On The Verge of Civil War or AI Utopia?

On Monday, Bridgewater Founder Ray Dalio wrote a well read article on Twitter and LinkedIn titled “Money, Civil and International War, Minneapolis, and Beyond – In Perspective”. In that article, Dalio argued that we are in the process of moving from Stage 5 (Breakdown) of his model to Stage 6 (Civil War). The rational course of action late in Stage 5 is to get out:

That brings me to my next principle: When in doubt, get out – if you don’t want to be in a civil war or a war, you should get out while the getting is good. This is typically late in Stage 5. History has shown that when things get bad, people want to move to where conditions are less bad or good and the doors typically close for people who want to leave. The same is true for investments and money as countries introduce capital controls and other measures during such times.

In Minneapolis, the conflict between the federal government (ICE) and the local citizens backed by state and local government has turned violent resulting in two deaths to date. We are badly in need of de-escalation from both sides but it’s unclear whether it will happen.

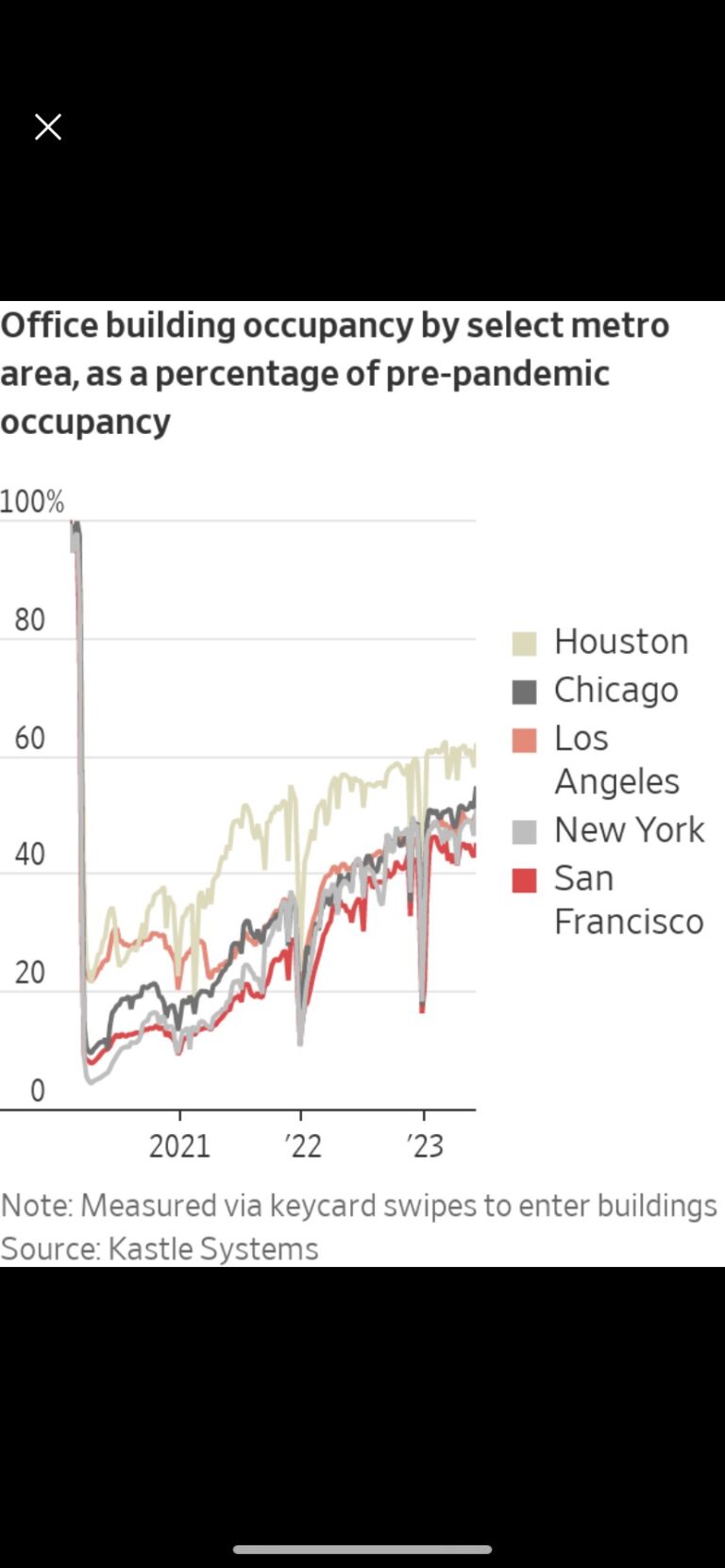

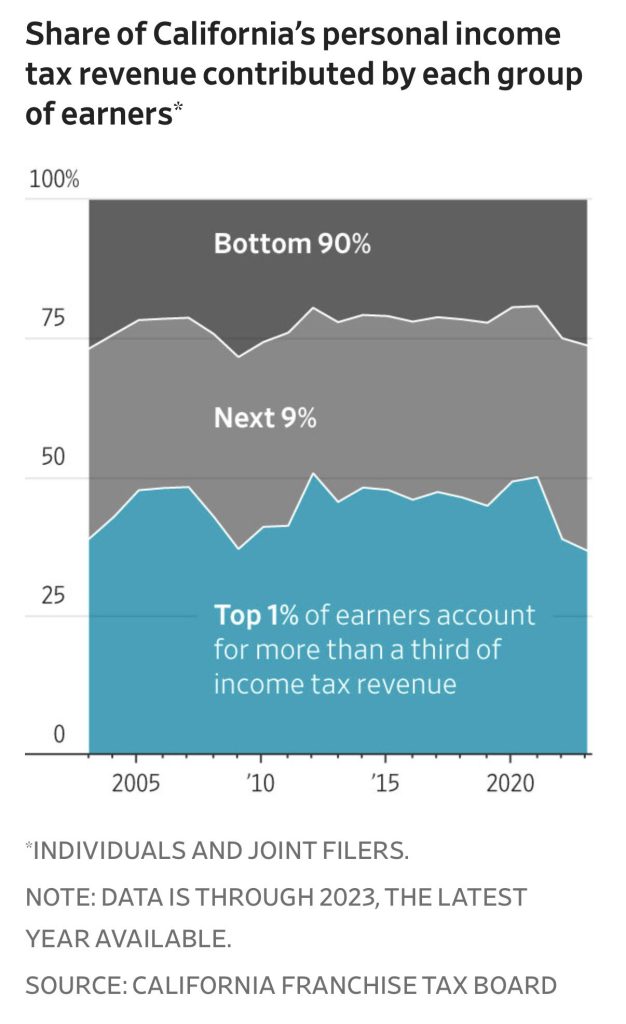

In California, there is a parallel fight going on over a proposed Wealth Tax. Wealthy citizens – who pay most of California’s taxes – appear to be leaving in droves to avoid the potential tax. In sum, the blue states appear to be on the verge of civil war and it seems prudent to at least consider moving to a red state if you don’t want to get caught up in it.

On the other hand is techno-utopian Elon Musk. On Tesla’s conference call on Wednesday afternoon, Musk talked about “creating amazing abundance” as the company shifts from producing electric vehicles to autonomous vehicles, robots and artificial intelligence. Musk has said that universal high income is on the way and that in the future – due to the lack of scarcity – there will be no need for money.

