How To Play A Stock Market Bubble

NOTE: Every week or two I wrote a Client Note for my clients. I post the notes to my blog but with a time delay usually between 1 day and 1 week. To receive the Client Notes at the same time as my clients, sign up in the box in the right hand corner of the website.

*****

In the last few weeks, I have become more and more persuaded that we are entering the bubble phase of the current bull market. Investing in such an environment is tricky. The opportunities for windfall profits are high – as are the risks of catastrophic losses.

In investing, it is crucial to distinguish between the market and the economy. Too often people make the mistake of equating the two. They assume that if the stock market is up, the economy must be good and vice versa. Same thing for individual stocks.

However, the truth is that the market is its own world. It is a world of perception dominated by professional investors trying to be one step ahead of their competition. (For an excellent recent articulation of this position, see Josh Brown’s “My Edge And The Crossroads”, April 27). In such an environment, the fundamentals often take a backseat to factors internal to the market itself.

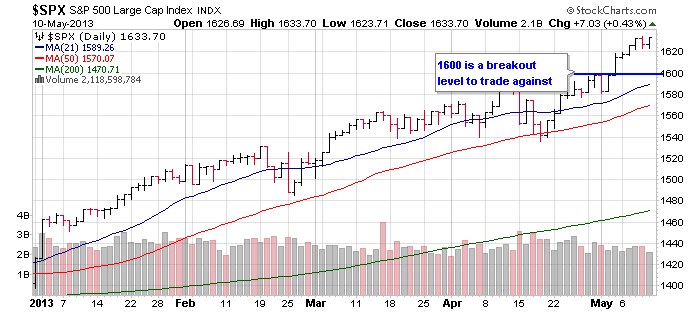

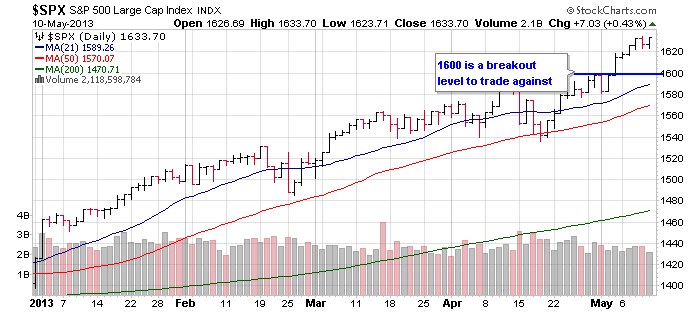

That is why the market can continue to go higher despite all of the fundamental weakness I have been hammering home in recent Client Notes. (Legendary hedge fund manager Seth Klarman took a similar tone in his latest note to investors (ZeroHedge)). Indeed, the blowout move two Friday’s ago through S&P 1600 has convinced me the direction of least resistance continues to be higher despite all my fundamental reservations. “Investors are convinced that central banks are in control and their actions support equity prices”, David Einhorn told his investors on a conference call.

As a result, I have arrived at a position where I am bullish on the stock market in the short term while continuing to be bearish longer term. This is an act of mental acrobatics that requires balancing various considerations and time frames.

First we must distinguish between a bubble and a sustainable bull market. A bubble is by definition an illusion while the latter is founded in fundamentals. As a result, we have to be much more cautious about protecting our downside because bubbles pop.

Two ways to protect our downside while profiting from a bubble are through position sizing and time frame. By reducing our position size and shortening our time frame, we reduce the risk of being fully exposed to a potential collapse.

Because investing in a bubble is speculative you should only do so with a small portion of your portfolio. Somewhere in the range of 10%-20% strikes me as the right sizing.

Second, we should be willing to take profits and losses much more quickly. Because a bubble is an inherently unstable environment that will eventually pop, instead of thinking in months and years we should think in days and weeks.

Specifically, 1600 seems to me to be important support (for example, see Larry McMillan in Steve Sears “The Smart Bull’s Guide To Riding This Rally”, Barrons.com, May 7). We can trade against that and give the market the benefit of the doubt as long as it holds.

