The State of the Market Heading Into The CPI

With inflation raging, the monthly CPI Report has replaced the Jobs Report as the government economic number with the most impact. Let’s take a look at the state of the market heading into the February CPI Report Thursday morning at 8:30am EST.

Wednesday’s Big Rally

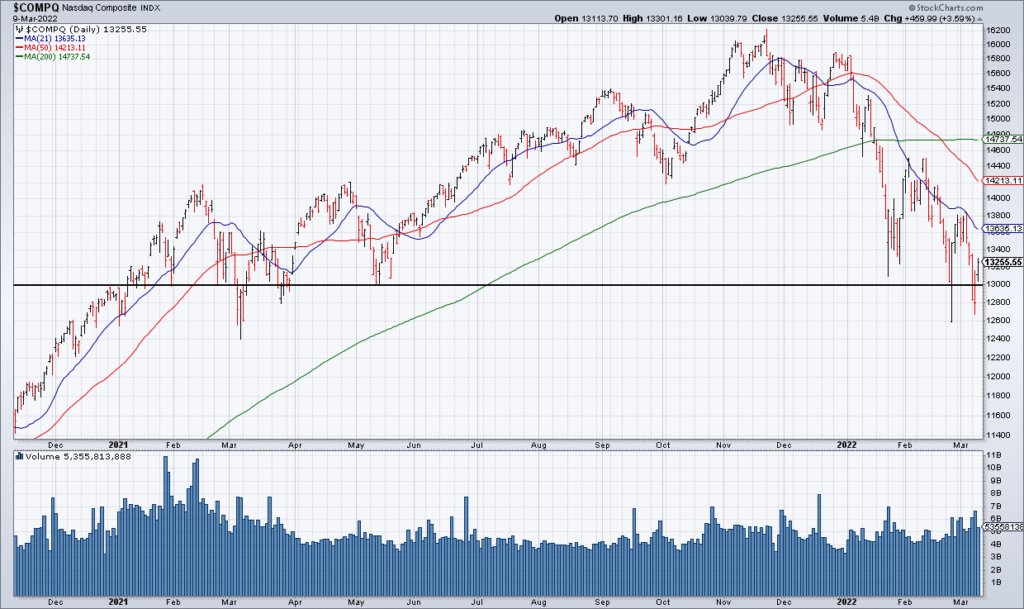

The NASDAQ closed Tuesday at its lowest level in about one year so Wednesday’s +3.59% rally relieved quite a bit of oversold pressure. Instead of being set up for an oversold bounce, the market is in a much more neutral position heading into the big number.

For that reason – as I recommended this morning (“Bear Market Rallies Are Ferocious; Use Today’s To Clean Up Your Portfolio”, Top Gun Financial, Wednesday March 9) – I sold some early stage growth and added to my short positions into the strength to tilt my portfolios marginally more bearish. I don’t know what the number will be but the technical condition of the market merits a slightly more bearish stance after Wednesday’s big move.

The market can move higher on a lower than expected number. However, a hotter than expected number risks a resumption of the downtrend. The line in the sand feels to me like 8.0%. (January’s number was 7.5%).

The CPI and The Fed

One of the reasons Thursday’s CPI Report is so important is that it will be a crucial input in the Fed’s decision about how much to raise interest rates next Wednesday (March 16). Powell told Congress last week that he believes a 25 basis point increase is appropriate. However, a hotter than expected CPI number likely puts 50 basis points back on the table. Developments in Russia/Ukraine will factor into the Fed’s decision as well.

Interest Rates

Russia’s invasion of Ukraine caused investors to buy US treasuries, relieving pressure on rising interest rates for a moment. Everybody seems to have forgotten about the 10 year yield breaching 2% a month ago (with the January CPI Report as the catalyst). However, interest rates have been surreptitiously creeping higher with the 10 year yield closing at 1.95% Wednesday. A hotter than expected number Thursday morning could cause interest rates to resume their trend higher and the market spotlight to refocus on that with all of its negative implications.

Wednesday’s market action was clearly bullish, Bumble’s (BMBL) 4Q21 earnings report provides more evidence that early stage growth is in the bottoming process and Amazon’s (AMZN) announcement of a 20 for 1 split after the close has its shares +7% in the after hours. But Thursday is a new day and the CPI Report is likely to determine the short term direction of the market going forward.