Tech Bounces Hard, Cathie Baby, Dead Cat Bounce Or End of the Correction?, ORCL Earnings Preview

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

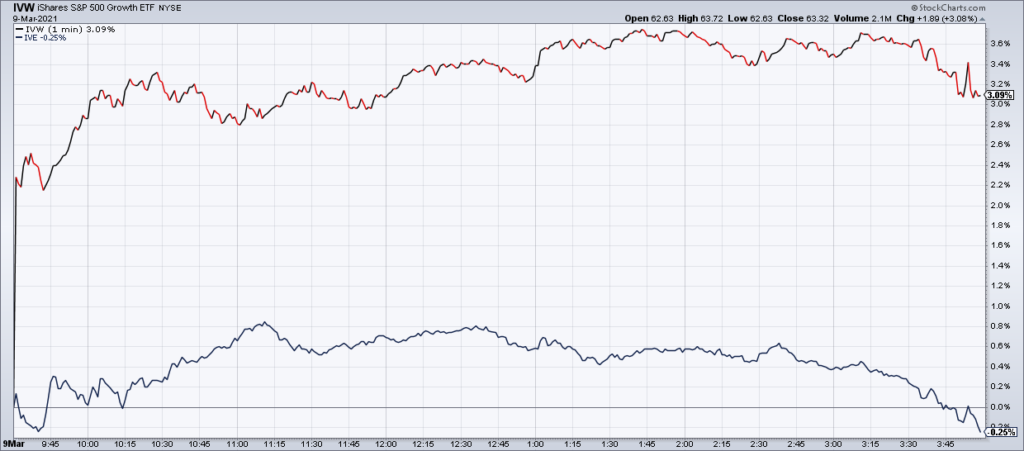

It was bound to happen: After months of underperformance versus Value, Growth (which is mostly tech) bounced hard yesterday (Tuesday). In a reversal of the recent trend, the S&P Growth ETF (IVW) was +3.08% while the S&P Value ETF (IVE) was -0.26%.

The NASDAQ led the major indexes up 3.68% – the S&P was +1.42% and the Russell +1.91%.

Despite the massive move in tech, the dominance of Value over Growth is likely only just beginning. JC Parets of All Star Charts did an excellent blog post yesterday on just this issue writing: “This still looks like a major top in Growth relative to Value” (“Add To Growth? Or Dump It?”, JC Parets, All Star Charts, March 9).

The star of the day was Cathie Wood’s Ark Investment Research whose flagship ARK Innovation ETF (ARKK) had one of it’s best days ever, up 10.42% on 2.5x average three month volume. Obviously, I was very happy as I am playing the bounce via a 10% position in ARKK. The rest of Ark’s ETFs had excellent days as well.

The question now arises if Friday’s low was the correction low or this is now a dead cat bounce in a bear market. Only the market will tell us in the days and weeks ahead but a survey of the technical landscape shows that – despite yesterday’s powerful moves – a lot of technical damage remains to be undone for this market to start looking healthy again.

The S&P, with its heavier value component, is doing just fine and closed back above its 50 DMA but the best performing growth areas of the market (NASDAQ, QQQ, SMH and ARKK) are still well below their 50 DMAs.

Lastly, I want to preview Oracle (ORCL, Market Cap $221 Billion) earnings coming this afternoon. The WSJ’s Dan Gallagher said it best when introducing his ORCL earnings preview yesterday: “Tech investors have been going old school of late. Oracle Corp. will be the first to educate them on the wisdom of their bets. The 43-year old software giant heads into its fiscal third quarter report this week in the rare position of being the hottest tech stock around” (“Oracle’s Low Bar Is Rising”, Dan Gallagher, WSJ, March 9 [SUBSCRIPTION REQUIRED]).

Ever since Eric Savitz published his brilliant Barron’s Cover Story on ORCL as a cheap cloud play, the stock has exploded higher – up 18.8% in the twelve sessions since the article.

Many investment banks took note and increased their estimates for ORCL going forward. Gallagher, once again, says it best: “ORCL is believed to be at the beginning of an improving cycle of growth, as more of its traditional software business has slowly transitioned to the cloud. When the company reports results Wednesday afternoon, Wall Street expects revenue of $10 billion for the quarter ended February – up nearly 3% year over year. That sounds anemic next to the double digit growth rates that even bigger software players like Microsoft and Amazon.com’s AWS cloud computing business have been generating of late. But it would be ORCL’s best growth rate in three years. The past four quarters averaged a decline of 0.2%.”

ORCL is the #1 stock on my buy list but I need a pullback after this run up. Perhaps a disappointing earnings report is the catalyst for one. I’m a buyer at the 21 DMA ~$65.