The Technicians Are Unanimously Bullish, COUP & SFIX Earnings, Pulling No Punches

Note: To sign up to be alerted when the morning email is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

It’s amazing how bulled up the technicians are getting. Most of them are convinced that, even after an 82%, 8 month move higher in the NASDAQ fueled by a $3 trillion injection by the Fed, we are only at the beginning of a new bull market that has years and years to run.

For example, The Chart Report’s Chart of the Day yesterday was from Yuriy Matso who projected up the Russell’s current breakout based on the last two which suggest to him that the Russell could reach 2300-2400 in the next year to two. That’s another 24% higher at the midpoint of the range after an 89% move higher already since March 23rd (Source: Yuriy Matso Twitter, December 6, 1:38 pm)

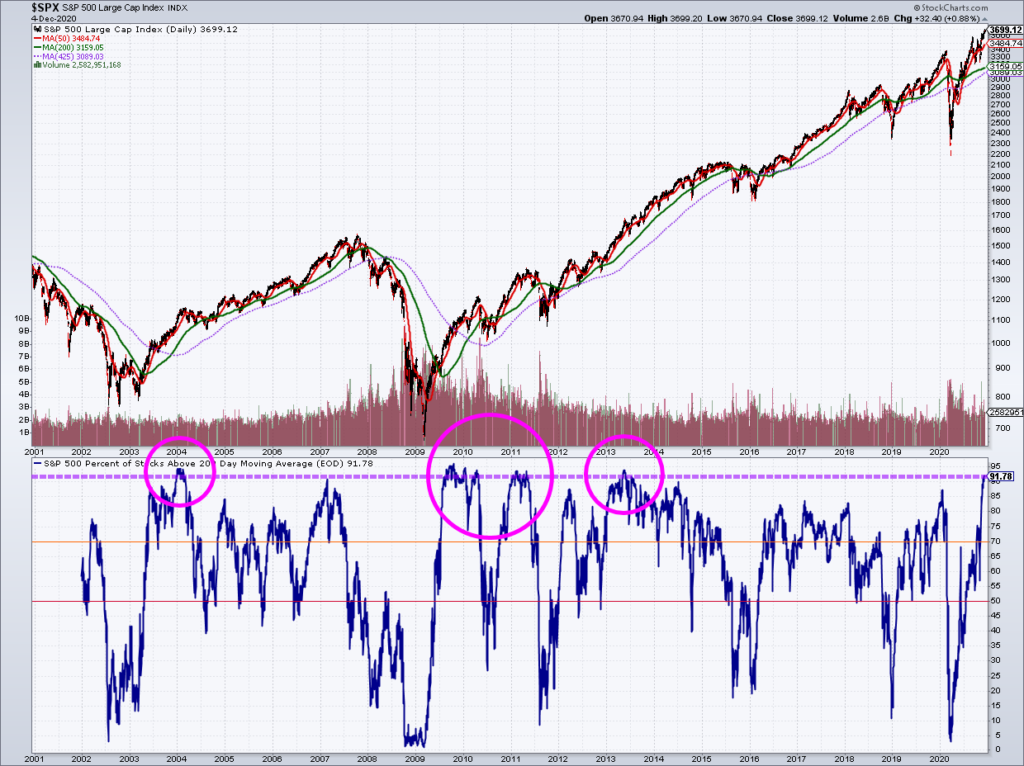

Take a close look at this chart by Grayson Roze which is supposed to show how bullish the currently extremely high breadth readings are (that 92% of S&P stocks are above their 200 DMA in this case). Roze circles early 2004, a few times between 2009 and 2011 and early 2013. But what about early 2007, an instance in which a similar breadth reading preceded The Great Recession? I asked Roze on Twitter and he replied that “It’s juuuuuust barely short of the line “. LOL. Give me a break. If you want to be objective, that data point needs to be included too (Source: Grayson Roze Twitter, December 6, 7:05pm).

What makes this even funnier is the next morning Grayson tweeted about the need for objectivity:

Constantly ask yourself,

“Am I being objective?”

