An Analysis Of My Trading – The Dangers Of Short Selling And The Energy Book Every Investor Must Read

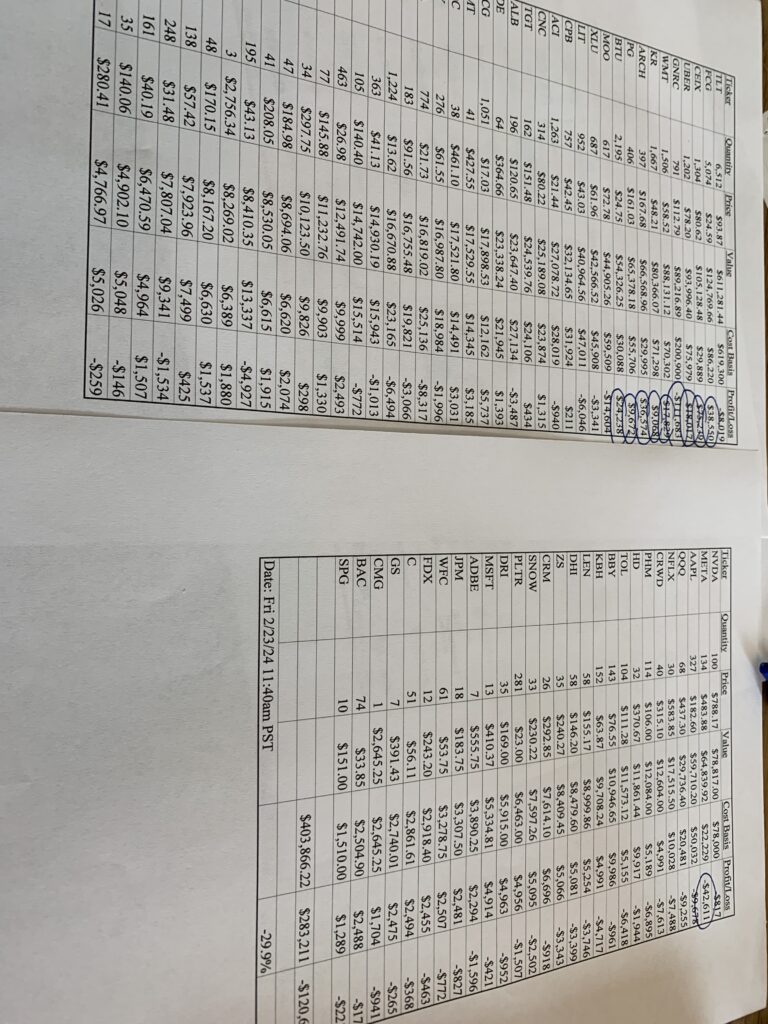

If you want to get better at trading – or anything else – you need to keep records and track your results. The way I do this is by having Excel spreadsheets with all of my positions, their quantity, current…