Historic #Rotation, Charley Grant on the Path Forward for the #COVIDVaccine, The Technicals Vs the Fundamentals, “Dueling Tails”

Note: A few months ago I started writing a daily morning market email for clients, friends and family. I recently decided to start making this email more broadly available. Email me at gfeirman@topgunfp.com if you’d like to be added to the list.

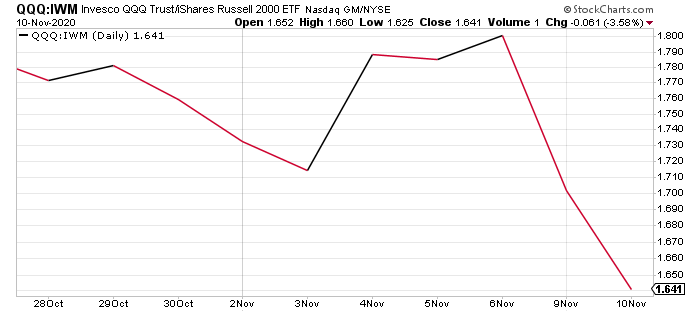

The most interesting thing happening in markets continues to be the historic #ReOpening #Rotation trade as investors rotate out of the formerly leading #PandemicBeneficiary #StayAtHome stocks and into the #ReOpen #RealEconomy stocks in the wake of Pfizer’s #COVIDVaccine announcement Monday morning. One way to visualize this trade is to look at the outperformance of small caps compared to the NASDAQ-100 on Monday and Tuesday.

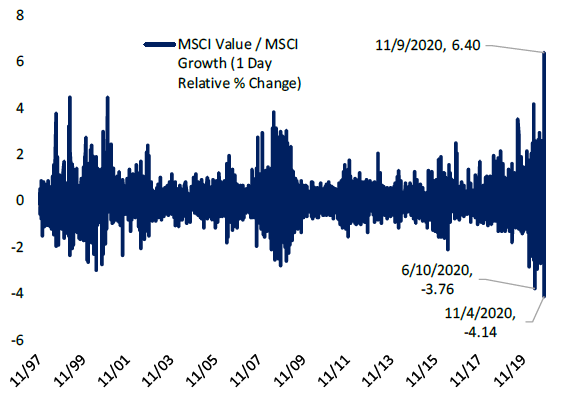

As you can see, the biggest move was obviously Monday but the trade continued yesterday (Tuesday). One illustration of just how extreme the #Rotation was on Monday is that MSCI Value outperformed MSCI Growth by 6.4% – the most since at least 1997 (Chart from BeSpoke Investment).

It will be interesting to see whether this trade continues today or if investors think it has gone a little too far and it reverses a bit given that actual immunization from the vaccine is a 2021 event. All we have now is the news; there’s a long road between what Pfizer said on Monday morning and an immunized population.

One of the WSJ’s many ace reporters, Charley Grant, had an excellent Heard on the Street column in yesterday’s (Tuesday) paper on the various factors to consider in thinking about the path forward for Pfizer’s #COVIDVaccine. While concluding that the news is “the shot in the arm that the world badly needed”, Grant carefully weighs various hurdles the vaccine will have to surmount on our way to an immunized population.

First are the safety concerns, I am not a doctor but what I have heard is that you always have to be careful about the side effects when dealing with a vaccine. So far, Pfizer’s vaccine looks good from that standpoint but the news announced Monday was on only 94 patients which included a placebo group. We’ll have to see if this continues to be the case in a larger study.

Second are the supply issues. Pfizer and its partner BioNTech plan to have 50 million doses manufactured globally by year end and more than 1 billion in 2021. However, two doses of the vaccine are required for vaccination “so even those figures fall well short of what is ultimately needed.”

In sum, while Monday’s news is a #GameChanger there is a way to go from the 94 patient study announced Monday morning to an immunized population. Grant thinks “assuming that no safety issues arise, a return to normal life by the spring seems conceivable.” He’s done more work on this than me but that does sound optimistic given the fact that the 1 billion doses projected to be manufactured by Pfizer and BioNTech in 2021 are “well short of what is ultimately needed.” (Grant does supplement this by saying that other vaccine programs will augment Pfizer/BioNTech’s). Either way, we’re going to be with this pandemic for at least a few more months though, as we have seen, investors are scrambling to price in a “Post-COVID World” immediately.

