Bear Market Rallies Are Ferocious; Use Today’s To Clean Up Your Portfolio

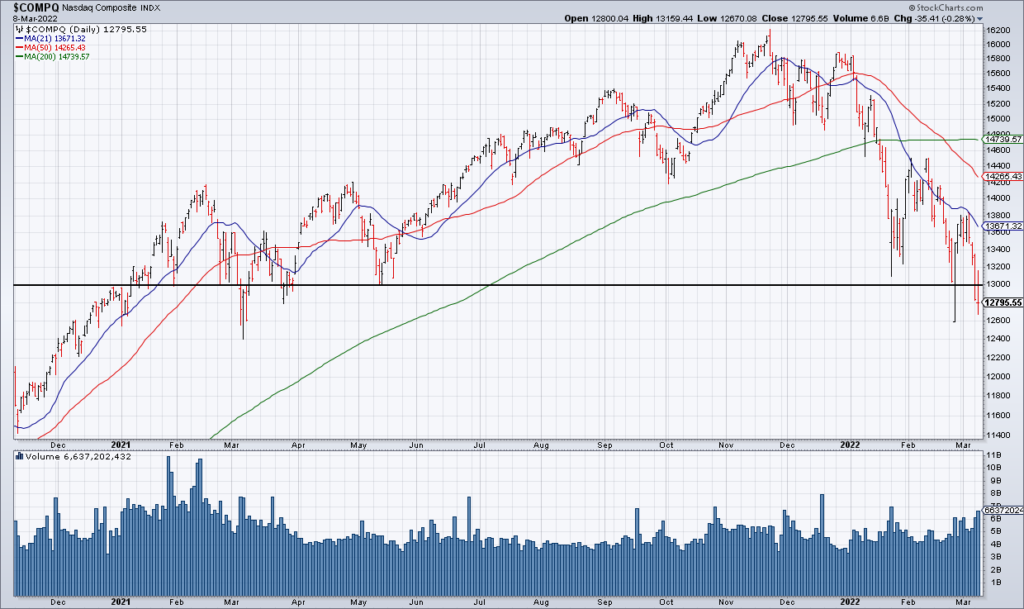

Germany’s DAX and France’s CAC are currently +5%. Britain’s FTSE and US Futures are +2%. It’s looking like today is going to be a face ripper of a bear market rally. However, this does not mean the bottom is in. Indeed, I think it highly unlikely. While the NASDAQ looks poised to reclaim 13,000 today, I’d expect the bear market to resume shortly. Therefore, this isn’t a time to go big but to clean up and right size your portfolio into strength.

Tomorrow morning is the March CPI report which is likely to come in hot and shift the market’s focus from Russia/Ukraine to the upcoming Fed Decision next Wednesday (March 16). Will they raise 25 basis points or 50 basis points? Because this could put a damper on the market in the days heading into the Fed Decision, I’d use today to clean up one’s portfolio.

Personally, I’m going to use today’s strength to reduce positions in my “leaders of the future”. These are my investments in early stage growth companies based on my bifurcated market thesis. While I think these stocks are bottoming, it’s a process and contractionary macroeconomic forces preclude a prolonged V-shaped rally in my opinion.

This is where I differ with Puru Saxena. While I think he’s right that early stage growth now represents opportunity, I don’t think one has to be in a hurry due to the foregoing reasons (it’s a process, no V-shaped rally due to contractionary macroeconomic forces). (As for ARKK specifically, the bubble has “mostly” popped in my opinion though I expect the real bear market bottom to be in the $40-$50 range. It is currently ~$60). Therefore, my goal is to reduce this part of my portfolio from a current 20% to 13%-14%.