Monday’s Crazy Session and Call Option Mania

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

Yesterday was one of the craziest sessions of my investment career. The only things that compare were a few days in 2008 such as the failure of Lehman Brothers on Monday, September 15, 2008. It doesn’t get much wilder than this.

After a marginally higher open, the S&P hit an “air pocket” (Scott Redler’s term) and dropped 60 points from ~3,860 to ~3,800 from 7:30am-8:10am PST before rallying all the way back to finish up 14 points or 0.36% at 3,855. NYSE + NASDAQ volume was quite heavy on the day at ~14 billion shares compared to ~11 billion shares on Friday (Chart Source: Northman Trader Twitter, January 25, 10:27am PST).

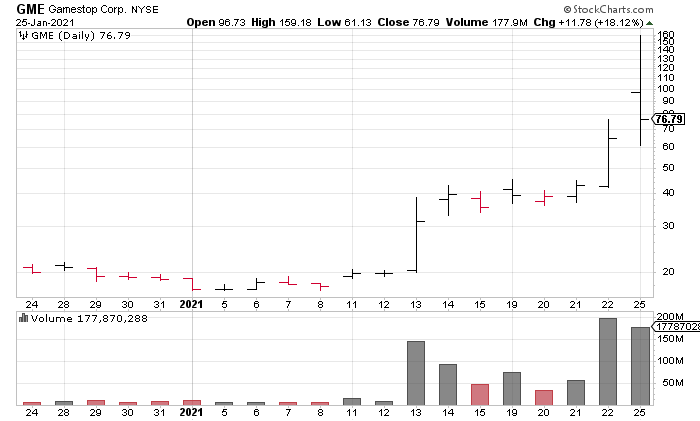

If that wasn’t crazy enough, failing video game retailer GameStop (GME) continued the short squeeze of the century, apparently driven up by traders from Reddit squeezing hedge fund short sellers who had sold short 102% of GME’s shares as of Friday (“GameStop Stock Jumps To New Record”, WSJ, January 26).

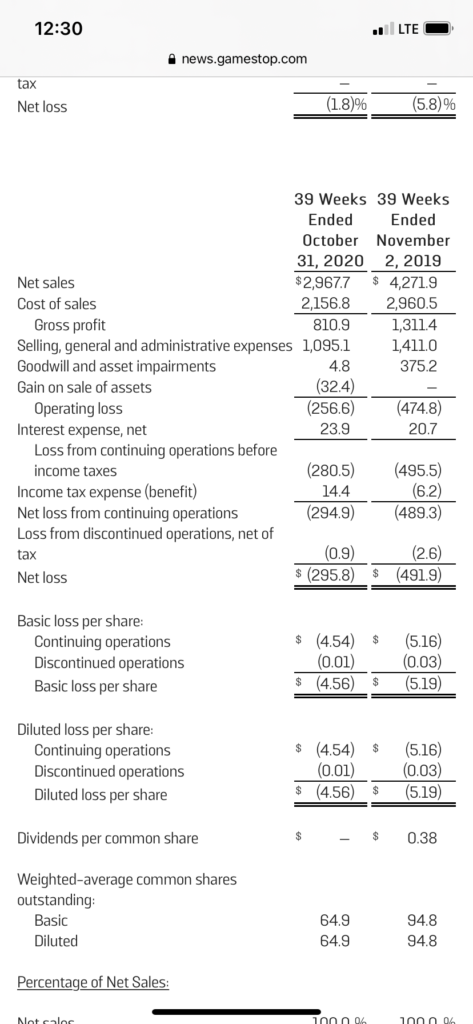

GME shares reached $159 early in the session before closing ~$77. That still gives the company, which has seen revenues decline 31% in the nine months ended October 31, 2020 and lost about $300 million during that period, a $5 billion market cap.

[My Dad] told me the stock market always recovers. It’ll always go back up – Hayden Cole, a 22 year old college student who started investing after he lost his job during the COVID lockdowns

This is the most popular I’ve seen call buying in my career – Jon Cherry, Head of Options, Northern Trust (both quoted in “Bullish Stock Bets Explode as Major Indexes Repeatedly Set Records”, Gunjan Banerji, WSJ, January 25, B1 [SUBSCRIPTION REQUIRED]).

More than half a trillion dollars of options on individual stocks traded on Friday January 8, a record, according to Goldman Sachs. The following week on Thursday January 14, a record 32 million call options traded hands, another record, according to Trade Alert. We have gone beyond The Point of Maximum Optimism to a psychology characterized by the belief that one cannot lose in the stock market. Consider yesterday mornings “air pocket” a warning: It will happen again soon but next time it may not bounce back.