Interest Rates, Indecision, Complacency and A Big Week Ahead

The great hedge fund manager David Tepper of Appaloosa Management gave an extended interview [CNBC Pro Subscription Required] to Scott Wapner on Friday’s Fast Money Halftime Report on CNBC. The key takeaway in my opinion is that interest rates will determine the direction of the stock market for the remainder of the year in his opinion. I completely agree. If interest rates hold steady we could get a “trader’s rally”. If they move higher, the stock market may well go lower, Tepper said.

In addition to the Tepper interview, Friday was an interesting trading day. After making an all time high in the first hour, the S&P hit what can best be described as an “air pocket”, losing 35 points from 7:30am PST to 8:45am PST. Then it rallied 20 points over the next hour while flatlining over the remaining 3 1/2 hours of the session. This created a “doji”, as you can see in the tweet above from the technician Callum Thomas, which represents “indecision” and can be a “key trend reversal indicator” according to him. The latter is yet to be seen but the shakeout in the morning was enough for me to take another shot on the short side.

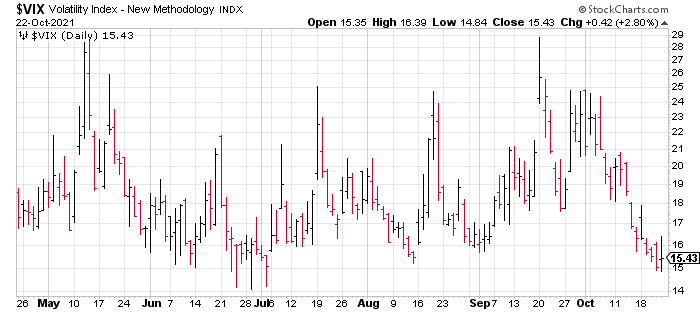

The VIX or “Fear Index” is based on the price of out of the money puts and calls. When it is low, investors are complacent; when high, fearful. It closed at the year’s low of 15.01 on Thursday and only moved slightly higher on Friday to close at 15.43 (it reached a high of 16.39 intraday Friday). In other words, investors are the most complacent they have been all year after the powerful rally we have seen over the last week and a half.

In fact, it feels like almost everyone believes the traditional year end rally is underway and is positioned accordingly. Paradoxically, when everyone is positioned one way that creates a lot of risk for a move in the opposite direction.

So there is a lot going on as we head into the biggest week of 3Q earnings season.