NASDAQ Closes Above Its 21 and 50 DMAs, Airline Stocks Fly, Bitcoin Corrects, Gold Miners Languish and Set Up

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

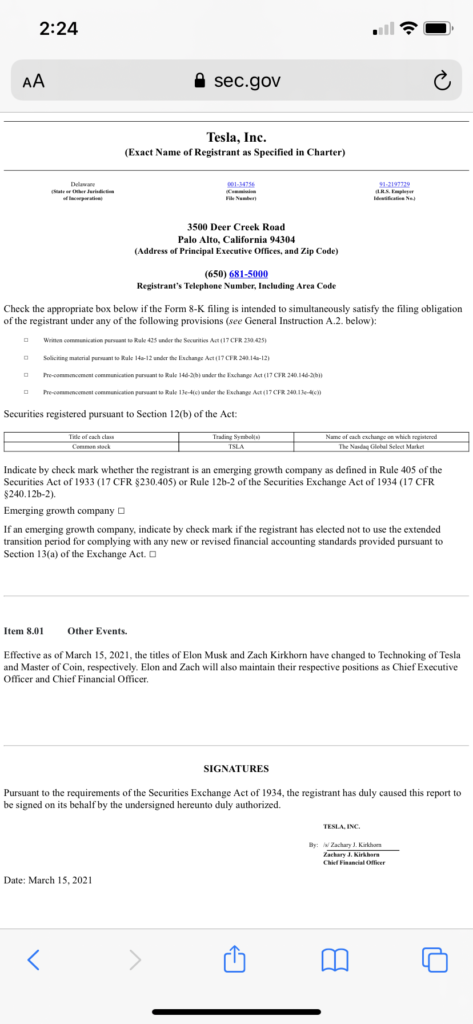

Elon Musk did a nice job getting the week off to a hilarious, if ridiculous, start by filing an 8-K with the SEC adding the titles “Technoking of Tesla” and “Master of Coin” to his CEO and Tesla’s CFOs’ titles. Personally, I think this is more than just funny but a tell on where we are in the sentiment cycle – uncharted euphoric territory.

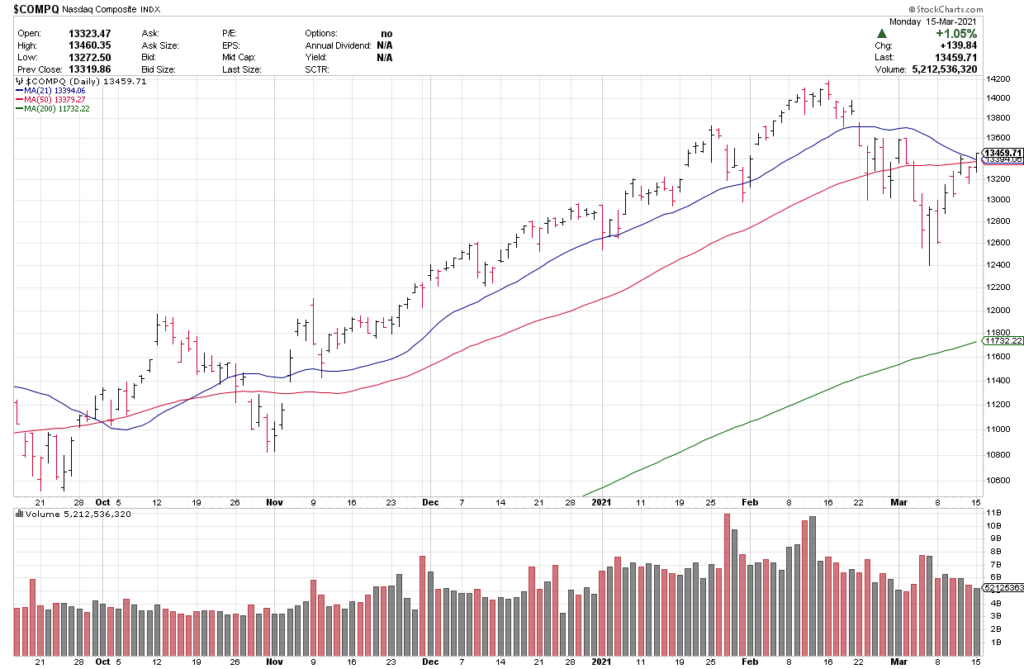

The major indexes continued their bounce since Friday morning March 5, with the S&P +0.65%, the NASDAQ +1.05% and the Russell +0.31%. 50 points of the NASDAQ’s 140 point gain occurred in the last 15 minutes of the trading session and may have been short covering.

The NASDAQ was already trading above its 21 and 50 DMAs before the last 15 minutes but the last minute surge gave it some breathing room.

The NASDAQ has been the leading index of the bull market since 2009 and suffered the most technical damage during the three week correction catalyzed by rising interest rates. Yesterday’s move is a good start toward repairing that technical damage.

Growth outperformed Value with the S&P Growth ETF (IVW) +0.83% while the S&P Value ETF (IVE) was +0.37%.

In Friday’s morning blog, I divided stocks into Mega Cap Growth, Speculative Growth, Reopen Value and Defensive Value. The Reopen Value stocks have been all the rage as investors rotate out of Growth and into them in an essentially universal consensus that the economy will rebound ferociously in short order as COVID is contained.

There is no better example of Reopen Value than airline stocks and the Airline ETF (JETS) surged +3.72% yesterday on almost 2.5x three month average volume. It has now recovered almost all of its COVID-related losses. As I’ve argued recently (for example see the section on Lyft in Saturday’s morning blog), and which David Hunter’s tweet above supports, these stocks appear to me to have already priced in a full recovery well before that has shown up in their numbers. I don’t personally see much more upside for Reopen Value.

After breaching $60k over the weekend, Bitcoin suffered a nasty correction and is currently trading around $55.6k.

Meanwhile, as Bitcoin goes towards the moon, gold, the traditional and proven store of value and hedge against fiat currency inflation, and the gold miners languish. Perhaps, however, the miners are setting up for a nice entry.