Extreme Bullish Sentiment For A Year End Rally Ahead Of Fed Decision/Taper, The Economy Is Hot: SPG LYFT MTCH Earnings, Bought Some MOS

The bullish sentiment for a year end rally is palpable. The Russell 2000 Small Caps ETF (IWM) closed up 49 cents (0.21%) on average volume Tuesday – hardly a convincing move – and yet the Twitter technicians were jumping over each other to call it a “breakout” and projecting a new leg higher.

I’m not saying it can’t happen but it does get my attention when seemingly everybody is expecting the same thing. If they’re all positioned that way, there’s not a lot of buying power on the sidelines to come into the market and push it higher while there is significant potential selling pressure from longs already in to push it lower.

Wednesday will be a crucial day in my opinion as the Fed is likely to announce a taper. This is prima facie bearish and it will be interesting to see how the market reacts should the Fed do so. It’s not like the Fed hasn’t done its best to prepare the market for it but that doesn’t mean it’s priced in. The press release will come out at 2pm EST followed by a press conference by Chairman Powell at 2:30pm EST.

Simon Property Group (SPG), a $50 billion market cap mall operator, reported sparkling earnings on Monday afternoon. Revenue was up another 3.38% compared to 2Q21 and they raised 2021 Funds From Operations (FFO) guidance 85 cents to $11.55 to $11.65. The stock jumped 6.45% on almost 3x average volume Tuesday and is now up 146% over the last year. Earnings reports from Lyft (LYFT) and Match Group (MTCH) confirmed how hot the economy is right now.

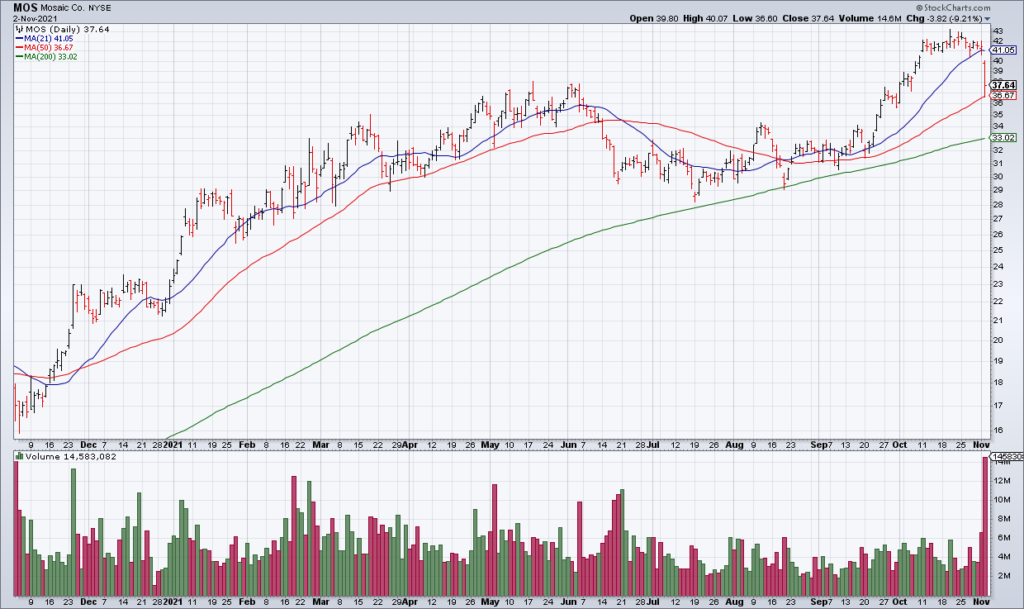

Mosaic (MOS), a $15 billion market cap fertilizer producer, reported an excellent quarter Monday afternoon but the stock got hit 9.21% on 3x average volume to close at $37.64 Tuesday. They earned $1.35/share in 3Q21 – up from $1.17 2Q21 – and projected even higher prices for phosphate and potash in 4Q21. If you think this is sustainable – as I do – and do the math, MOS is trading at 6-7x forward earnings. I took the selloff as an opportunity to initiate a small position.