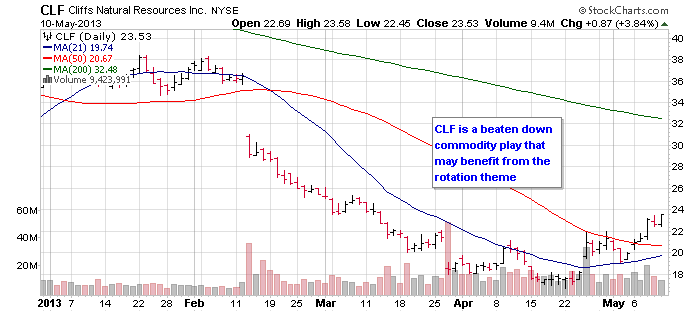

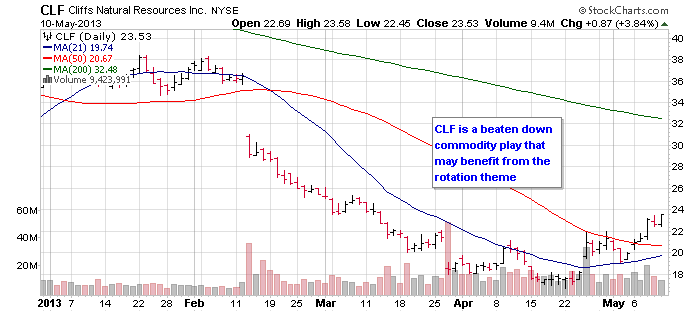

One of the important themes that should drive the next leg up is rotation. Defensive stocks have driven the market so far this year (see “Market Internals: A Look Beneath The Surface”, Top Gun Financial, April 3). Since the Jobs Report, however, we have started to see rotation into higher beta, more cyclical names. Since defensive stocks are now overvalued and overextended, this will probably have to continue for the market to keep moving higher.

Commodities in particular may be the beneficiaries. One stock getting a lot of attention from traders on this score and that I will look to trade is beaten down iron producer Cleveland Cliffs (CLF) (see, for example, Jim Cramer’s “Tacking The Rotation Dilemma”, TheStreet.com, May 7).

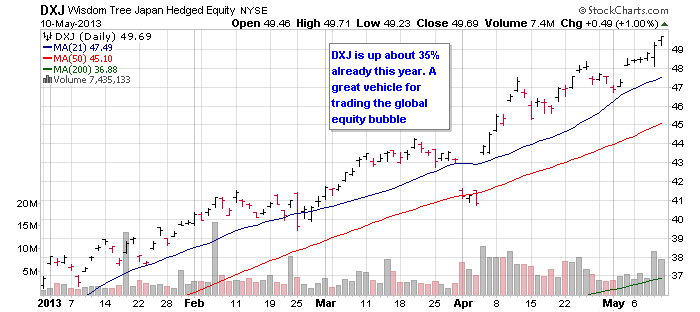

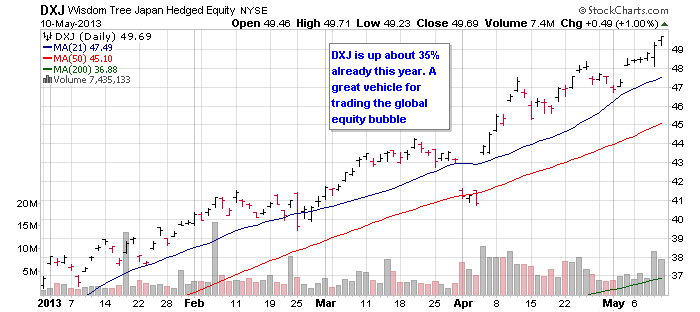

Another excellent choice for playing the bubble is Japan. While the US Federal Reserve is starting to make sounds about “tapering” and “exit” (see “Fed Maps Exit From Stimulus”, The Wall Street Journal, May 11, A1), the Bank of Japan (BOJ) is just getting started. Indeed, while the S&P is up on the order of 20% since mid-November, Japan is already well into bubble territory with the Nikkei having risen almost 70% in the same time period. The vehicle of choice here is the Wisdom Tree Japan Hedged ETF (DXJ) which hedges out exposure to the weakening yen.

This is an exciting time to be trading the market. Lots of money is being made as global securities move relentlessly higher. Fast, easy money can be made in this kind of environment. It can also be lost. The trick is to balance both considerations.

If you are interested in this strategy but concerned about the risks, you may want professional help. Give me a call at (916) 224-0113 to discuss setting up a separately managed account via Scottrade Advisors.

Greg Feirman

Founder & CEO

Top Gun Financial (www.topgunfp.com)

A Registered Investment Advisor

Bay Area, CA

(916) 224-0113