Redler: Bears “Don’t Have Much Power”, Interest Rates Continue Higher, NVDA Earnings, CRM Earnings Preview

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

After seeming to take control Monday and especially Tuesday morning, the bears have once again turned the ball over. After rallying mostly or even all the way back from being down big in the first 20 minutes of Tuesday’s session, the bulls continued to push the market higher Wednesday. The S&P was +1.14%, NASDAQ +0.99% and Russell +2.38%. It’s like Monday and Tuesday morning didn’t even happen.

Nevertheless, the catalyst for the selloff, rising interest rates, have continued to push higher this week with the 10 Year Treasury yield closing yesterday around 1.39%, up 4 more basis points from last week. While I agree with Cornell Professor Dave Collum that the Fed is “feckless”, I’m not yet prepared to say they’re losing control of the bond market. If this is about growth, then investors are simply shifting out of bonds and into riskier parts of the market. If it’s about inflation, then Professor Collum could be right. My feeling is that it’s a little of both. Definitely keep an eye on this.

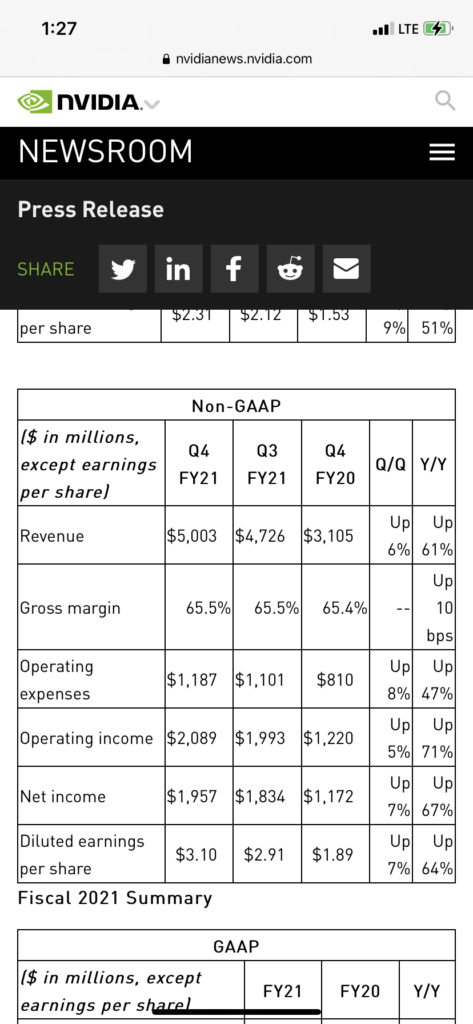

Nvidia (NVDA, Market Cap $357 Billion), perhaps the 7th most important stock in the US market after Apple, Amazon, Microsoft, Google, Facebook and Tesla, reported earnings yesterday afternoon. As expected the numbers were spectacular with Revenue +61% and Non-GAAP Diluted EPS +64%. However, even with such stellar numbers, the stock couldn’t get much traction in the after hours as Enterprise Value (EV) to Trailing Twelve Month (TTM) EPS is 56x. As I wrote yesterday morning: “The quarter was likely excellent; it’s the reaction we want to pay attention to”. So let’s keep an eye on NVDA today as well for any tells it might give us on any limits to tech stock valuations.

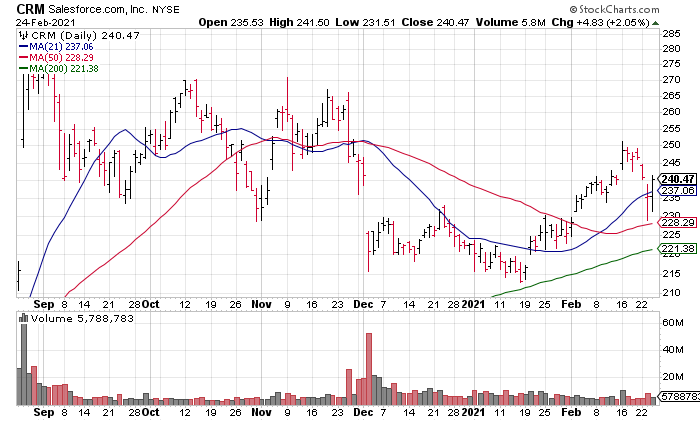

Finally, Salesforce (CRM, Market Cap $226 Billion), another Top 20 stock, reports earnings this afternoon. Again, like NVDA, the numbers are likely to be good but it’s the reaction we’re focused on because CRM is also very expensive at 51x EV to TTM EPS.