BMBL Provides More Evidence For My Bifurcated Market Thesis

The market is bifurcated into the mega cap tech stocks that have held up well so far – and thus propped up the indexes – and the smaller but still important stocks that have already suffered brutal bear markets. My premise is that the mega cap tech stocks will roll over into their own bear markets over the course of 2022 while there are opportunities to pick up the leaders of tomorrow in the stocks that have already suffered brutal bear markets – “The Bifurcated Market”, Top Gun Financial, February 16

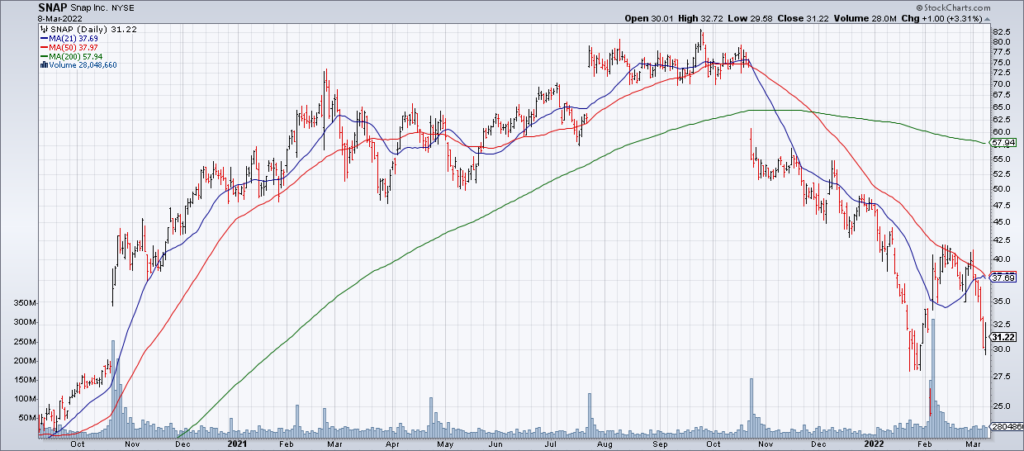

On February 2, Facebook (FB) reported terrible 4Q21 earnings and the stock got slaughtered the next day. Snapchat (SNAP) – which was scheduled to report its own 4Q21 earnings after the close on February 3 – was down 20% ahead of its report in sympathy with FB.

I sensed an opportunity and picked up shares. SNAP’s report was solid and shares rallied 60% on Friday February 4. That was my first clue that while mega cap tech had not yet rolled over and was propping up the major indexes, beneath the surface some of the “leaders of tomorrow” – which had already been hit 50% to 80% – were in fact bottoming and presenting opportunities.

While I am not calling for a V-shaped bottom in the “leaders of the future”, BMBL’s report Tuesday afternoon provides more evidence for my thesis that they are in fact in the bottoming process. As you can see in the chart above, BMBL had lost ~80% of its value from the time of its IPO about a year ago heading into today’s earnings reports. Investors accelerated their dumping of the shares heading into the report on concerns about Badoo’s exposure to Russia/Ukraine (Badoo is a BMBL subsidiary). Last Thursday, I sensed opportunity and increased my position from 1% to 3%. While the stock continued to get hit Friday and Monday, my conviction was that if BMBL reported a solid quarter, the stock could rally hard. And that’s exactly what appears to be happening.

BMBL 4Q21 Paying Users, Revenue, Adjusted EBITDA as well as 1Q22 and full year 2022 guidance were all solid. BMBL is in the early stages of its growth cycle and its results continue to suggest that it is progressing nicely. As a result of the oversold condition of the stock and the solid report, BMBL shares are currently up ~20% in the after hours. While I don’t expect a V-shaped rebound in BMBL – or any of my other “leaders of the future” – due to contractionary macroeconomic forces, I do think they are bottoming and it is time to start establishing positions.

Another way of looking at my bifurcation thesis is to compare QQQ with ARKK. I associate QQQ with mega cap tech and ARKK with early stage growth, of which my “leaders of the future” are a subset. As you can see in the chart above, while QQQ peaked only three months ago and has had a 20% drawdown since, ARKK peaked in February 2021 with the selling accelerating in the last four months for a 60% drawdown. What I’m saying is that the stocks in QQQ are sells as they have not had their bear market unwind yet, while some stocks similar to those in ARKK represent “leaders of the future” that are in the process of bottoming. As I wrote in “The Bifurcated Market II”: “This is a unique perspective that I have not seen articulated elsewhere”.