Emerging Market Stocks Lead The Rally

For the medium term, I’d avoid emerging markets because of the froth there.

– Chris Zook, Chief Investment Officer, CAZ Investments

What we’re living through now is something of epic proportions.

– Alan Conway, Head of Emerging Market Equities, Schroders, comparing the economic rise of the BRIC countries to that of postwar Japan

A couple of interesting pieces on emerging markets from Barron’s and The New York Times:

“Back In Your Own Backyard”, Vito Racanelli, Barron’s, December 26

“Emerging Markets Soar Past Their Doubters”, Heather Timmons, The New York Times, December 30, B1

A couple of factoids from the articles that caught my attention:

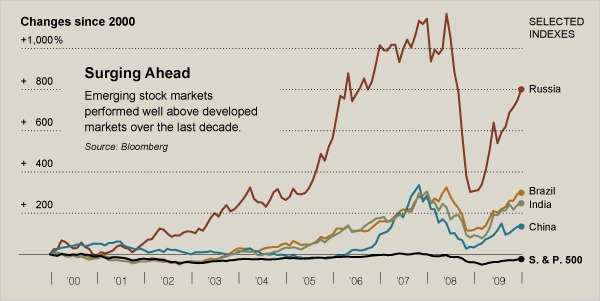

- MSCI Emerging Market Index up 73% in 2009 compared to 25% for the S&P 500

- $75 billion globally has flowed into emerging market equity funds so far this year, according to EPFR Global

- $85 billion globally has flowed out of US equity funds, according to EPFR Global

This is a very crowded trade. If the fundamentals are truly there, it can continue. If not, look out below….

Disclosure: Top Gun is short emerging markets via the EEM, ADRE and EEV.