The consensus on Wall Street was nicely laid out by James Mackintosh in Thursday’s WSJ (“Can This Bull Market Run?” B1). Analysts are forecasting a continuation of the bull market on the basis of 15% earnings growth for the S&P in 2026 and 2027 – after 13% in 2025. That would be the first time S&P earnings have increased at a double digit pace for three years in a row since before the 2008 Financial Crisis. “I find it hard to disagree with the core of the bull case, that the economy looks fine despite everything”, concludes Mackintosh.

How to reconcile these disparate points of view?

Most of the time, the best bet is that the status quo (Mackintosh) will continue. That means markets will go up 10% as the economy and politics muddle through. The catastrophic (Dalio) and utopian (Musk) scenarios are possibilities but outliers.

My personal opinion – however – is that imbalances in the economic system combined with a decay in the moral and cultural foundations of our free society have been building since the 1960s and have now reached an inflection point: the center cannot hold. I believe Dalio is right that we are on the brink of a sort of low grade civil war in the blue states and that prudent people should seriously consider moving to red states.

I’m not predicting the end of the world as that is a bad bet since it only happens once. I’m simply saying that prudence dictates insulating oneself from the metastasizing toxicities of our economy and culture. From a financial perspective, that means owning hard assets – the precious metals, commodities, real estate – to protect oneself from the decline of the dollar and fiat currencies generally. From a lifestyle perspective, that means removing oneself from toxic blue states where decent citizens are being put at risk by radicals hellbent on revolution and willing to employ violence to bring it about.