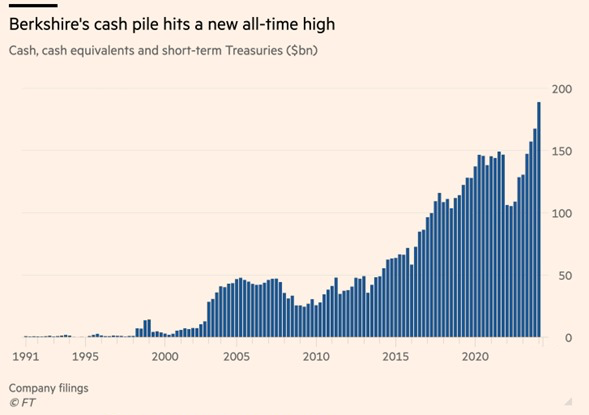

Bill Smead: Read Between The Lines: Buffett Is As Bearish As He’s Ever Been

I am not attuned to this market environment and I don’t want to spoil a decent record by trying to play a game I don’t understand – Warren Buffett, Letter To Partners announcing the closing of the original Buffett Partnership,…