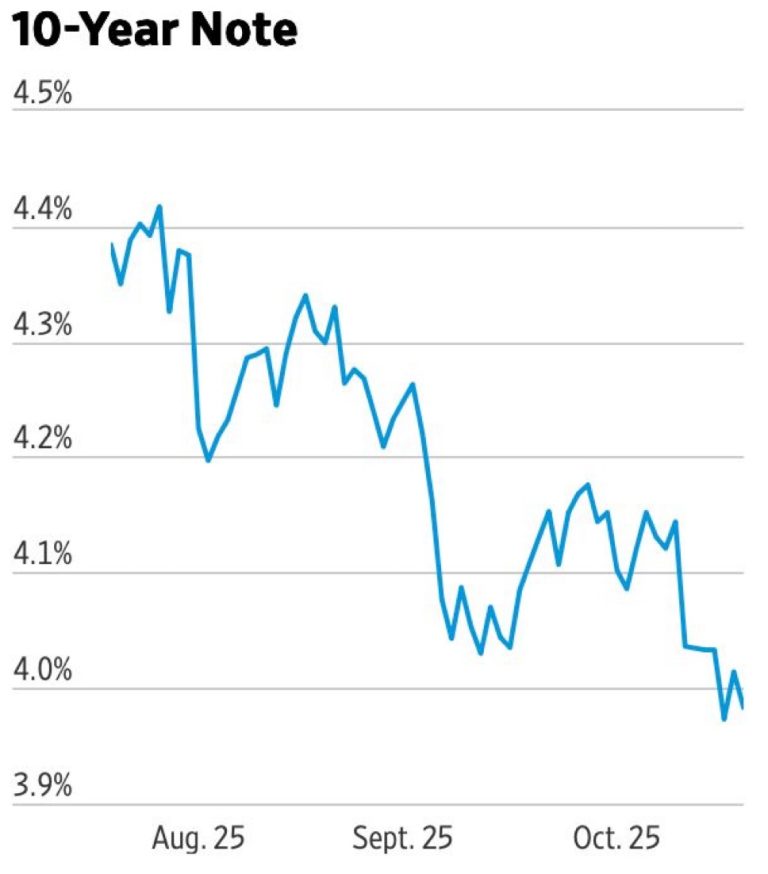

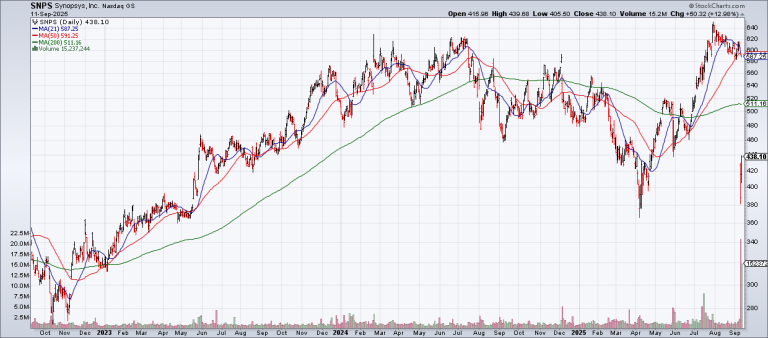

The State of the Market; The Debate Over Interest Rates; Gold Crash

The S&P continues to trade within the 200 point candle from Friday October 10th defined by 6750 on the topside and 6550 on the bottom. From a technical standpoint, until we breakout of that candle one way or the other…