The End Game: 1 – 10 Year Treasury Yield Jumps 13 Basis Points, 2 – Stocks Plummet, 3 – Crescat: The Fed Is Trapped, 4 – Young and Dumb

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the email.

After rising 15 basis points last week and another 4 basis points through Wednesday, the 10 Year Treasury yield jumped 13 basis points on Thursday to 1.52%.

The jump in yields yesterday led to a massive selloff in stocks with the S&P -2.45%, NASDAQ -3.52% and Russell -3.69%. Real technical damage was done. The NASDAQ closed below its 50 DMA.

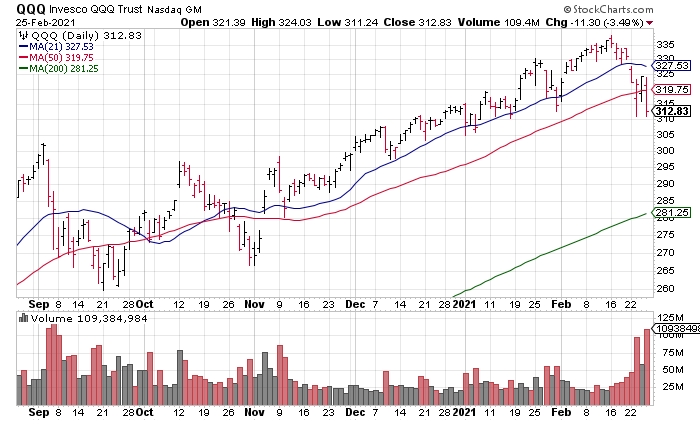

The most important ETF in the market, the QQQ, was -3.49% and closed below its 50 DMA as well on almost 4x three month average volume. It is now negative YTD.

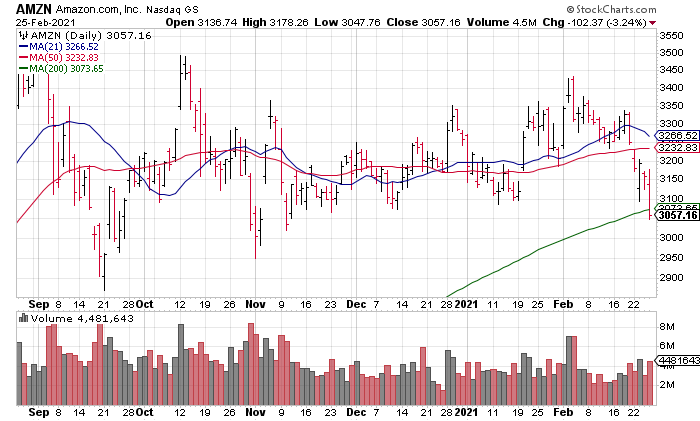

The QQQ is dominated by FAAMG and Tesla (TSLA) with Amazon (AMZN) and Facebook (FB) both closing below their 200 DMAs.

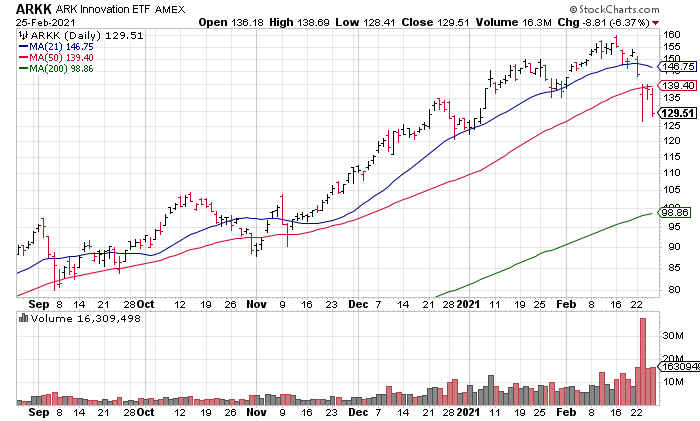

I believe the 2nd most important ETF in the market right now is the Ark Innovation ETF (ARKK) and it also closed below its 50 DMA. It is -17.3% over the last eight sessions and now up only $5 YTD.

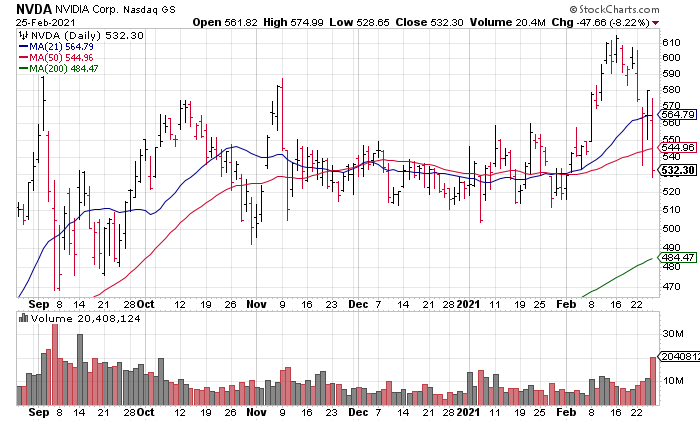

Yesterday (Thursday) morning, I reviewed Nvidia (NVDA) earnings, calling in the 7th most important stock in the market, and advising to focus on the reaction to their earnings report, not the report itself which was excellent. NVDA was -8.22% yesterday on 3x three month average volume. The stock is -13.2% over the last seven sessions.

