How To Play Crime, Violence And The Decline Of America’s Great Cities

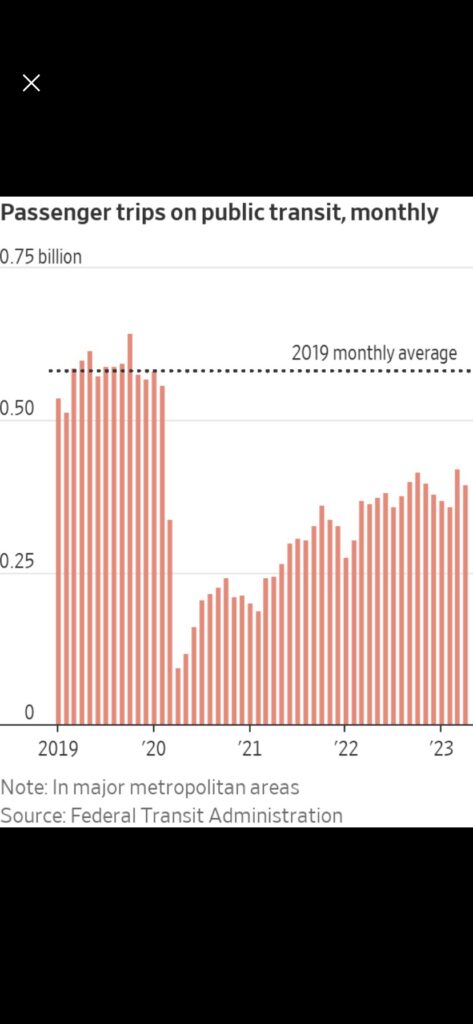

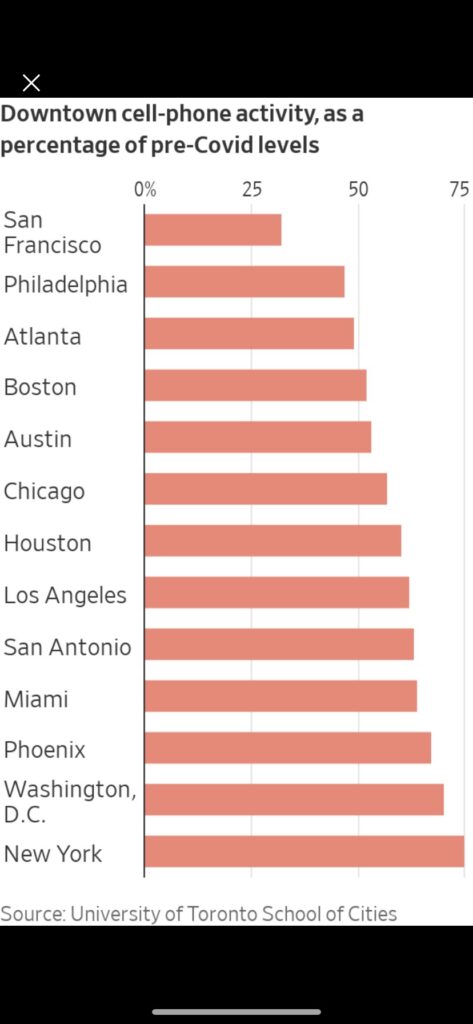

On the front page of Wednesday’s WSJ, Heather Gillers wrote a terrific article on the decline of America’s great cities (“Wall Street Sours On America’s Downtowns” [SUBSCRIPTION REQUIRED]). As you can see in the charts above from the article, they have not recovered from the pandemic. Office occupancy is about 50% pre-Covid levels across 10 major metro areas, public transportation ridership is at less than 70% and cell phone activity is as low as 32% in San Francisco. While Gillers focuses on the decline in price in investments linked to cities, one of the main reasons for their decline is increasing crime and violence.

As more and more citizens wake up to the rising tide of crime and violence, my guess is that gun ownership for self defense will increase. There was a huge spike in gun sales during the pandemic for just this reason. And while gun sales have declined significantly with the passing of the pandemic, my contention is that there is a secular trend higher in crime and violence that will lead to a corresponding secular increase in gun ownership.

There are two publicly traded gun stocks to play this trade: Smith & Wesson (SWBI) and Sturm Ruger (RGR). Top Gun has small positions in both. Both stocks have been beaten up as gun sales have declined with the waning of the pandemic, but I think they may start to pick up soon. I’ll be very interested in SWBI’s quarterly earnings report out Thursday afternoon.

Also see:

“Theft To Cost TGT $500 Million”, May 18, 2023, Top Gun Financial