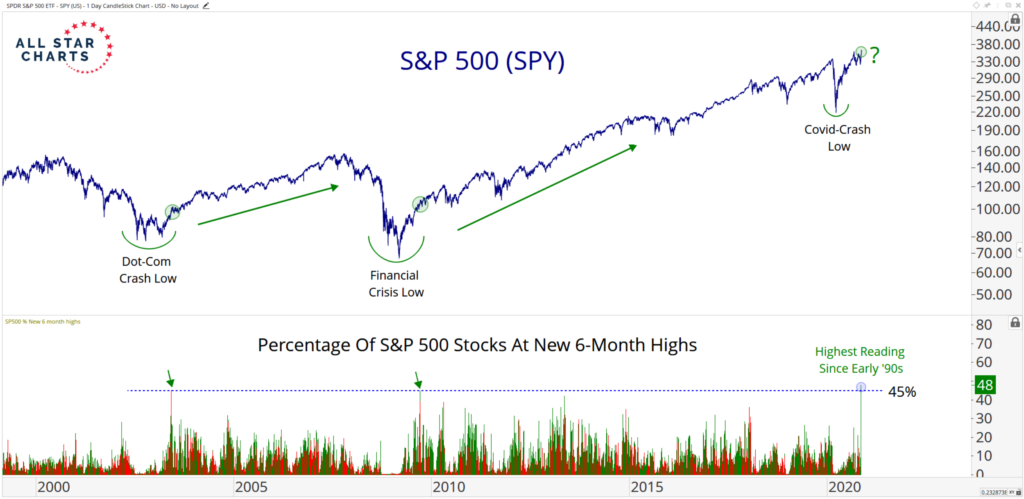

There seems to me to be an enormous “disconnect” (Jeremy Grantham) between financial markets and economic fundamentals. Since for technicians all there is is price, they are essentially unanimously bullish the stock market as price as well as breadth measures continue to be incredibly strong.

The Chart Report’s Chart of the Day yesterday was from Steve Strazza of All Star Charts showing that at Monday’s close > 45% of S&P components closed at 6-month highs, only the third time that’s happened in about 20 years. The previous two occurred as we were coming out of the Dot Com Bust and the Great Recession and so Strazza told The Chart Report: “These types of breadth thrusts are typically seen in the early innings of secular bull markets” (https://www.thechartreport.com/todays-daily-chart-report/).

Pivot Analytics backtested what happens when > 40% of S&P stocks close at 6 month highs. In the previous 5 instances prior to Monday since 1970, the S&P has been higher a quarter later every time (https://pvota.com/what-happens-when-the-40-of-sp500-stocks-are-at-6-month-highs/).

Clearly the technicals are extremely bullish. However, if you read my extensive earnings report tweets, sections on earnings in my morning emails and Client Notes, you know that the fundamentals ae either terrible (#ReOpen #RealEconomy stocks) or terrific but extremely overvalued (#PandemicBenificiary #StayAtHome stocks, which is composed of a lot of tech).

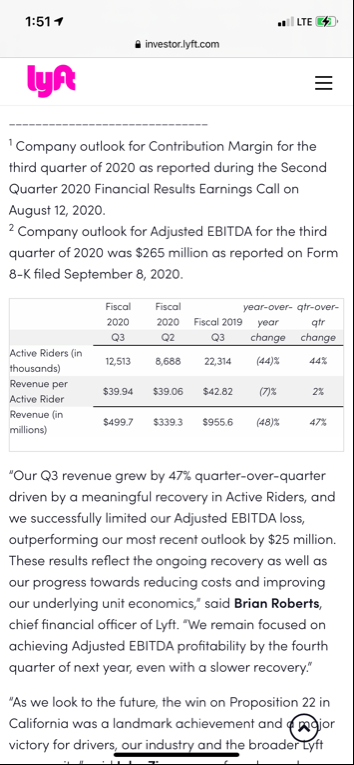

A perfect example of this was Lyft’s (LYFT) earnings report yesterday (Tuesday) afternoon. LYFT’s revenue was -48% year over and they lost $280 million on an adjusted basis. However, I just glanced at the headline of a Yahoo! Finance article on the quarter and it said something like “Lyft Revenues Up Almost 50% From The Previous Quarter” which is also true and can be seen in the screenshot from their earnings release below.

I guess it all depends on how you look at it. To me, LYFT is essentially in a depression from peak activity a year ago. To more bullish investors, the results show a massive improvement from the #COVIDQuarter which they project to continue into the future. The bulls are winning this argument early this morning with LYFT shares up almost 6% in the premarket at 2:42am PST.

Lastly, I wanted to write about a brilliant chart from David Zarling of Adaptiv on the “Dueling Tails” created on Monday and Tuesday. We hit 3,649 three minutes into trading on Monday but faded all day to close at 3,550. Yesterday (Tuesday) we sold off to as low as 3,511 before closing at 3,545. To Zarling this is a form of “indecision” about whether we go higher or lower from here. In the short term, I extrapolate that a breakout above 3,649 suggests a move even higher while a breakdown below 3,511 suggests lower and adds more weight to the Potential Double Top scenario I laid out in yesterday’s morning email. These are the short term levels I’ll be watching