Market Preview Week of Feb 13-17: Leaders of the Future: ABNB SHOP DASH DKNG

The main event next week is the January CPI Report on Tuesday morning (for more on this see “Icahn’s Puts And The January CPI”, Top Gun Financial, February 10).

In addition to the CPI, a number of what I have termed “leaders of the future” are reporting earnings. These are the companies that will lead the next bull market as we move towards an increasingly app based digital economy. I’m talking about Airbnb (ABNB), Shopify (SHOP), DoorDash (DASH) and Draft Kings (DKNG).

Let’s start with ABNB which allows home owners to rent out their homes and guest houses with ABNB’s app. It is disrupting the hotel industry by matching home owners who want to make extra money with travelers who want a different kind of experience. ABNB will do about $60 billion of gross bookings this year for about 400 million nights booked. ABNB takes a cut of the gross bookings for the use of its app. ABNB reports 4Q22 earnings on Tuesday afternoon.

Next up is SHOP. SHOP enables ecommerce for small businesses with an online store platform that facilitates transactions. SHOP will do almost $200 billion in gross merchandise volume this year. It reports 4Q22 earnings on Wednesday afternoon.

On Thursday afternoon, DASH and DKNG report. DASH – along with Uber Eats – is streamlining the restaurant food delivery business with its app. It allows restaurants to outsource food delivery and customers to order from a wide variety of restaurants through its app. DASH will deliver about $50 billion in total orders this year and takes a cut of that from the restaurants it serves.

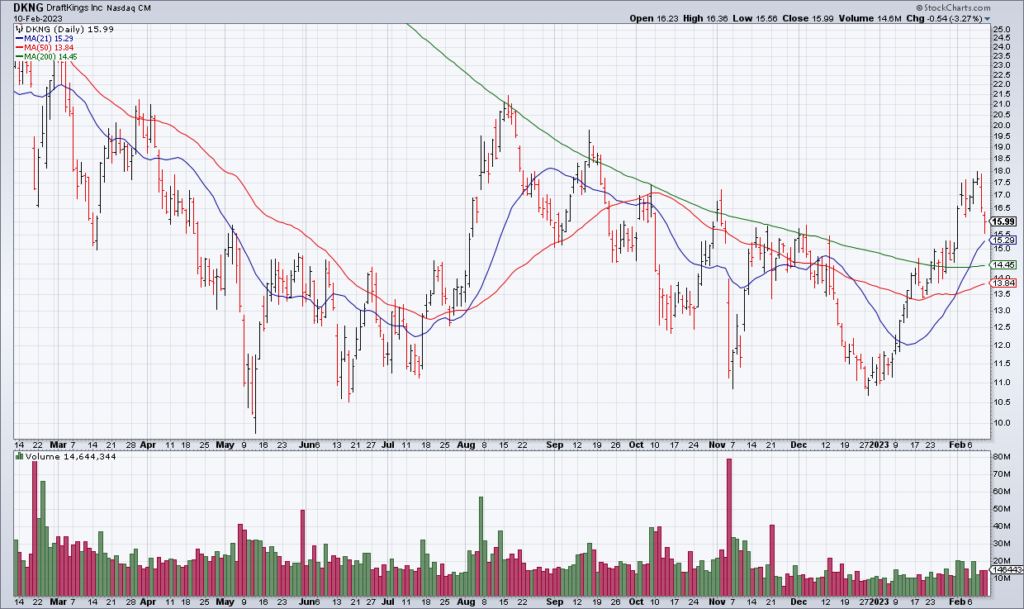

Last is DKNG which is an app for sports betting with 1.6 million monthly unique payers. Similar to the trend toward the legalization of marijuana, the US is slowly moving toward the legalization of sports gambling, state by state. DKNG is one of the leaders enabling sports betting through its app. A lot of people will be betting on the Super Bowl this weekend using DKNG.

The economic future is app based and digital. This secular trend is still in the early innings and these are four of the companies leading the way. While we have a nasty recession still in front us, these companies are building the foundation for the economy of the future. It’s worth paying attention because getting in early on the next generation of stock market leaders is one of the perennial strategies for investment outperformance.