Gold Hedges Against More Than Just Inflation

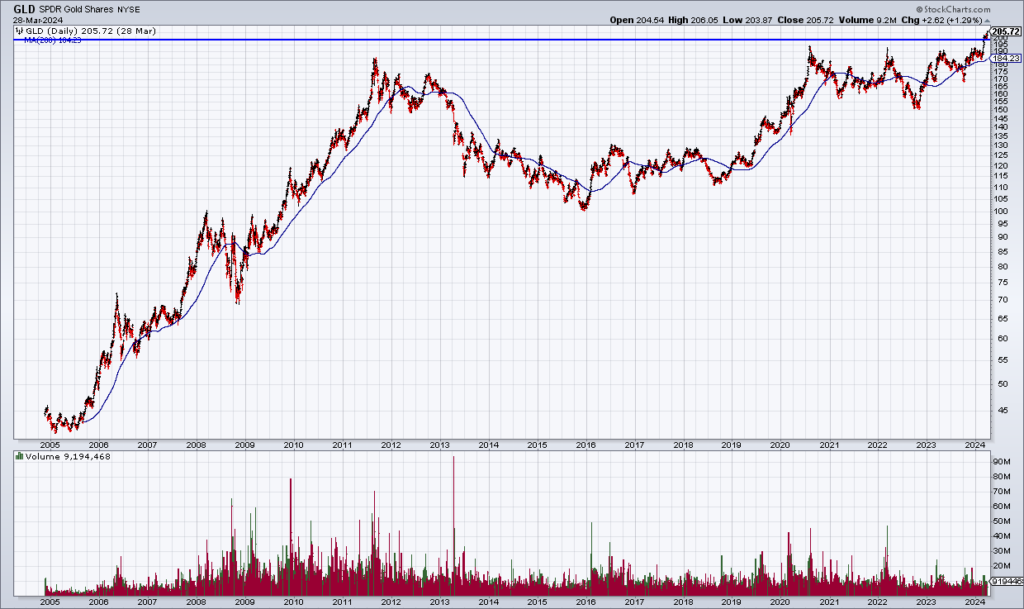

For most of my professional investment career beginning in 2007, I’ve been a gold bull. Having studied the work of the great Austrian economist Ludwig von Mises in college, I early understood the fundamental role monetary policy plays in the business cycle and inflation. Therefore, I expected 0% interest rates and Quantitative Easing in the wake of The Great Recession of 2008 to cause inflation. But while gold rallied hard from 2009 through the last top in the Fall 2011 in that expectation, inflation never materialized at that time.

When the Fed started raising rates aggressively in 2022 to combat surging inflation – and I was finally convinced that they were serious about it – I sold all of my gold. But in recent months gold has started to move again, breaking out to new all time highs and baffling me. The Fed’s monetary policy is tight and inflation is under control. I couldn’t figure out why gold was rallying.

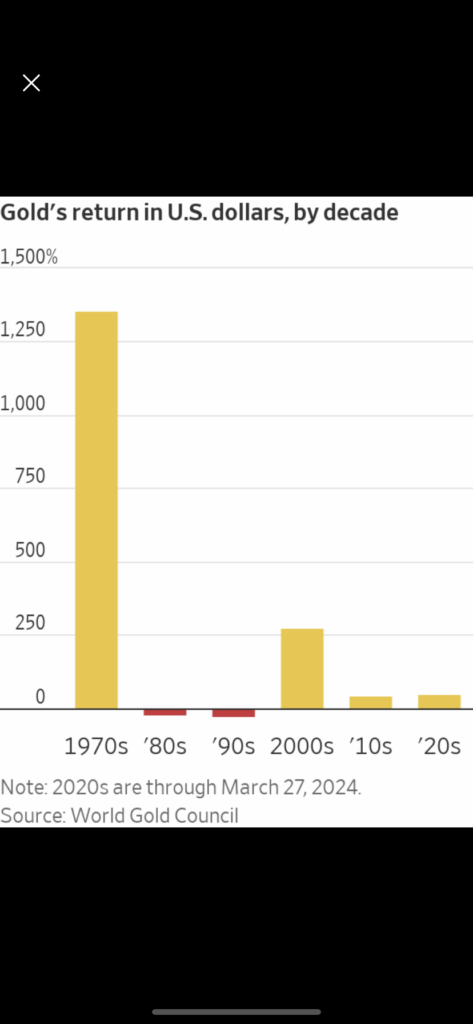

The best explanation can be found in a superb article from Friday’s WSJ by Aaron Back (“Gold Is Rallying. It Isn’t About Inflation This Time” [SUBSCRIPTION REQUIRED]). Gold isn’t just a hedge against inflation. It’s also a hedge against civilizational disorder:

When confidence in society and political institutions erodes, the appeal of gold and other precious commodities like diamonds rises as alternative stores of value that aren’t contingent on societal arrangements.

Now think of our current moment. The Ukraine war rages on, tensions between China and the U.S. are on the rise and a clash over Taiwan can’t be ruled out in the foreseeable future. One of the most contentious presidential elections in U.S. history is approaching, with both sides of the political divide fearing unusually dire consequences should they lose.

When I read Back’s article this morning, I finally understood the current rally in gold. I believe oil is rallying for the same reason. I’m getting back in on Monday.