Commentators Start To Call It A Bubble

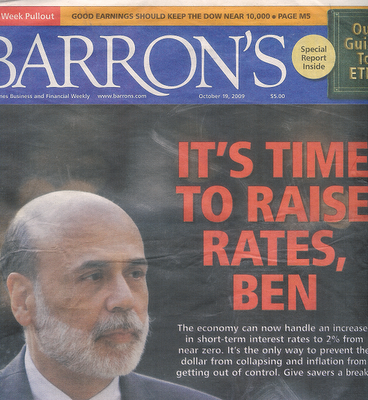

IT’S TIME FOR THE FEDERAL RESERVE TO STOP talking about an “exit strategy” and to start implementing one.

There’s no need for short-term rates to remain near zero now that the economy is recovering. The call to action is clear: Gold, oil and other commodities are rising, the dollar is falling and the stock market is surging. The move in the Dow Jones industrial average above 10,000 last week underscores the renewed health of the markets. Super-low short rates are fueling financial speculation, angering our economic partners and foreign creditors, and potentially stoking inflation.

The Fed doesn’t seem to be distinguishing between normal accommodative monetary policy and crisis accommodative policy. There’s a huge difference.

With the crisis clearly past, the Fed ought to boost short-term rates to a more normal 2% — still low by historical standards — to send a signal to the markets that the U.S. is serious about supporting its beleaguered currency and that the worst is over for the global economy. Years of low short rates helped create the housing bubble, and the Fed risks fostering another financial bubble with its current policies.

– “C’Mon Ben” (subscription required), Andrew Bary, Barron’s, October 17 Cover Story

Asset prices are being driven more by unusually low interest rates than economic fundamentals. It’s time for policy makers to mop up that liquidity. That includes Federal Reserve Chairman Ben Bernanke in Washington.

……..

Happy hour is lasting a bit too long for comfort. If stocks are rallying because of economic fundamentals, then so be it. If they are rallying because of easy-money policies, then Asia’s stability is more fiction than fact. It’s time for monetary bartenders to start declaring closing time.

– “Bubble in Bubbles Means It’s Time To Close Bar”, William Pesek, Bloomberg October 19

We did not need to wait until the Dow Jones Industrial Average hit 10,000. It has been clear for some time that global equity markets are bubbling again. On the surface, this looks like 2003 and 2004 when the previous housing, credit, commodity and equity bubbles started to inflate, helped by low nominal interest rates and a lack of inflation. There is one big difference, though. This bubble will burst sooner.

……

The single reason for this renewed bubble is the extremely low level of nominal interest rates, which has induced people to move into all kinds of risky assets. Even house prices are rising again.

– Wolfgang Munchau, “Countdown To The Next Crisis Is Already Under Way”, Financial Times, October 18