NASDAQ: Technical Divergences, Einhorn on The Fed, Inflation, GME and the $100 Million Deli

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

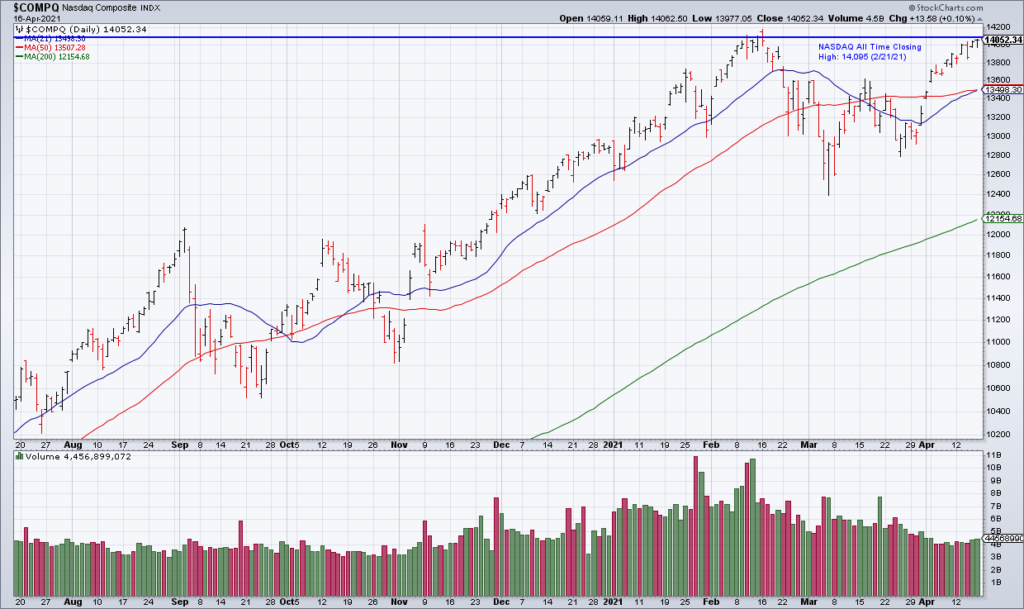

While the NASDAQ closed Friday at 14,052, only 43 points shy of its All Time Closing High, beneath the surface there are significant divergences. As you can see in the first tweet from Jonathan Krinsky, while the NASDAQ itself moves higher, the number of its components above their 50 DMAs has declined from greater than 80% at the February highs to 42% currently. In the second tweet, Mike Moses shows something similar with regard to the NASDAQ’s Advance/Decline Line which has been trending downward since the February highs. Brian G shows the same thing with respect to the NASDAQ-100. The explanation is that Mega Cap Tech is carrying this market higher overshadowing weakness among many of the smaller stocks on the NASDAQ which have rolled over since February.

As for the Fed, it fundamentally changed its framework last August. It no longer seems to care that monetary policy works with a lag. Actually, it has embraced an asymmetrical inflation policy: The Fed wants to be ahead of the curve on the downside to protect

the stock market and corporate bondholdersthe economy. Behind the curve is fine on the way up no matter how frothythe stock marketthe recovery. Now, it says it is only going to react to actual inflation that exceeds its 2% target for a period of time.Furthermore, the Fed has indicated that it believes any abnormally high inflation will be transitory. We wonder, how will the Fed know? Do price increases come with a label that says “transitory”? Our sense is that no matter how hot inflation gets in the coming months, the Fed will continue with zero interest rates and large-scale asset purchases. After all, the U.S. Treasury has a lot of debt to sell and it isn’t clear who, other than the Fed, can absorb the supply (David Einhorn, Greenlight Capital 1Q21 Letter To Investors, April 15, 2021).

With inflation already percolating, economic reopening just around the corner and a Fed disinclined to do anything that might hurt financial markets, inflation is almost certain to continue to increase and the Fed almost certain to be behind the curve in facing up to it. Whether it can put the genie back in the bottle when it finally does get around to facing up to inflation is unclear. Volcker did in the late 1970s and early 1980s but at the cost of a major recession. Is the Fed willing to pay that price this time around? If not, the result could be a complete economic meltdown with inflation spiraling out of control.

Einhorn on the Gamestop (GME) episode:

Finally, we note that the real jet fuel on the GME squeeze came from Chamath Palihapitiya and Elon Musk, whose appearances on TV and Twitter, respectively, at a critical moment further destabilized the situation. Mr. Palihapitiya controls SoFi, which competes with Robinhood, and left us with the impression that by destabilizing GME he could harm a competitor. As for Mr. Musk, we are going to defend him, half-heartedly. If regulators wanted Elon Musk to stop manipulating stocks, they should have done so with more than a light slap on the wrist when they accused him of manipulating Tesla’s shares in 2018. The laws don’t apply to him and he can do whatever he wants.

Einhorn on the $100 million deli:

Someone pointed us to Hometown International (HWIN), which owns a single deli in rural New Jersey. The deli had $21,772 in sales in 2019 and only $13,976 in 2020, as it was closed due to COVID from March to September. HWIN reached a market cap of $113 million on February 8. The largest shareholder is also the CEO/CFO/Treasurer and a Director, who also happens to be the wrestling coach of the high school next to the deli. The pastrami must be amazing.