Pressure Point

NOTE: Every week or two I wrote a Client Note for my clients. I post most but not all of the notes to my blog but with a time delay usually between 1 day and 1 week. To receive the Client Notes at the same time as my clients, sign up in the box in the right hand corner of the website.

*****

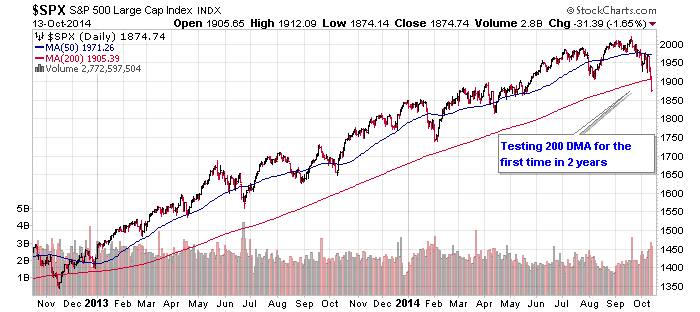

Last Thursday and Friday were the worst two days for the markets since February. The S&P is testing its 200 day moving average (DMA) for the first time in 2 years.

Real fear has entered the market for the first time in quite a while. 5 1/2 years into the bull market investors are worried: Is this just a standard correction or the beginning of something more ominous?

The next few weeks should provide some answers. As we begin earnings season, companies will tell us not just about their results for the last three months but what they see going forward. Everybody will be keying into forecasts as a way to gauge global growth.

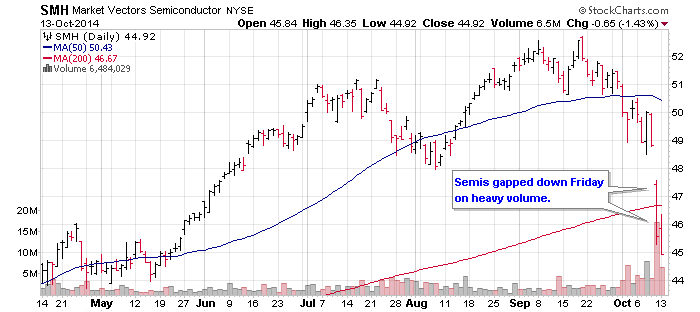

The hardest hit sector last week was semiconductors. Timely then that Intel (INTC) will be reporting 3rd quarter results Tuesday after the close. In their 2nd quarter earnings report, they forecasted revenue of $14.4 billion +/- $500 million compared to $13.5 billion in the year ago period. Investors will also be closely scrutinizing their 4th quarter forecast. This will be an important earnings report that will set the tone for earnings season.

The conjunction of technical support at the 200 DMA with the beginning of earnings season creates a pressure point. Earnings should be the catalyst to determine which way the market goes from here and the movement either way could be explosive.

Greg Feirman

Founder & CEO

Top Gun Financial (www.topgunfp.com)

A Registered Investment Advisor

Bay Area, CA

(916) 224-0113

FOLLOW ME ON Twitter, LIKE ME ON Facebook AND INVEST LIKE ME WITH CoVestor!