ATHs, Fund Managers Are All-In, PG Earnings

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

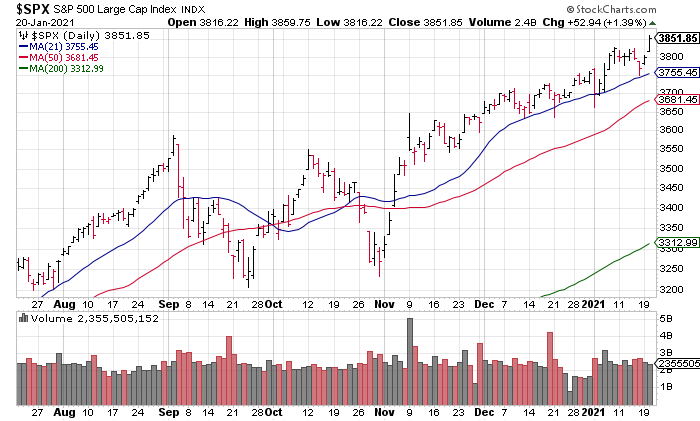

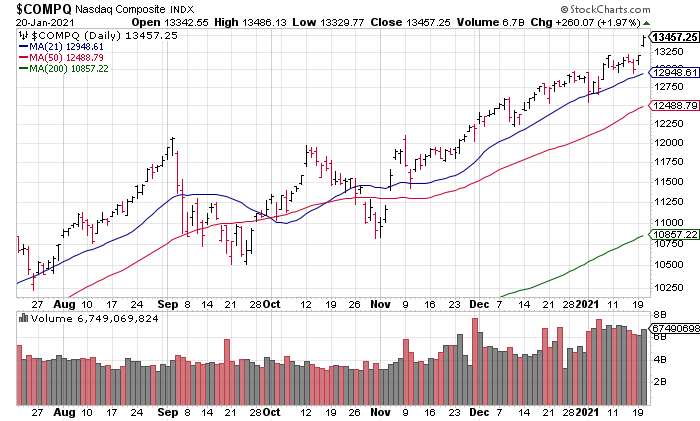

This market is relentless. On Sunday, I was writing about support at the 21 DMA after some faulty action Thursday and Friday. Two trading days into the week and the S&P and NASDAQ have soared to new ATHs of 3,852 and 13,457, respectively. Despite being an undoubted humdinger of a bubble, there is no suggestion in the price action that we are at the top.

I have written a lot recently about the risky behavior of retail investors such as piling into call options, record margin, microcap and penny stocks, etc… That type of behavior continues unabated as pointed out in yesterday’s WSJ by James Mackintosh who showed that lower price and microcap stocks are outperforming so far this year. Mackintosh’s interpretation: “The pattern could partly be the result of the widespread willingness to pile on risk, because rules on penny stocks and delisting make certain types of stocks riskier” (“When Investors Forget Fundamentals, The Market Is Broken”, WSJ, January 20 [SUBSCRIPTION REQUIRED]).

Professional fund managers are now All-In as well. According to the monthly Bofa Fund Manager’s Survey, the fund managers surveyed are taking the most perceived risk in more than 20 years (Chart Source: “Fund managers are taking a record level of risk”, Sentimentrader, January 20 [SUBSCRIPTION REQUIRED])

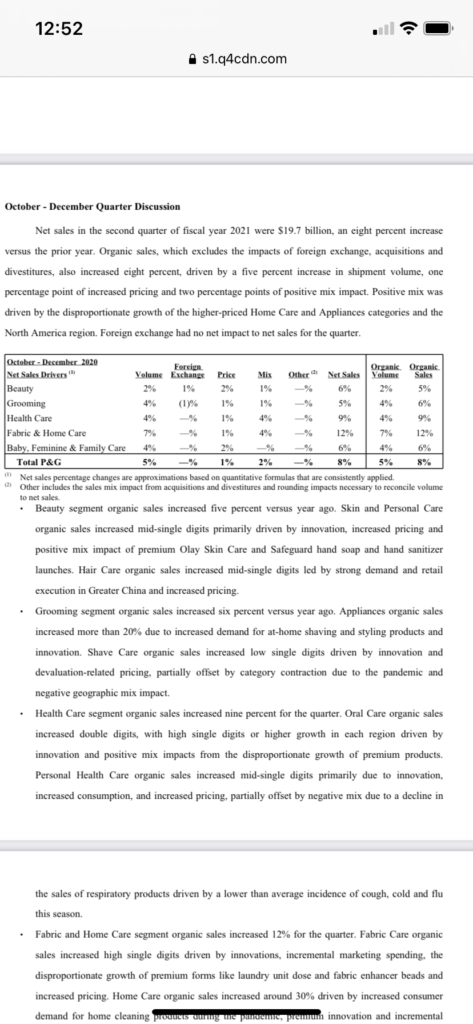

Lastly, I want to talk about Proctor & Gamble (PG, $345 billion market cap) earnings. PG reported a strong quarter FY2Q Wednesday morning with Organic Sales +8% and Core EPS +15%. They also slightly raised full year Organic Sales and Core EPS guidance. However, even a blue chip consumer staple like PG is not in demand at the moment and investors sent shares down 1.67% an almost 2x average volume. PG is worth a look at the 200 DMA ~$130 where it would trade for a forward P/E of 23x.