In sum, the 13 basis point jump in treasury yield resulted in significant stock market carnage. Next, I want to discuss an excellent letter put out by hedge fund Crescat Capital yesterday (Thu 2/25) titled “The Fed Is Trapped”. Crescat starts the letter out this way:

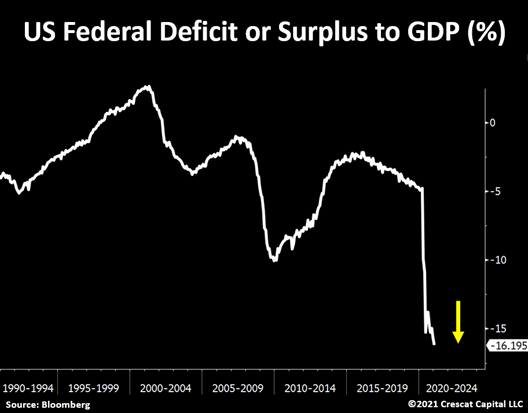

The Fed faces the impossible task of continuing to prop up already historic asset bubbles while also preventing inflation. The current extreme fiscal imbalances put the central bank on a crash course to fail at both.

With the Federal Government running historic deficits and a stock market bubble that is propping up the economy, the Fed has no choice but to continue down its current path of easy money. If if stops monetizing the Federal Government’s debt, interest rates will surge pricking the stock market bubble leading to an immediate collapse. Instead, they’ll try to hold this thing together for as long as possible by continuing to monetize the debt though investors are starting to price in inflation from all this money printing by selling treasuries anyways which will eventually lead to the same outcome.

