Inflation Watch: PG & KMB To Raise Prices, Precious Metals & Miners Surging, Tobacco Stocks Face Regulatory Risk

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

The Company added that it has started the process of implementing price increases on its Baby Care, Feminine Care and Adult Incontinence product categories in the United States to offset a portion of the impact of rising commodity costs. P&G said the exact amount of the price increase will vary by brand and sub-brand in the range of mid-to-high single digit percentages and will go into effect in mid September – PG 3QFY21 Earnings Report 4/20

This is one of the bigger increases in commodity costs that we’ve seen over the period of time that I’ve been involved with this, which is a fairly long period of time – PG COO, Jon Moeller, a 33-year company veteran quoted in Sharon Terlep, “Procter & Gamble Will Raise Prices In September” [SUBSCRIPTION REQUIRED], WSJ, April 21, B1

Kimberly-Clark Corporation announced today that it is notifying customers in the U.S. and Canada of plans to increase net selling prices across a majority of its North America consumer products business. The increases will be implemented almost entirely through changes in list prices and are necessary to help offset significant commodity cost inflation. The percentage increases are in the mid-to-high single digits. Nearly all of the increases will be effective in late June and impact the company’s baby and child care, adult care and Scott bathroom tissue businesses – KMB Press Release 3/31

When Procter & Gamble (PG) reported earnings Tuesday morning they also said that they will be raising prices in some categories by the mid to high single digits starting in mid-September. According to the WSJ’s Sharon Terlep, PG said that this could be a precursor to broader increases. This follows on Kimberly Clark’s (KMB) announcement on March 31 that it will be raising prices in the majority of its North America consumer products businesses by mid to high single digits starting in late June. Both cited the rise in commodity prices as the reason for the price increases.

You can put your head in the sand and say March Core CPI was only 1.6% so there is no inflation but in the real world (i.e. market prices) inflation is percolating and set to surge when the economy reopens and economic activity increases substantially.

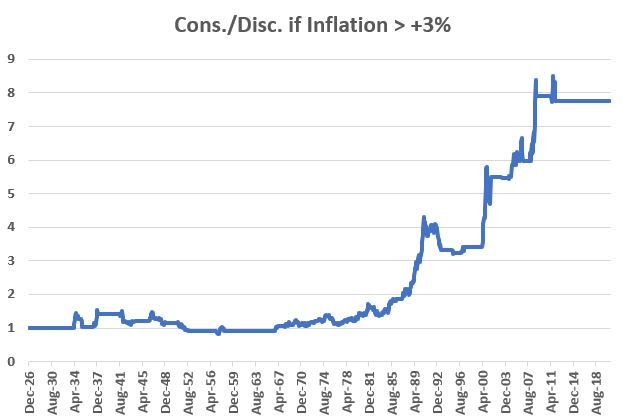

Top Gun is perfectly positioned for this with a huge position in the precious metals miners via GDX, GDXJ, SIL and SILJ and other stock holdings that are mostly defensive consumer staples businesses. It turns out that Consumer Staples stocks do quite well, at least relative to Consumer Discretionary stocks, when inflation is greater than 3% (“When it’s time to switch into Consumer Staples” [SUBSCRIPTION REQUIRED], Sentimentrader, April 19).

With this inflationary context, it’s no surprise that the precious metals and their miners are really starting to move. The Van Eck Gold Miners ETF (GDX) is up about 20% since the beginning of March and, as Gregory Krupinski’s tweet above shows, the 2011 All Time Highs are already in play for a few of the miners.

On Monday afternoon, news broke that the Biden Administration is considering requiring tobacco companies to reduce the nicotine in cigarettes to levels that are no longer addictive as a means to push millions of smokers to either quit or switch to less harmful alternatives like nicotine gums, lozenges or e-cigarettes (“Biden Administration Considering Rule to Cut Nicotine in Cigarettes” [SUBSCRIPTION REQUIRED], WSJ, April 20, A2).

Top Gun holding Altria (MO) is down about 10% since the news broke and cigarette stock holders like myself have been shaken out of our complacency and forced to think hard about the new risk/reward equation (“Danger for Cigarette Stocks Re-Emerges” (Print Title) [SUBSCRIPTION REQUIRED], Carol Ryan, WSJ, April 21).