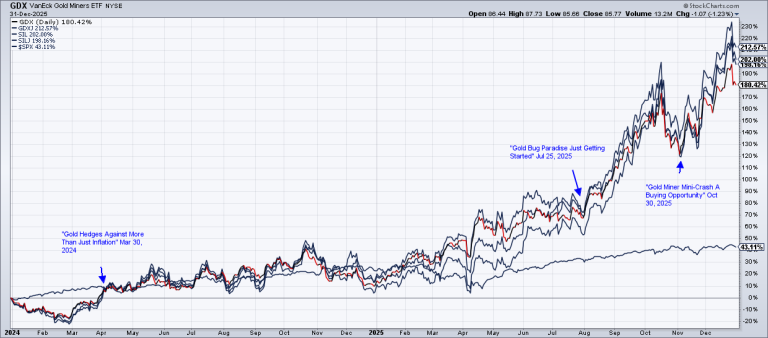

Year End Letter: Top Gun Returns 38% in 2025

January 3, 2026 It takes a man a long time to learn all the lessons of all his mistakes – Jesse Livermore The test of a first rate intelligence is the ability to hold two opposing ideas in mind at…

January 3, 2026 It takes a man a long time to learn all the lessons of all his mistakes – Jesse Livermore The test of a first rate intelligence is the ability to hold two opposing ideas in mind at…

The market is pricing in an 87% probability that the Fed will cut interest rates by 25 basis points on Wednesday. But the benchmark 10-year Treasury yield has risen sharply over the last week. What gives? Contrary to many people’s…

The S&P continues to trade within the 200 point candle from Friday October 10th defined by 6750 on the topside and 6550 on the bottom. From a technical standpoint, until we breakout of that candle one way or the other…

It’s been two weeks now since I wrote “How To Navigate A Bubble”. Since then, the S&P has tacked on another 50 points – from 6,664 to 6,715. Market timing is notoriously difficult. So difficult, in fact, that many of…

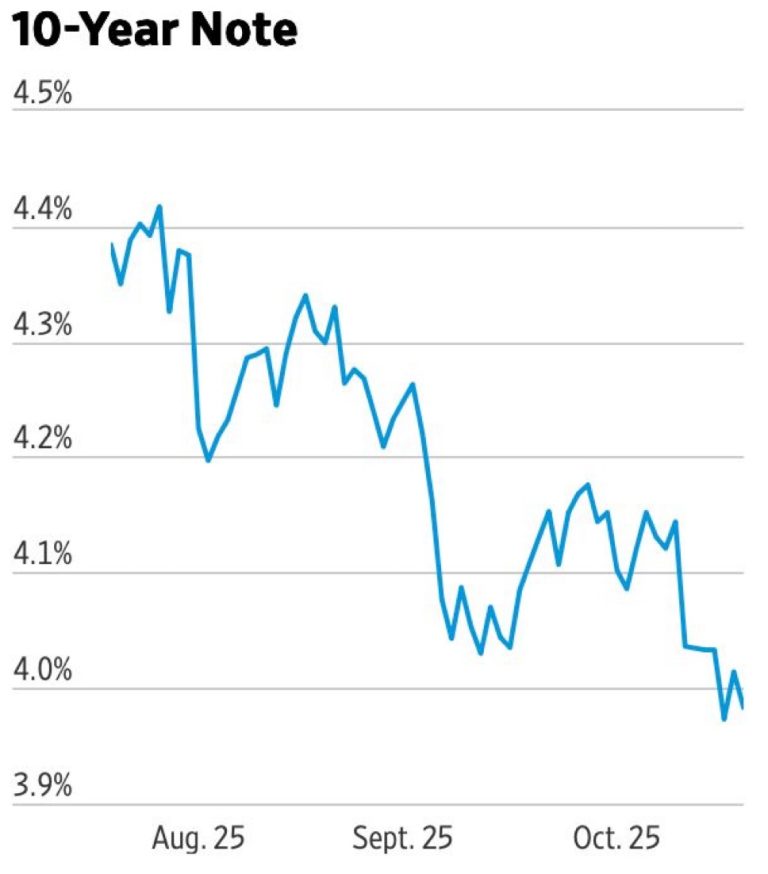

The consensus after Fed Chair Powell’s speech Friday morning at Jackson Hole is that the Fed will cut rates by 25 basis points on September 17. Therefore interest rates are going lower, right? Not so fast. The Fed controls the…

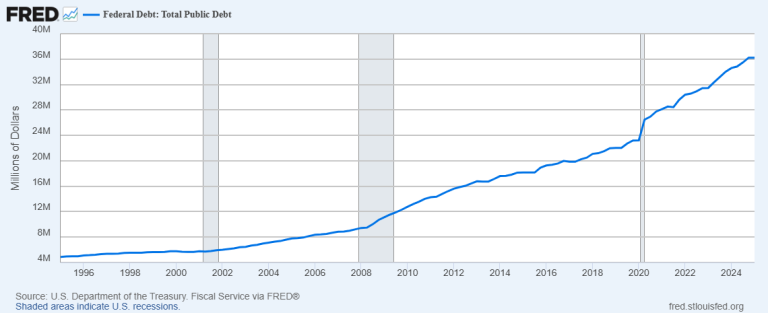

The stock market continues to move higher since its April 9 low with the S&P now up more than 30% since then. The move is starting to defy logic as there are risks around tariff policy, the deficit and debt,…

For the last two months I’ve been trying to determine if the rally initially spurred by Trump pausing the Liberation Day tariffs by 90 days on April 9 represents a continuation of the long bull market or a bear market…

The market was cruising along until a weak 20 year treasury auction in the middle of the day Wednesday sent interest rates soaring and stocks stumbling. Early Friday President Trump spooked markets once again by calling for a 50% tariff…

Even a downgrade of the US credit rating by Moody’s couldn’t derail the current momentum in the stock market Monday as the S&P clawed back all of the 60 points it lost at the open plus 5. The technicals have…

Probably the most important development in financial markets over the last few months is the steep rise in interest rates. Since the Fed started cutting rates with a 50 basis point cut on September 18, the 10 year yield has…