The Great Disconnect Grows: Dems Control Senate, Trump Supporters Protest, Russell ATHs, Bitcoin $37k and TSLA $756, Extreme Speculative Behavior and Bubble Valuations

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

It was quite a day for our country yesterday. Let’s start with the Democrats surprise wins in both Georgia Senate runoffs to take control of the Senate. The Democrats now control the Presidency, House and the Senate opening the door for President Elect Biden to push through his program of higher capital gains and corporate income taxes, increased spending on clean energy, socialized medicine and increased business regulation. This is not a business friendly political program.

In Washington D.C., Trump supporters protested the election by storming the Capitol embracing violence and chaos in the same way as the BLM movement last year. The social fabric is fraying.

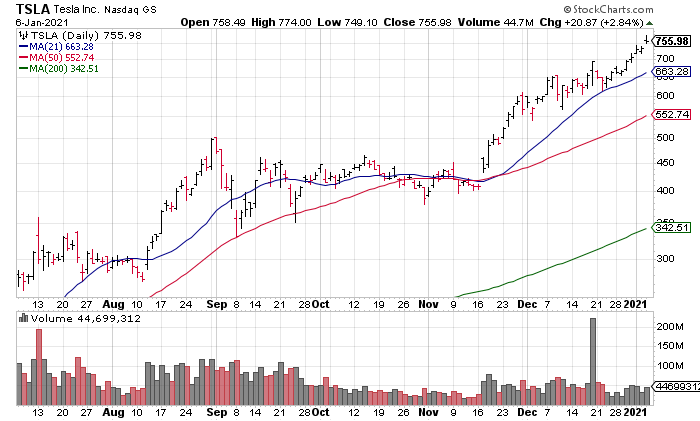

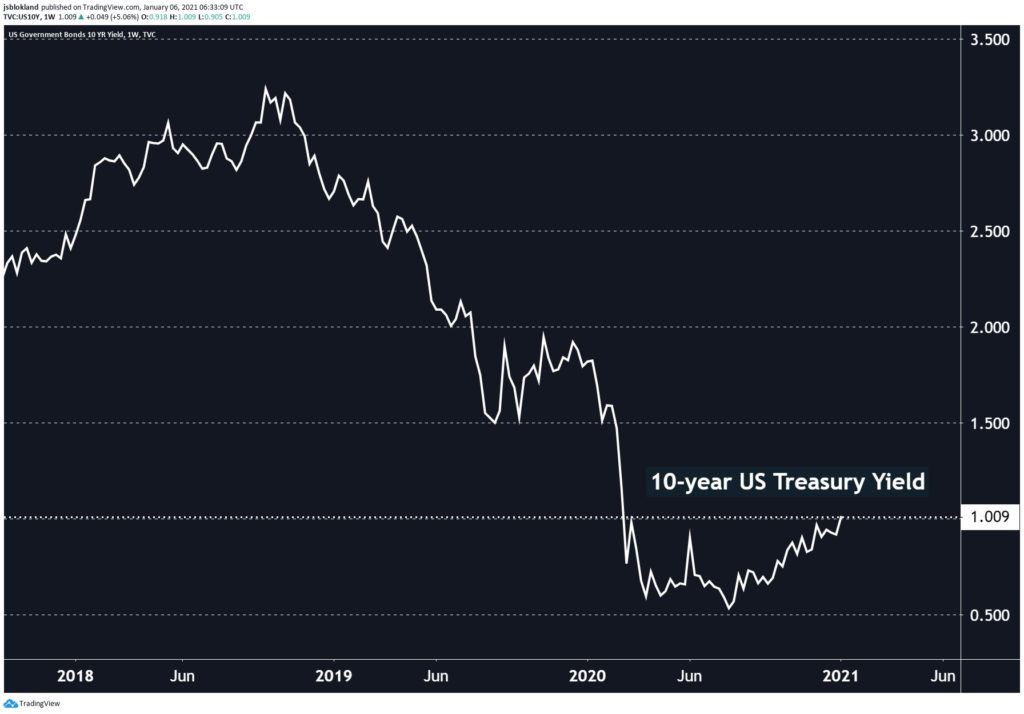

However, the stock market couldn’t care less as the Russell surged 3.98% to an All Time High of 2,058, Bitcoin broke through $37k and TSLA also hit an All Time High of $756. NYSE + NASDAQ volume was enormous at 13.773 billion shares. The 10 year Treasury yield also exceeded 1% for the first time since March.

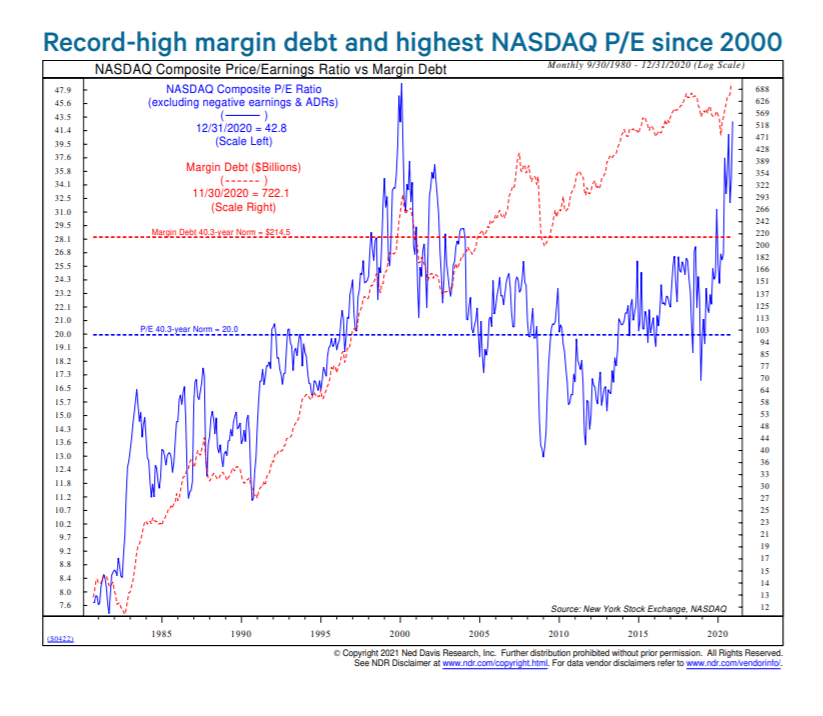

The single most dependable feature of the late stages of the great bubbles has been really crazy investor behavior, especially on the part of individuals – Jeremy Grantham, “Waiting for the Last Dance”, January 5

As noted yesterday, individual investors are indeed acting “really crazy” as they made up 54% of the premium spent on calls at the end of last week compared to 28% for professionals.

Correlated with this extreme speculative behavior are bubble valuations. With a P/E of 43x, the NASDAQ is now approaching the heights seen at the peak of the Dot Com Bubble (Chart Source: Daniel Lacalle Twitter, January 6, 12:59am PST).

In sum, the disconnect between stock prices and reality continued to grow yesterday.