Yields And Inflation Are Driving Everything, Market Internals

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

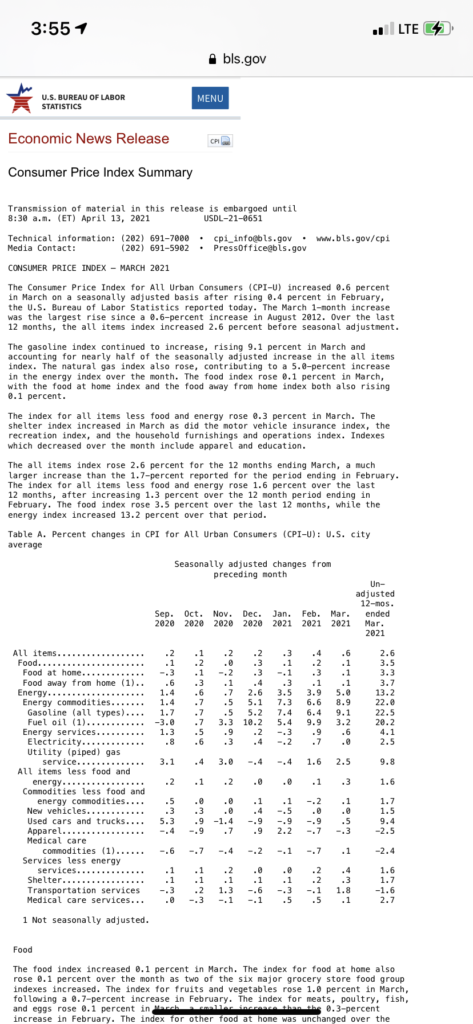

Tuesday’s market action was a microcosm of the larger picture. It started with the slightly hotter than expected March Consumer Price Inflation (CPI) number at 8:30am EST. But the decisive event was a strong 30 year Treasury auction at 1:00pm EST that resulted in a significant drop in interest rates which caused the NASDAQ and stocks in general to find a bottom and rally into the close.

In the chart of the day, Schwab’s Chief Investment Officer Liz Ann Sonders laid bare the larger context. As you can see yields have been driving everything for the last month. From November through February, we saw a rotation from Growth/Tech into Cyclical Value as the announcement of Pfizer’s COVID vaccine on Monday morning November 9 caused investors to start to position themselves for economic reopening. However, the Reopen Trade may have gotten overdone and, as yields have stabilized over the last month, investors have rebalanced out of it and back into Growth/Tech.

However, while the S&P and NASDAQ continue to go higher, all is not well beneath the surface. The market is being led by Mega Cap Tech which is masking weakness in the overall market. In another great chart from yesterday, the technician Andrew Thrasher showed how Cyclical Value stocks are not participating at the moment. Even though the S&P was +0.33% and the NASDAQ +1.05% yesterday, NYSE + NASDAQ Decliners (3,882) outnumbered Advancers (3,579).

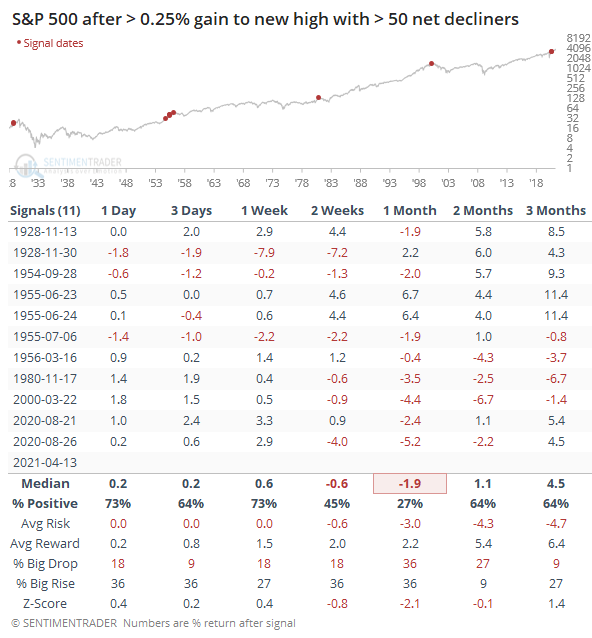

Sentimentrader also highlighted the internals yesterday in their Daily Report blog [SUBSCRIPTION REQUIRED] after the market close. Even though the S&P was +0.33%, 279 stocks in the index declined compared to only 225 that advanced. In fact, yesterday was only the twelfth time the S&P has advanced more than 0.25% to a new high with net decliners greater than 50 in nearly 100 years! As you can see in the table, the S&P was down a month later in eight of the previous eleven instances including the last six.

Combining weak breadth with the extreme valuation and sentiment I wrote about yesterday morning puts investors in a tough spot. Sentimentrader said it best yesterday morning: the market is risky for late buyers but it’s also risky to bet against the momentum! I am managing this tension by being extremely overweight the precious metals miners with a significant allocation to defensive stocks and am not even considering shorting at the moment.