Don’t Call It A Bubble, BBY Earnings

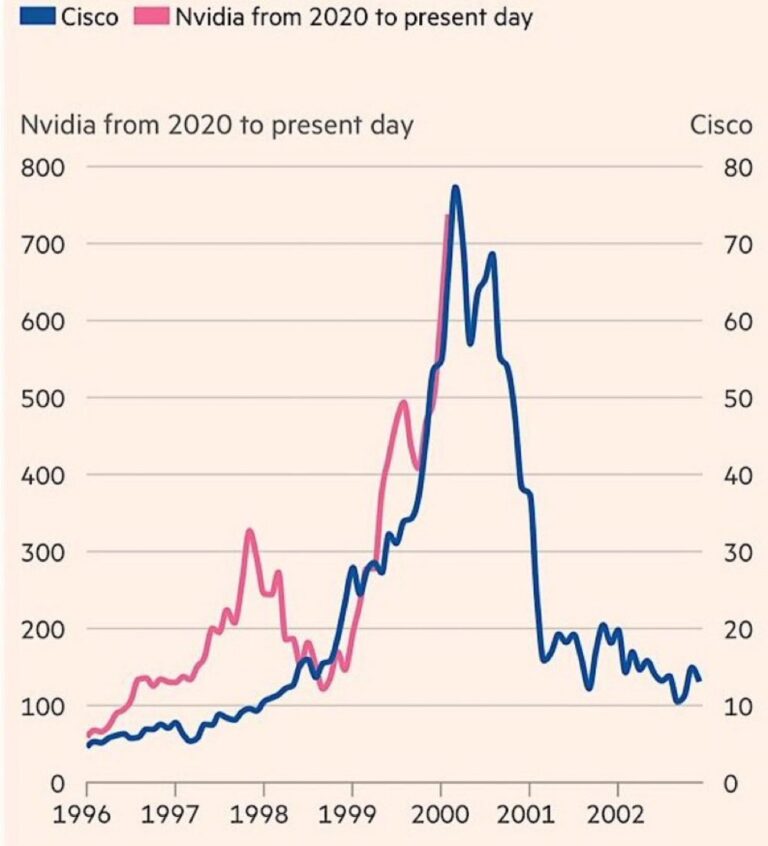

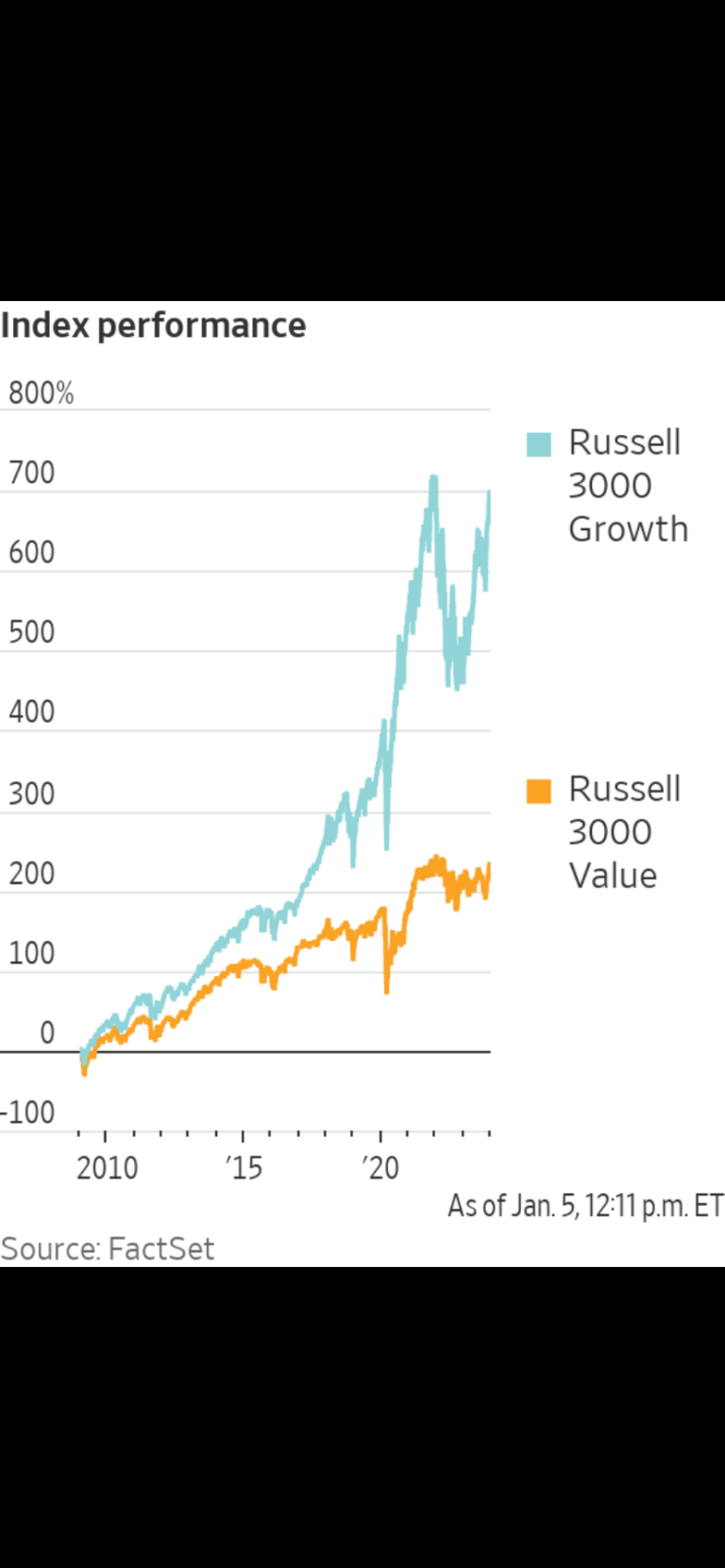

Jon Sindreu wrote a very interesting article for the WSJ’s Heard On The Street section this morning (“Don’t Call AI Craze A Bubble” [SUBSCRIPTION REQUIRED]). Sindreu wants to make a distinction between the current market – in which blue chip…