Not Your Ordinary Tuesday, HD Earnings, NVDA Earnings Preview

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the email

Yesterday was not your ordinary Tuesday! The NASDAQ dropped about 550 points (4%) within the first 20 minutes of trading. I had seen the NASDAQ down almost 3% in the locker room of my gym near the open and was surprised when my friend said it was down 4% as we walked out of the gym at about 6:50am PST. That would turn out to be the day’s low as the NASDAQ rallied almost all the way back to breakeven, finishing down just 68 points or 0.5%.

I focus on the NASDAQ because tech has been the leader of this bull market, especially the last year. If and when the NASDAQ breaks down, I don’t believe the rest of the market has enough to carry the S&P higher.

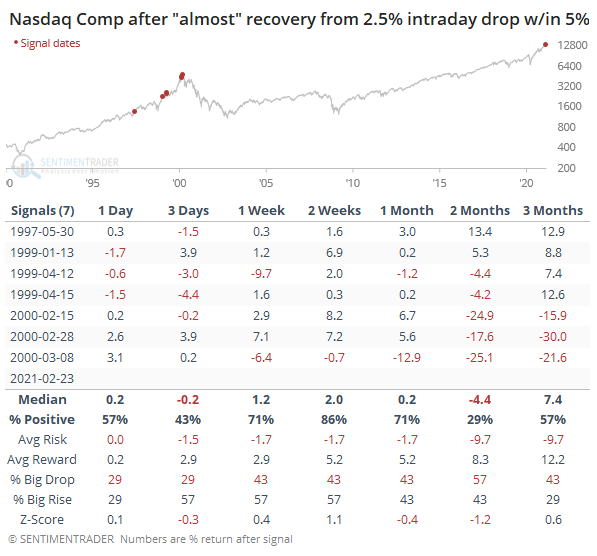

What does it mean? Of course, nobody knows but the guys at Sentimentrader looked at times since 1990 when the NASDAQ “almost” recovered from a greater than 2.5% drop when trading within 5% of ATHs. It turns out that it’s happened 7 times previously, three of them in 1999 and three of them in 2000 within one month of the top of The Dot Com Bubble on March 10, 2000 (“Daily Report”, Sentimentrader, February 23, 2021 [SUBSCRIPTION REQUIRED]).

If history is any guide, then, we are in the latter stages of a massive bubble. Of course it makes a big difference whether this is early 1999 or February/March 2000. My own sense is that this is February/March 2000. So while yesterday was a win for the bulls who were able to absorb the growing selling pressure, soon enough it will overwhelm them.

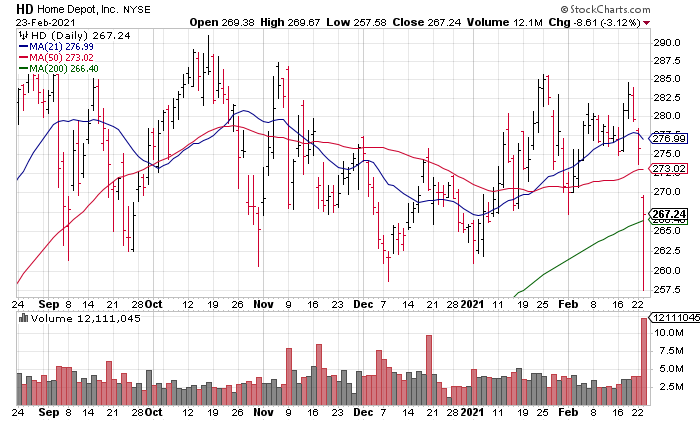

Now let’s take a look at Home Depot (HD, Market Cap $288 billion) earnings from Tuesday morning. HD reported another exceptionally strong quarter with US Comps +25% and Operating Income +20%. However, the stock traded down 3.12% on greater than 3x three month average volume. It’s always about the reaction, not the news.

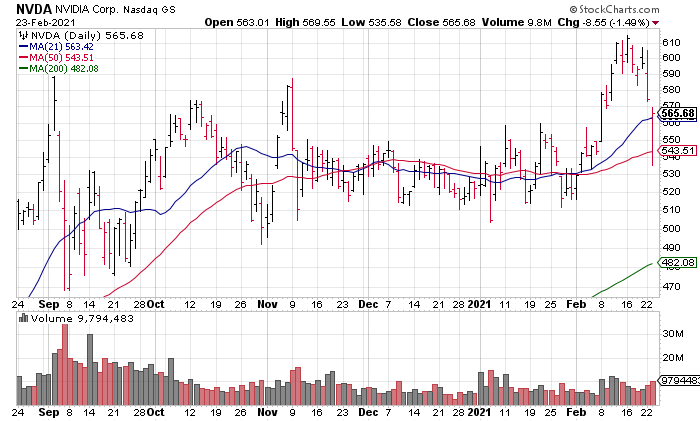

Lastly, let’s preview Nvidia (NVDA, Market Cap $356 billion) earnings this afternoon. NVDA is one of the largest and most important stocks in the market, perhaps coming in importance only after The Big 5 and TSLA. It is the seventh and second biggest component of the important QQQ and SMH ETFs.

NVDA’s fundamentals have been on fire for the last year and I see no reason why that would have changed in the 4Q20. The problem here, as in so much of tech, is valuation. Even after backing out NVDA’s $3 billion net cash, it is trading at an Enterprise Value (EV) to Trailing Twelve Month (TTM) EPS of 64x. NVDA is a great company doing extremely well but there are still limits to how much it’s worth. Again, the quarter was likely excellent; it’s the reaction we want to pay attention to.