Too Hot Too Handle

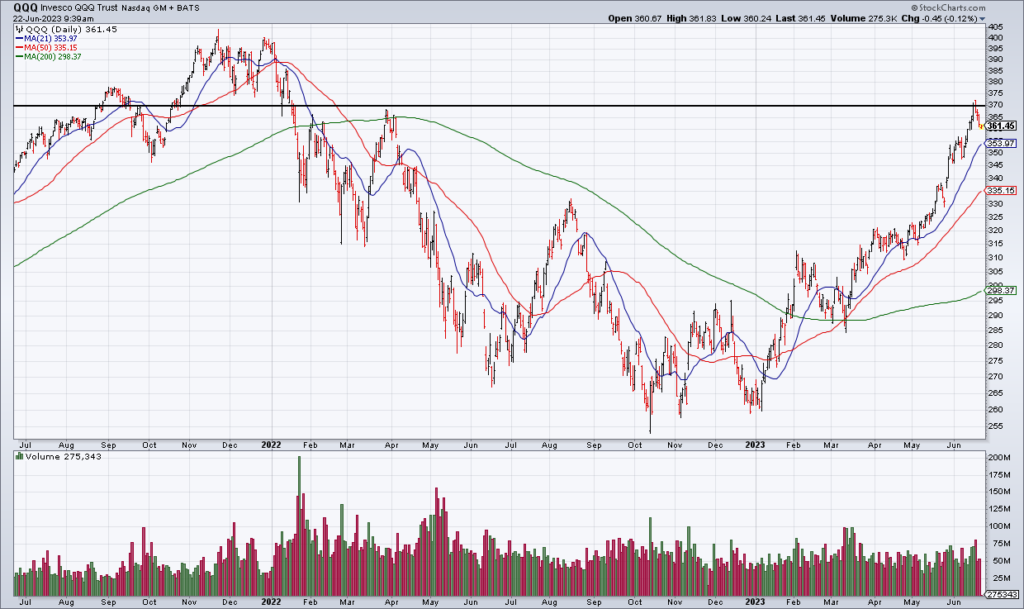

Even if this is a new bull market, stocks got a little too hot to handle and we’re undergoing a mild pullback this week. Powell talked tough in front of Congress Wednesday and Federal Express (FDX) and Darden (DRI) both reported weaker than expected top lines. FDX’s revenue declined 10% versus a year ago and its FY24 forecast Tuesday afternoon was for flat to low single digit revenue growth. DRI’s same store sales were +4.0% and it guided FY24 to +2.5% to +3.5% Thursday morning. (DRI is the owner of Olive Garden, Longhorn Steakhouse and other popular restaurant chains). These are by no means awful numbers but they’re not good enough considering the run these stocks – and stocks in general – have had. The $370 level on QQQ looks important from a technical perspective.