The Tell and Inside Wednesday

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

Consider [Monday] morning’s “air pocket” a warning: It will happen again soon but next time it may not bounce back – Top Gun Financial, “Monday’s Crazy Session and Call Option Mania”, Tuesday, January 26, 1:12am PST

On Monday morning we hit what the great short term trader Scott Redler called at the time an “air pocket” in which the S&P dropped ~60 points in a 40 minute period from 7:30am-8:10am PST for no apparent reason before reversing to recover most of the losses. A lot people were wondering what it meant but weren’t too concerned since we’ve seen every dip bought now for 10 months. I, on the other hand, saw it as a warning that would happen again soon and might not be bought so hard the next time around. And that’s exactly what happened yesterday (Wednesday). I will say more about yesterday’s session in a minute but first I want to discuss some of the clues that suggested the market was peaking – at least in the short term.

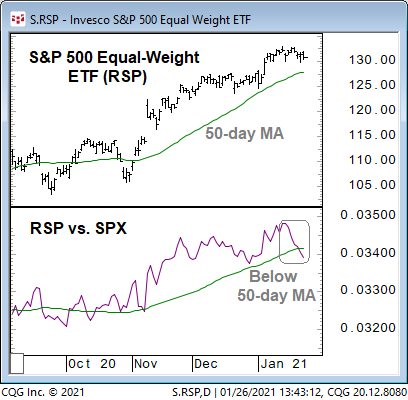

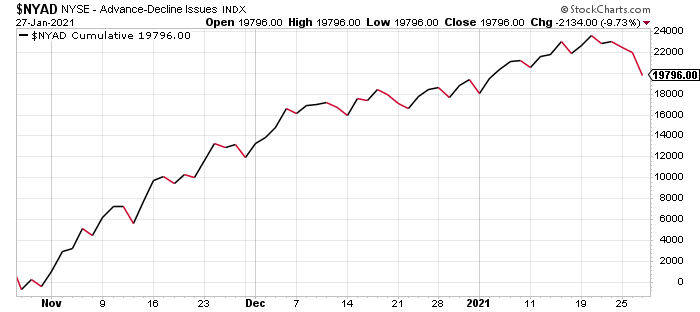

Yesterday (Wednesday) morning I talked about the end of the rotation trade from Mega Cap Tech into the Reopen Names best represented by the QQQ and IWM, respectively (“Deterioriating Internals, MSFT Earnings and a Big Earnings Afternoon (AAPL TSLA FB)”, Top Gun Financial, Wednesday January 27, 1:19am PST). Katie Stockton had a great chart showing the weakness of the Equal Weight S&P, especially versus the S&P itself. What this told us was that the market was thinning out again as investors rotated out of the Reopen Names and back into Mega Cap Tech. This can also be seen in a chart of the NYSE Cumulative Advance/Decline line which was negative Thursday, Friday, Monday and Tuesday.

That put a lot of pressure on Mega Cap Tech ahead of a big earnings afternoon yesterday (Wednesday) with 3 of The Big 6 reporting: AAPL (#1), TSLA (#5) and FB (#6). Yesterday (Wednesday) morning I wrote: “Now, if we’re experiencing an end of the rotation from QQQ into IWM and the beginning of the rotation back the other way, the big Mega Cap Tech stocks better deliver or the market will crack…. The real test comes this afternoon when Apple (AAPL), Tesla (TSLA) and Facebook (FB) all report.”

Now, AAPL TSLA FB all in fact did deliver great quarters (see my tweets about each earnings report by clicking on the ticker) but were nevertheless sold off in the after hours. That is setting us up for another potentially big down day today (Thursday) as Japan sold off 1.53% and Europe is off to a bad start (Germany -2.01%, France -1.25%, England -1.73%). Our Futures are trading down in sympathy with the S&P Futures -0.84% and the Nasdaq-100 Futures -1.22% as I write.

The logic was straightforward: If the Reopen Names represented by the IWM were no longer working and the market was being held up by Mega Cap Tech as represented by the QQQ, AAPL TSLA & FB better deliver or the market would be without its only prop. Now, as I wrote earlier, they did deliver great quarters but it wasn’t enough for the market and that is setting us up for a second consecutive big down day. I don’t know if this is “the top” or a correction but it wouldn’t surprise me, for all the reasons I’ve detailed here in recent months, if it’s the former.

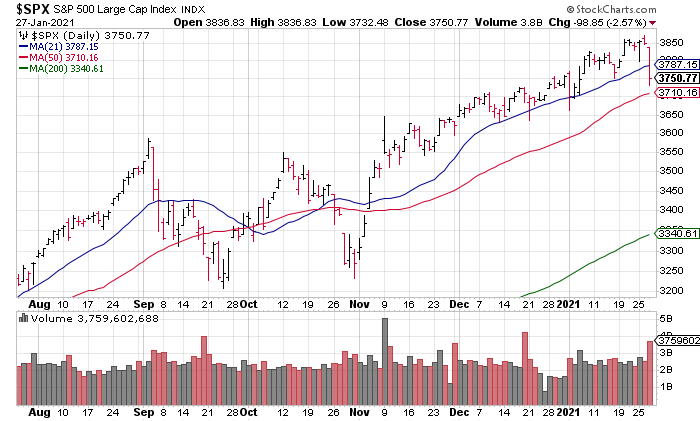

Now let me say a few things about Wednesday’s session which was a potentially historic top. Here were the returns for the major indexes: S&P -2.57% NASDAQ -2.61% Russell -1.91%. However, there were a number of other significant features of the session as well. For starters, volume was off the charts with NYSE + NASDAQ volume ~20.7 billion. The number for Tuesday was ~12.7 billion. In addition, while not a 90/10 down day, NYSE + NASDAQ Advancers to Decliners was 1,142 to 6,003. With 7235 securities traded, that means only 16% were up on the day. Investors were getting out of Dodge in a big way.

That resulted in some real technical damage with the S&P closing below its 21 Day Moving Average (DMA) for the first time since November 3, 2020. The 50 DMA at 3,710 appears to be very much in play today at this early hour.