Scenario Analysis For Friday’s Trading Session

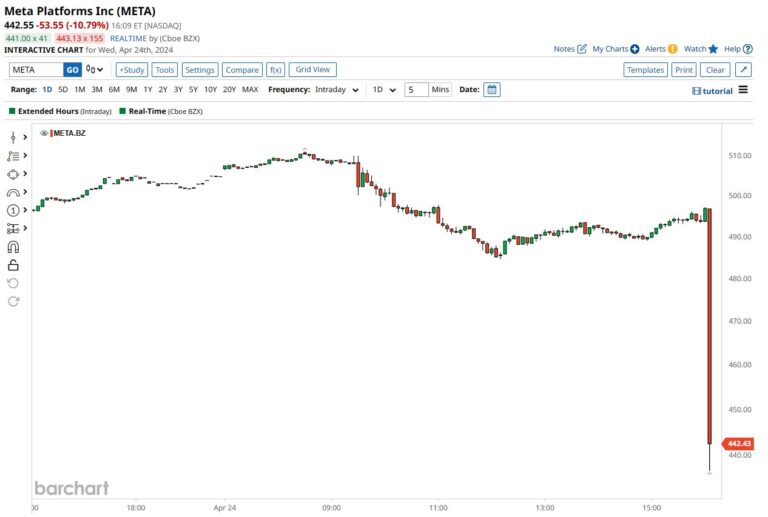

The S&P is currently in a range between 4950 and 5250. After blowout earnings from Google (GOOG/GOOGL) and excellent earnings from Microsoft (MSFT) Thursday afternoon, the market is going to gap up at Friday’s open. The question is: What happens…