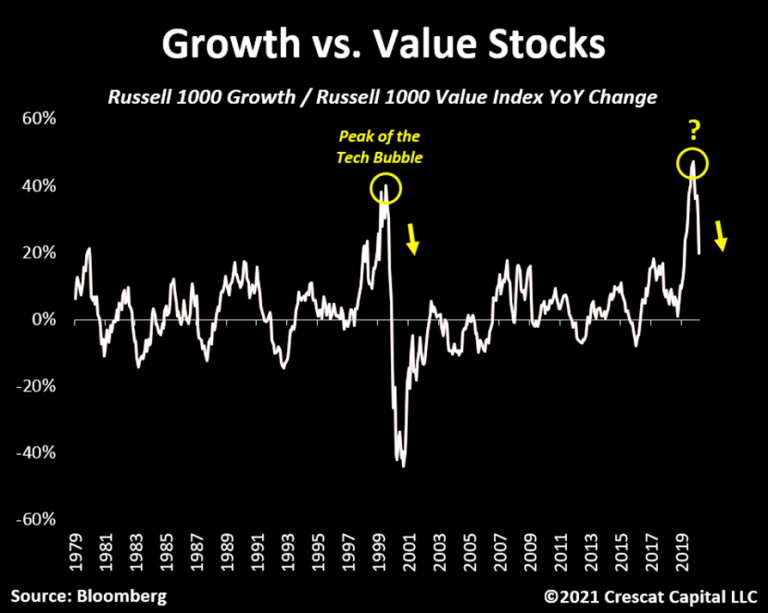

Crescat finds itself in the middle of the two positions, though squarely in the bearish camp with respect to stocks. They agree with the Reflationists that the reopening of the economy will lead to significantly increased economic activity, perhaps even a boom, but disagree that this will lead to a corresponding continuation in the rise of stock prices becaue it’s already priced in. Contrary to the Deflationists, Crescat believes that the inflationary forces unleased by monetary and fiscal responses to the coronavirus will leak out of asset markets and into the real economy creating inflation this time, unlike in 2008 when inflationary forces were contained within asset markets. Therefore, the catalyst for the stock market crash this time around will be inflation, which was poison for stocks in the 1910s and 1970s. This economic boom, therefore, could paradoxically be paired with a financial market meltdown in 2021.

There is a high probability that the same disconnect between financial markets and the economy we had last year might redevelop in 2021. However, instead, the roles will likely be reversed. We believe most of the good news about the reopening of the economy is already priced in.

Their Macro Thesis is the same as mine:

It comes down to our primary macro call: long commodities and short equities, but especially long precious metals.

Being a precious metals bull has been extremely painful the last eight months. Yesterday was no exception with gold closing below $1700 after being above $2000 in August 2020. The Junior Gold Miners ETF (GDXJ) is 23% off its August 2020 highs and at crucial support. (In fact, it is actually worse than the chart makes out because the GDXJ was -4.43% Tuesday to $43.55).

Nevertheless, Crescat points out that there is a huge disconnect between the stock prices and the fundamentals of the gold and silver miners:

Gold and silver companies continue to report exceptionally strong fundamentals. Free cash flow estimate for miners keeps improving despite the recent correction in precious metals…. Stocks tend to follow fundamentals. We believe there is a major catch up in prices ahead of us.

I am in almost complete agreement with Crescat’s macro view and highly recommend a close reading of their March Letter.