Post Modern Economics: Modern Monetary Theory (MMT) And The Flight From Reality

MMT’s ideas have insinuated themselves deep into government, central banking and even Wall Street – “Modern Monetary Theory Isn’t The Future. It’s Here Now” [SUBCRIPTION REQUIRED], James Mackintosh, The Wall Street Journal, November 22

The current fad in economics is Modern Monetary Theory (MMT). The main idea is that because the government creates money, there is no limit to money creation. Therefore, we can pay for whatever we want – as long as it doesn’t cause inflation.

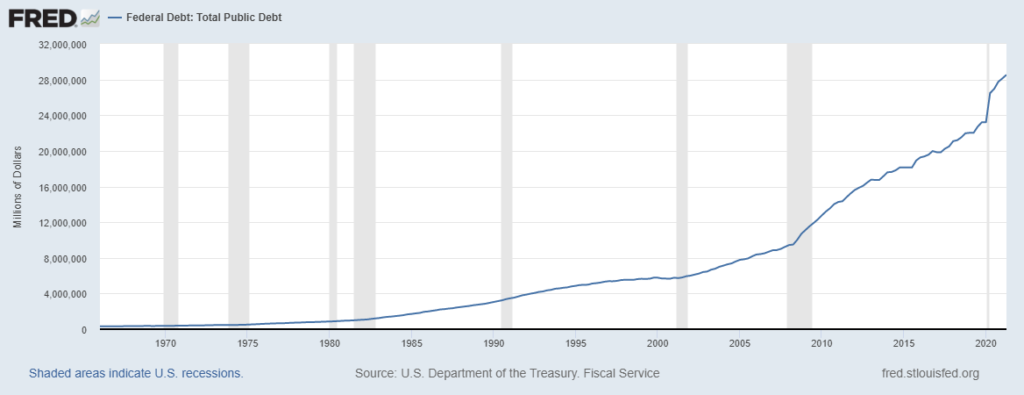

Emboldened by the fact that the huge federal debt the United States has run up since WWII has not caused inflation, MMT adherents argue “deficits don’t matter”. We can just monetize them – as we have been doing since the Great Recession via Quantitative Easing (QE).

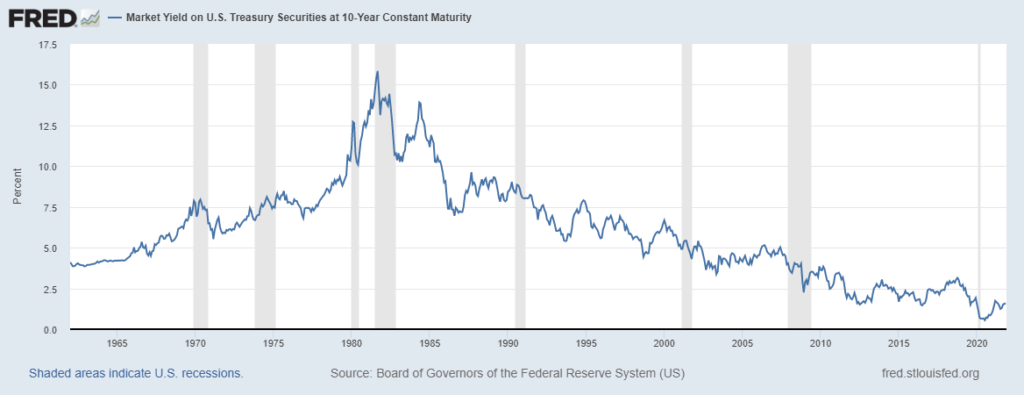

It’s somewhat of a mystery why all this money creation and debt has not caused consumer price inflation until now. One of the main reasons is that central banks have channeled money creation into financial markets creating asset price inflation but not consumer price inflation. Another reason inflation has been held down is globalization – the outsourcing of production to cheaper locales around the world.

At any rate, the policy response to COVID has been so massive that this is no longer the case. The amount of money central banks have pumped into financial markets has created the greatest asset bubble in history. And fiscal stimulus packages are now creating runaway consumer price inflation.

MMT essentially argues that there is such a thing as a free lunch. Put another way, the idea that resources are scarce is just a “narrative”, as Stephanie Kelton wrote in her best selling MMT primer “The Deficit Myth”. Unfortunately, scarcity is not a “narrative” but a fact of reality. Real economic growth is caused by increasing productivity not money creation. The latter creates the illusion of prosperity but ultimately ends in bust.

The global monetary system has been heading for a day of reckoning since Nixon removed the last link to gold on August 15, 1971. That day is now upon us.