We’re human. We’re emotional, irrational decision makers by default.

But by questioning our objectivity, we can begin to combat the impacts of our cognitive biases.

You’ll be a sharper trader and a better investor for it!

(Source: Grayson Roze Twitter, December 7, 11:27am)

Pretty hilarious to exhibit the kind of confirmation bias Grayson did in his Sunday night tweet and then preach the need for rigorous objectivity the next morning!

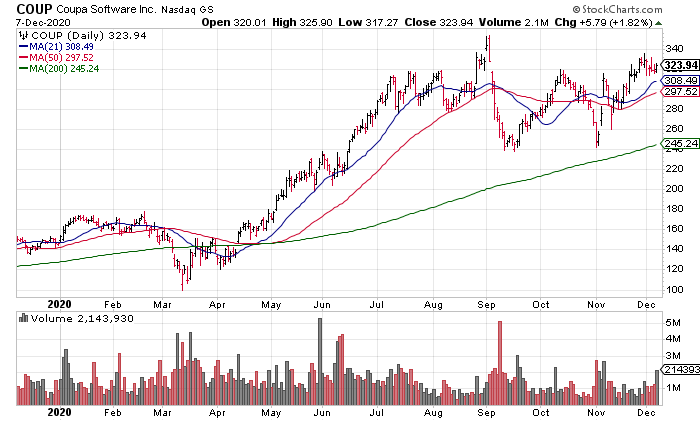

Next, I want to talk about Coupa (COUP) and Stitch Fix (SFIX) earnings, both of which reported yesterday afternoon. COUP reported a 31% increase in revenue to $133 million and 18 cents Non-GAAP EPS. They also guided current year revenues to $523-524 million. With a market cap of $24 billion as of today’s close (Monday 12/7), that’s a Price / Sales ratio of 46x. A Price / Earnings ratio of 46x is expensive. I have no idea what to say about a 46x Price / Sales ratio!

SFIX reported a 10% increase in revenue and 9 cents EPS and the stock jumped about 1/3 to ~$48 in the after hours. How do you pay $48 for a company that just earned 9 cents in their most recent quarter? Crazy!

It’s still too damn easy out here but what are we going to do? Complain about the fed and short? (Aaron Jackson Stocktwits, December 7, 1:22pm)

I’m almost certain this is a subtweet of me as my morning email yesterday included a section “The Shorting Opportunity of a Lifetime” and I tweeted excerpts from James Mackintosh’s “Thank the Fed for This Year’s Run in the Stock Market” (WSJ, December 7) mid morning.

If you read my nuanced and many sided take on why I believe this is “the shorting opportunity of a lifetime” you wouldn’t mistake it for “complaining” about the Fed and emotionally shorting as a result. Read Aaron’s post “Investors are bulled up. For good reasons” (December 6) and you tell me whose of what intellectual caliber.

What great contrarians understand is the broad consensus of bullish breadth and sentiment alone is not bearish – Aaron Jackson, “Investors are bulled up. For good reasons” (12/6)

Of course you shouldn’t be bearish now based on technicals alone. That’s a strawman, however. All of the technicians are unanimously bullish. Investors that are bearish like me look at things from different perspectives like fundamental or macro.

In my case, it’s all three – plus many other disciplines like history and psychology that I bring to bear. Obviously technicals plays a big role in what I do as evidenced by the many technical charts I include in every morning email. I just did fundamental analysis on COUP and SFIX, which I do almost everyday as well. And I am well aware of the role the Fed is playing in the current bull move as well the whole bull market that began in 2009. It’s because of my strong background in Austrian Economics, including the Austrian Theory of the Business Cycle, that I was able to spot, short and profit from the housing bubble and subsequent bust in the mid-to-late-2000s and why I can see that we are in an even bigger bubble today. As a pure technician, like Aaron, who was probably still in college when The Great Recession struck, the only thing you understand is what the market believes since you make no distinction between perception and reality, price and value. All great investors, who sometimes must be contrarians, make that distinction.