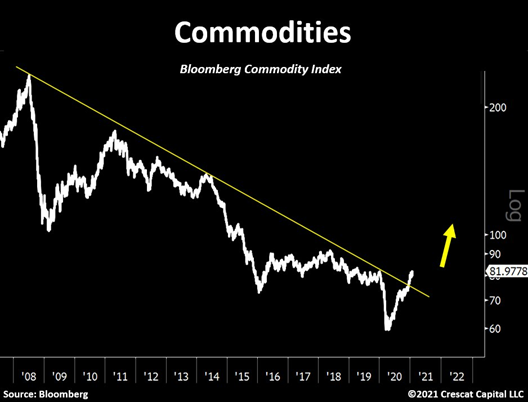

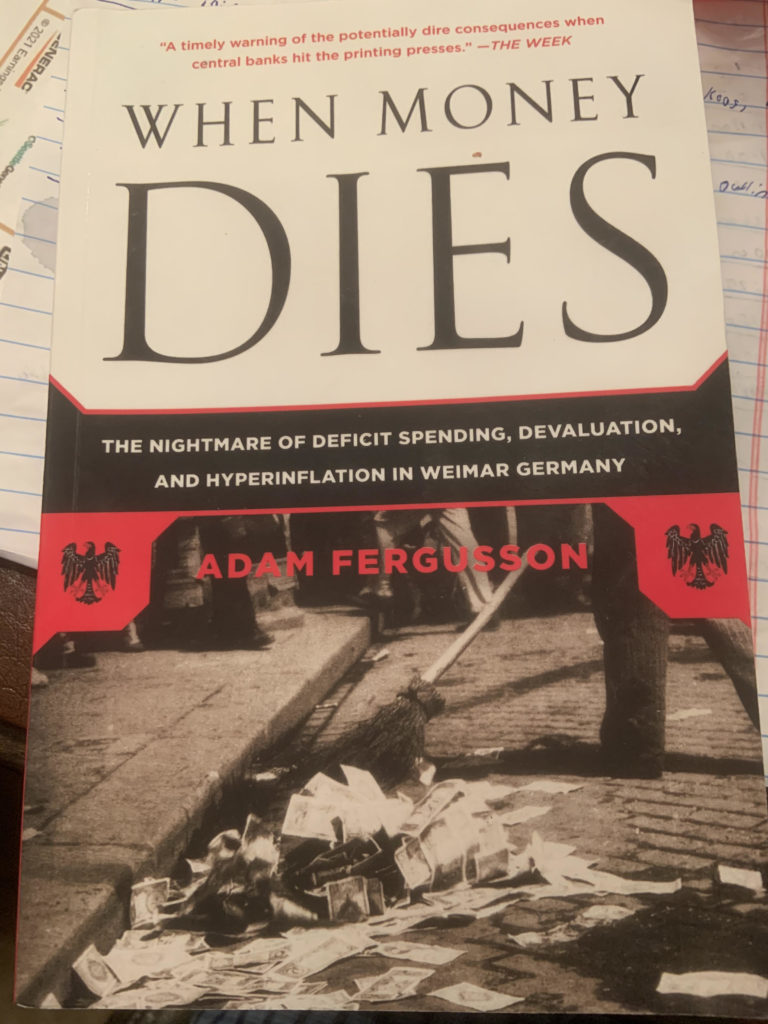

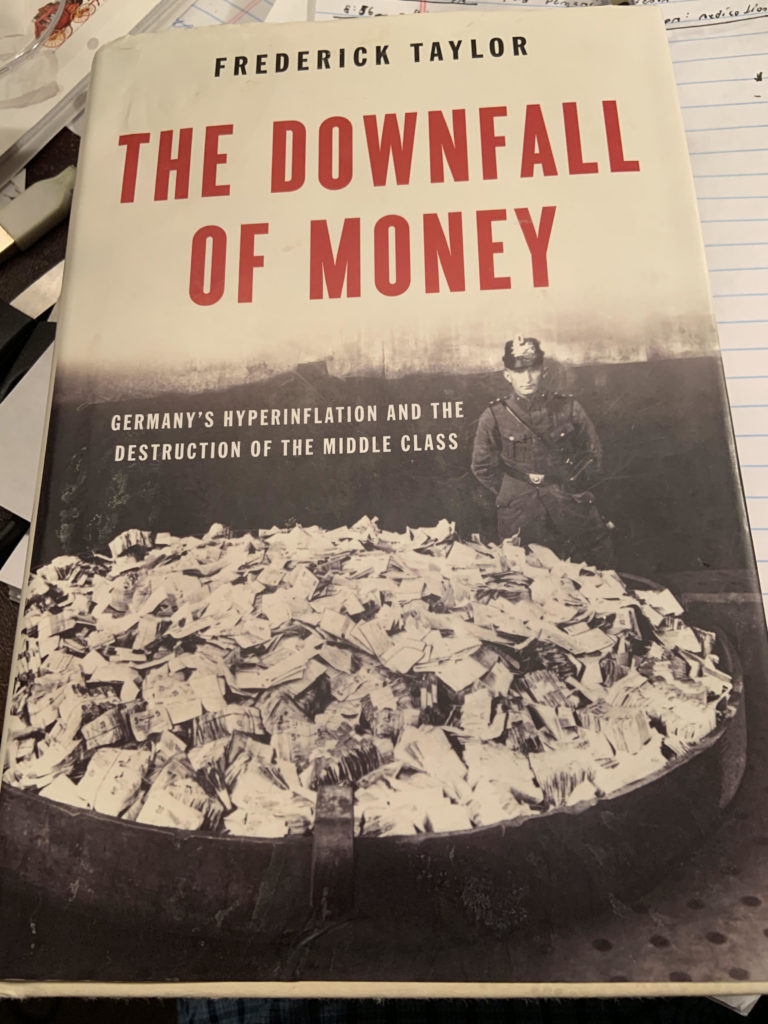

This is now The End Game for the Fed as inflation is percolating causing interest rates to rise which are pricking the stock market bubble. A modern, complex, global division of labor economy depends on sound money and that money has been the dollar since Bretton Woods. However, with the Fed’s injection of more than $3 trillion of liquidity into financial markets over the last year, the dollar is in freefall. As Crescat says, however, they are trapped and have to continue printing money though this may well mean the end of the dollar as a viable medium of exchange. That’s why we’re now facing not just a Second Great Depression but Civilizational Breakdown like what happened in Germany in the early 1920s when the Mark failed to function as a medium of exchange due to the central bank’s unending money printing.

Lastly, I want to talk about a fascinating survey of retail investors by Deutsche Bank which showed investors between 25 and 54 and those with less than 1 year experience to be quite bullish while those over 55 and with more than a year of experience far less so. “Stonks only go up” say the young folks. While that’s been true for almost a year now, they’re about to find out that making money in the stock market isn’t this easy.

The Kiddie Technicians are also uber bullish at what may be the top of the greatest bubble in history.

There is an early 30s technician by the name of Ian McMillan who has almost 50k Twitter followers who personally attacked me about three months ago calling my work “shitty” and me a “shitty person” and a “dork”. Just last week he was tweeting about how strong the intermediate to long term case for stocks was, that we are closer to the beginning of the uptrend than the end and that this move is a “generational trend”. I tried to reconcile with Ian but he simply took my entreaties as an opportunity to further attack me so we already know who the shitty person is. Now we’re going to find out whose work is actually “shitty”.