Some Perspective On Gold

*****

If you can keep your head when all about you are losing theirs.– Rudyard Kipling “If”

Societe Generale wrote a piece titled “The End Of The Gold Era”. Goldman Sachs recommended shorting it. The New York Times ran a feature on Thursday (“Gold, Long A Secure Investment, Has Lost Its Luster”, Thursday, April 11, B1). Paul Krugman devoted his Friday op-ed to it. This morning, Josh Brown wrote an over the top obituary to the gold bull market while insinuating that belief in gold is equivalent to religious faith: “Where the $#!@ is your Gold Messiah now?” he bellowed.

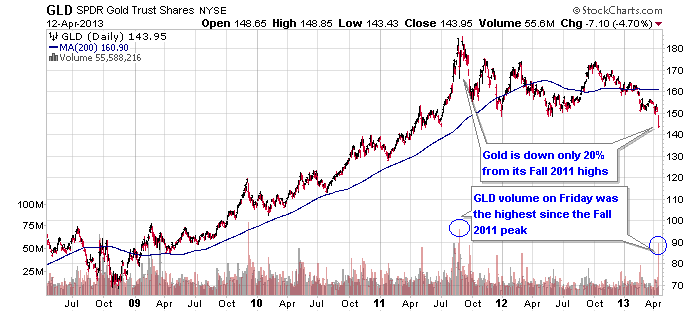

Based on the quantity and tone of the chatter, you’d think gold was on its way out. In fact, it is down only 20% since its 2011 highs. Let me say that again: gold is down only 20% from its 2011 highs. A 10 year chart shows that gold is still up nearly 300% in that time period.

A longer term perspective suggests that this is merely a blip in an ongoing secular bull market. All of the factors that have driven gold higher the last 10 years are still in effect. Gold is a store of value that trades inversely to the supply of and confidence in paper money. The creation of new money by global central banks has never been greater at any time in history. The Federal Reserve, the ECB and now the BOJ.

Technically, volume in the GLD Friday exceeded 50 million shares for the first time since the peak in the Fall of 2011. Just as there are countless bearish stories on gold now, there were bullish stories back then. We are much closer to the end of this correction than to the beginning of a collapse.

*****

The best lack all conviction, while the worst are full of passionate intensity.

– William Butler Yeats, “The Second Coming”

For many of us this weekend is a good time to take a deep breathe and aim for some longer term perspective. I have spoken to investors who are panicked to get into the stock market and others who are completely despondent about the crash in the gold market. I have said it many times and it bears repeating: extreme emotion is the surest sign of a market turning point. It is at times like these that our mettle as investors is tested. The temptation is to act reactively and impulsively but that is always a losing investment strategy. Now, more than ever, conviction and patience are needed (“The Need For Conviction And Patience”, February 18).