Bank Earnings, Gold Vs Bitcoin

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

Yesterday (Wednesday) 1Q21 earnings season got off to a strong start with reports from JP Morgan (JPM), Wells Fargo (WFC) and Goldman Sachs (GS). Let’s take a look at each in turn.

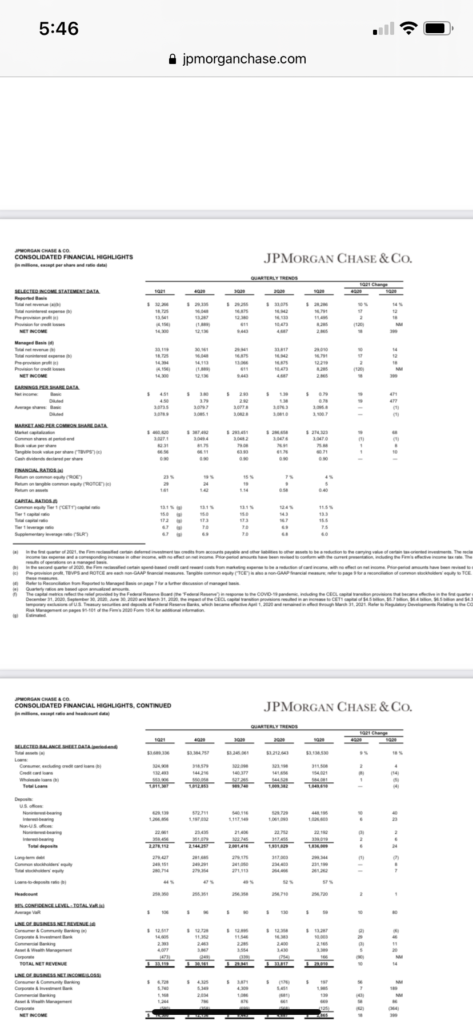

Let’s start with the biggest JPM (Market Cap $465 Billion). JPM reported a 10% increase in Revenue and 19% increase in Net Income to $4.50/share from $3.79/share compared to the 4Q20. While the former is solid, the latter was aided by a $5.2 billion release of provision for credit losses which works out to $1.28 per share. It was probably for this reason that JPM’s report was the least well received of the three with shares off 1.87% yesterday.

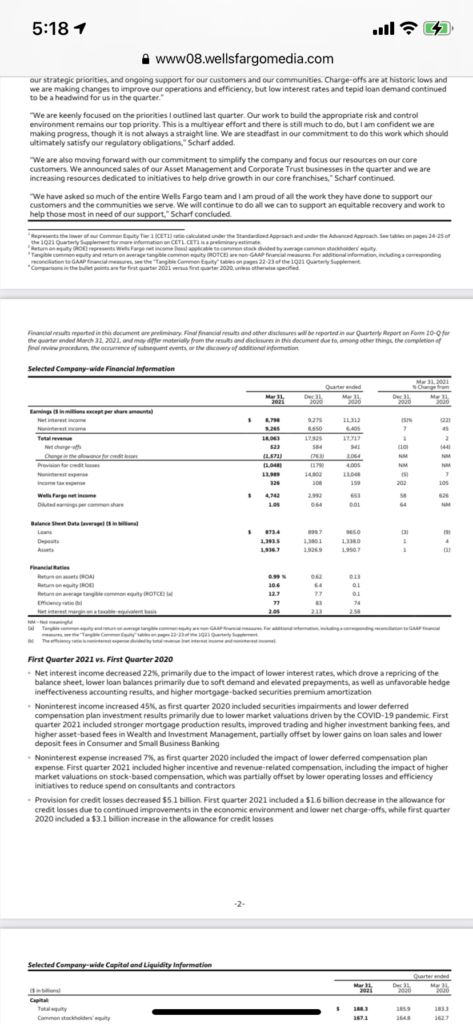

Now let’s take a look at WFC (Market Cap $175 Billion). Revenue was +1% and Net Income +64% to $1.05/share from 65 cents/share compared to the 4Q20. They released $1.571 billion in provision for credit losses or 28 cents/share pretax. Non performing assets as a % of total loans was 0.95% at the end of the quarter. The report was quite well received with investors sending shares up 5.53%.

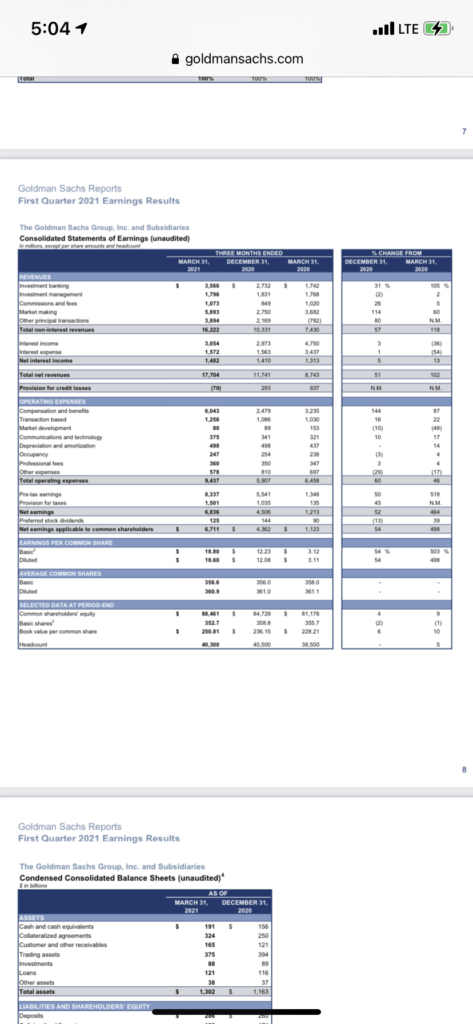

Lastly let’s turn to GS (Market Cap $121 Billion). Their numbers were phenomenal with Revenue +51% and Diluted EPS +54% compared to 4Q20. Investors sent shares up 2.34%.

Overall this was a strong start to earnings season as all three companies appear to be firing on all cylinders.

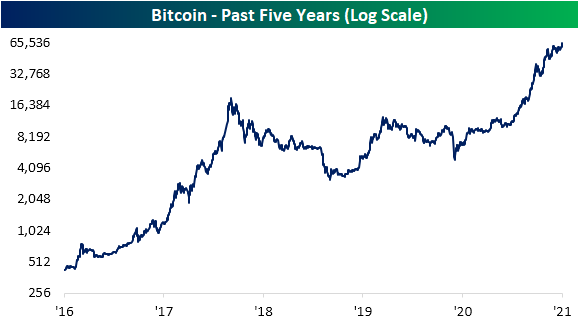

Coinbase (COIN) went public yesterday and investors are piling into Bitcoin which hit an All Time High above $64,000 yesterday. Meanwhile, the traditional hedge against paper money devaluation and inflation, gold, languishes well off its August 2020 highs as investors pull money from the sector to invest in cryptocurrencies.

Personally, I prefer gold which has a much longer track record than Bitcoin as money in human history. With sentiment negative and the metal and its miners well off their August 2020 highs, I also perceive a lot more value here than in the beloved and overheated crypto sector. Lastly, gold and its miners are starting to perk up and show signs of life.