Sell Calls, Play Defense

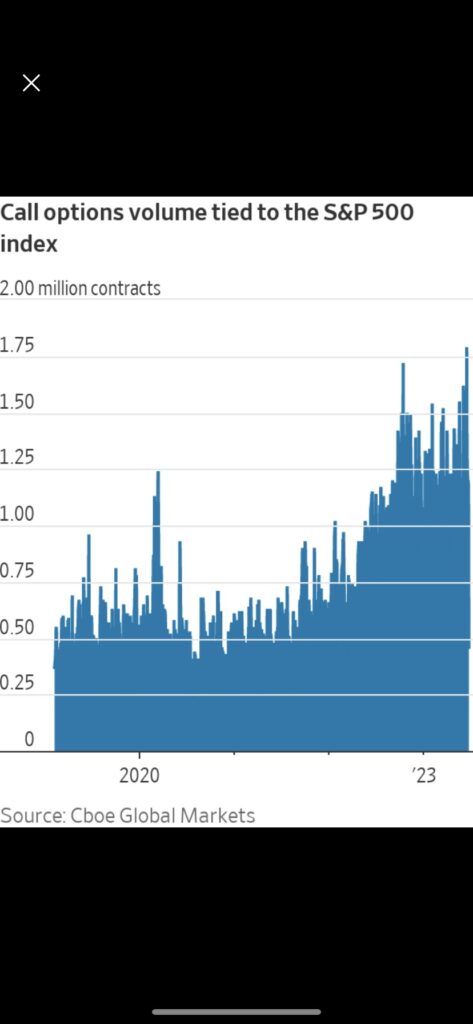

There is an article on the front page of today’s WSJ Business & Finance section about how investors are buying calls in record volumes – and paying up for them (“The Bull Market Is Just Getting Started, Traders Bet” [SUBSCRIPTION REQUIRED]). As a result, skew – which measures the difference in price between puts and calls with the same expirations – is at its lowest levels since at least 2019, according to the article. This creates an opportunity to sell bullish investors calls at high premiums for those like myself who are not believers in the new bull market narrative. I implemented this by selling some QQQ Jan24 $400 calls for almost $10. The only way this trade loses money is if the QQQ is above $410 in January 2024 – which would be an all time high.

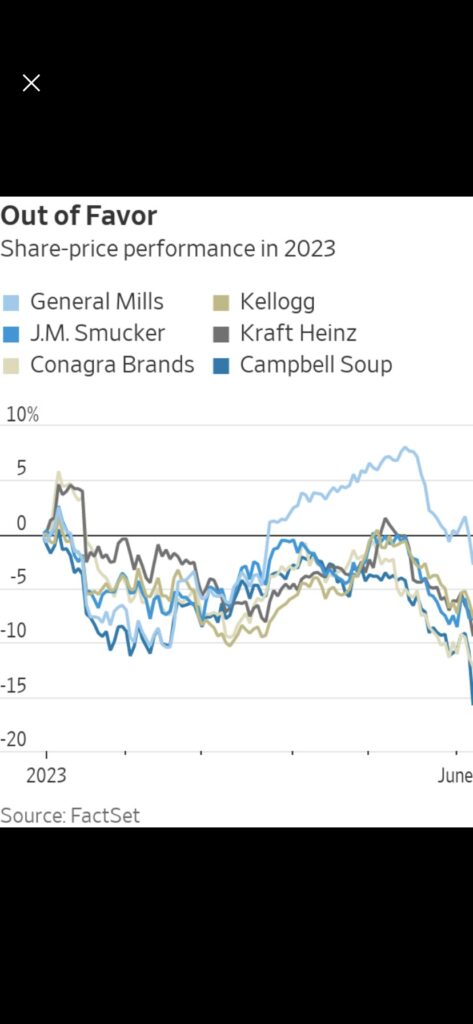

The other trade I made this morning was buying a few shares of General Mills (GIS) which reports earnings on Wednesday morning. As you can see in the chart above, GIS has pulled back hard over the last month to its 200 DMA – which has been a buying opportunity for the last two years. Food stocks have been hit this year for a couple of reasons. One, investors are putting money to work in the big technology stocks and shifting out of defensive names. Two, investors are concerned that the price increases food companies have been able to push through are at an end (see “Investors Go Cold On Food Stocks” [SUBSCRIPTION REQUIRED], Aaron Back, WSJ, June 7). That is a big problem as GIS’s 12% organic sales increase in the first nine months of its fiscal year is the result of a 16% increase in pricing and a 3% decrease in volume. Personally, I’m still bullish on the food stocks and view this as a buying opportunity.