Friday’s Anemic Bounce Attempt, The Week In A Nutshell: Rising Rates Cause Rotation From Growth to Value

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the email.

The bulls tried to rally the market Friday but a nasty selloff in the last 10 minutes vitiated any real upside. The NASDAQ, for example, lost 150 points in the last 10 minutes of the session.

I’ve discussed The Weekend Rule before which claims that the Friday close is the most important price of the week because it’s the price that traders and investors are willing to assume the risk of holding stocks over the weekend at. Apparently, many traders and investors didn’t want to hold them over the weekend.

As a result, after being up of the day, the S&P finished -0.48%, the NASDAQ +0.56% and the Russell +0.04% NYSE + NASDAQ Decliners outpaced Advancers 4466 to 2836. The S&P finished just a couple of points above its 50 DMA.

Salesforce (CRM), which reported earnings Thursday afternoon and is one of the 20 most important stocks in the market, sold off 6.31% to close below its 200 DMA.

So, just like four weeks ago when the S&P closed slightly below its 50 DMA, the bears once again have the ball heading into the week.

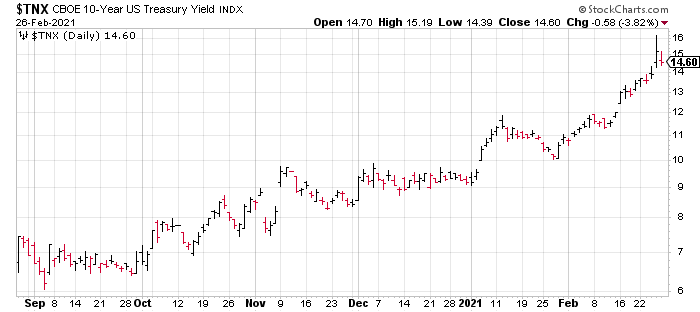

Analyzing the week is pretty straightforward since it’s the same thing we saw the week before: Rising rates driving investors out of Growth stocks and into Value stocks. The 10 Year Treasury Yield rose 11 basis points, on top of the 15 basis points it rose the previous week, to finish at 1.46%.

Value stocks as measured by the S&P Value ETF (IVE) have lost 0.27% over the last two weeks compared to 5.65% for the S&P Growth ETF (IVW).

I explained the reason why rising rates hurt growth stocks more than value stocks last Tuesday in “The Differing Impact of Rising Rates on Growth and Value Stocks”.

Bigger picture, rising rates could be the catalyst that ends the bull market since growth makes up such a larger share of the market cap of the major indexes than value. Value can’t move them higher on its own.