The Bifurcated Market: Why NVDA Is A Sell And DASH A Buy

As I wrote this morning in the context of Shopify (SHOP), the market is bifurcated into the mega cap tech stocks that have held up well so far – and thus propped up the indexes – and the smaller but still important stocks that have already suffered brutal bear markets. My premise is that the mega cap tech stocks will roll over into their own bear markets over the course of 2022 while there are opportunities to pick up the leaders of tomorrow in the stocks that have already suffered brutal bear markets. The cases of Nvidia (NVDA) and DoorDash (DASH) – which both reported earnings Wednesday afternoon – illustrate my point.

NVDA reported an excellent quarter with revenue +8% and EPS +13% sequentially to $7.6 billion and $1.32, respectively. Guidance for the current quarter was solid as well. But the stock is currently -2% in the after hours. Why? At 50x my estimate of $5.25 EPS for calendar year 2022, all the good news is already priced in. As you can see in the NVDA chart above, the stock has suffered more of a correction – about 20% off its highs – than a bear market. In other words, you’re not yet getting a big enough discount – given the current market environment – to buy NVDA well.

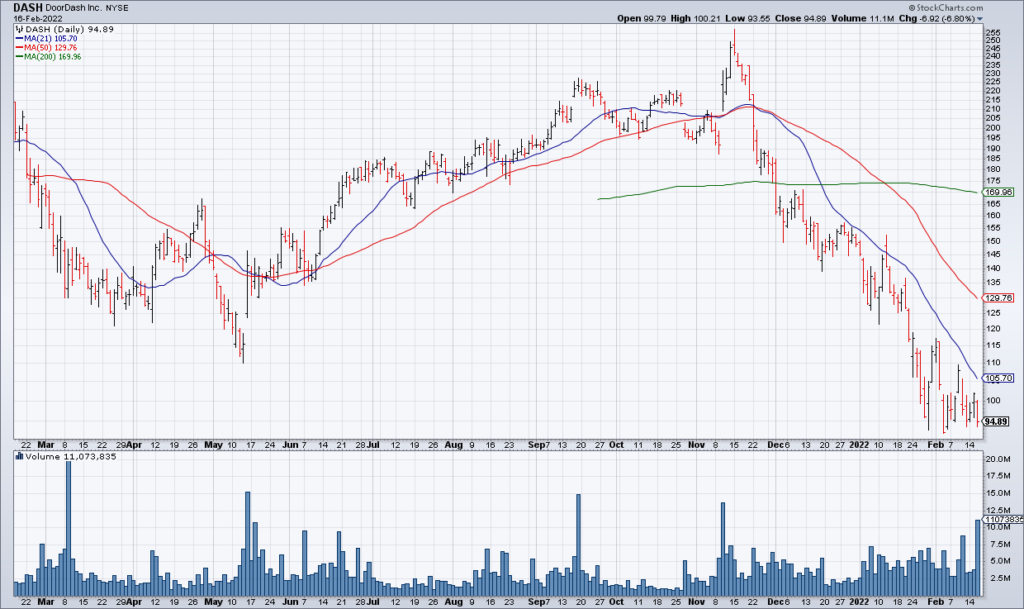

DASH is another story. Gross Order Volume (GOV) of $11.2 billion was +7% sequentially and current quarter guidance of $11.4-$11.8 billion represents +4% sequential growth at the midpoint. In many ways, NVDA and DASH’s earnings reports are equivalent. And yet DASH is currently +28% in the after hours. Why? It’s not that DASH is all that cheap of a stock but with a brutal drawdown of over 60% in the last three months a lot bad news is priced in. As you can see in the DASH chart above, the stock has already suffered a brutal bear market. (Note: I consider DASH a high quality business and what I have been calling a “leader of the future”).

Along the same lines, I’m interested to see the reaction to Palantir (PLTR) earnings Thursday morning and DraftKings (DKNG) Friday Morning.