Death Cross Debates

A few weeks ago, Mark Hulbert started a debate over the value of Death Crosses – which I mentioned in my Client Note from two weeks ago – in a column for MarketWatch (“The Kiss Of The Death Cross”, Mark Hulbert, MarketWatch, July 9). Hulbert claimed that the Death Cross was a good indicator of bearish stock market performance going forward for most of the 20th century but that it has failed over the last 20 years:

It turns out that the death cross has had a mediocre track record at best over the last two decades. To be sure, it’s had some great recent successes — such as the one that occurred in December 2007, very early in the 2007-2009 bear market. But there have been a number of other failures — such as one that occurred in October 2005, in the middle of the 2002-2007 bull market.

Overall, in fact, there has been no statistically significant difference since 1990 between the average performance following death crosses and all other market sessions.

Both Mebane Faber and MarketSci have disputed Hulbert’s claim. In fact, they argue, the Death Cross has especially shined in the last decade as it guided investors to dodge most of two nasty bear markets.

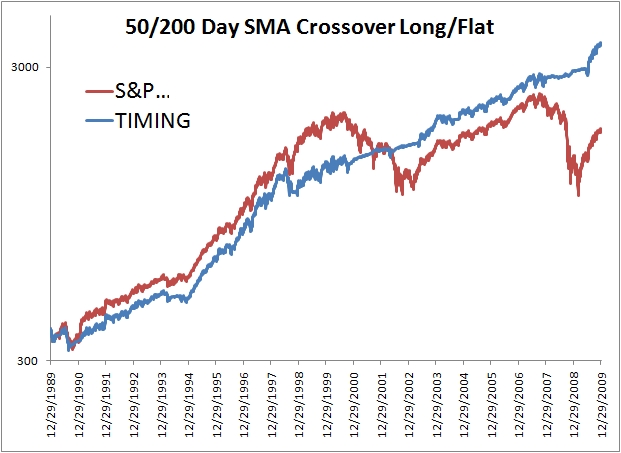

Two charts illustrate their case. The first is from Mebane Faber and shows the performance of a buy and hold strategy versus one selling and moving to a bond fund after a Death Cross since 1990.

The second chart is from MarketSci and shows market performance during Golden Crosses versus Death Crosses since 1930.

One potential source for the dispute is that Hulbert uses the Dow Jones Average while Faber and MarketSci use the S&P 500.

At any rate, the evidence suggests to me that the Death Cross is a valuable indicator though there is no Holy Grail. Use it as a part of your overall market analysis in conjunction with many other technical, fundamental and macro pieces.