“Please Make A U-Turn. Thank You. Recalculating Route.”

GPS maker Garmin (GRMN) is getting torched again today after reporting disappointing 2nd quarter earnings before the open (GRMN 2nd Quarter Earnings Release). They reported earnings of 94 cents a share, excluding a 25 cent per share gain on the sale of some stock they owned in another company, which is below analyst estimates for $1.00. They also lowered their full year outlook to EPS of $4.13 a share on revenue of $3.9 billion from EPS in excess of $4.40 on revenue in excess of $4.5 billion (GRMN 4th Quarter Earnings Release, pg. 3).

Garmin makes those cool, or annoying, Global Positioning Systems (GPS) found in cars that tell people how to get where they’re going: “Make a left at Rosecrans. Make a left at Rosecrans. Thank You…… Re-calculating route….. Re-calculating route.” It’s a pretty cool product, at least in concept, that is useful to a lot of people who don’t want to be bothered with maps.

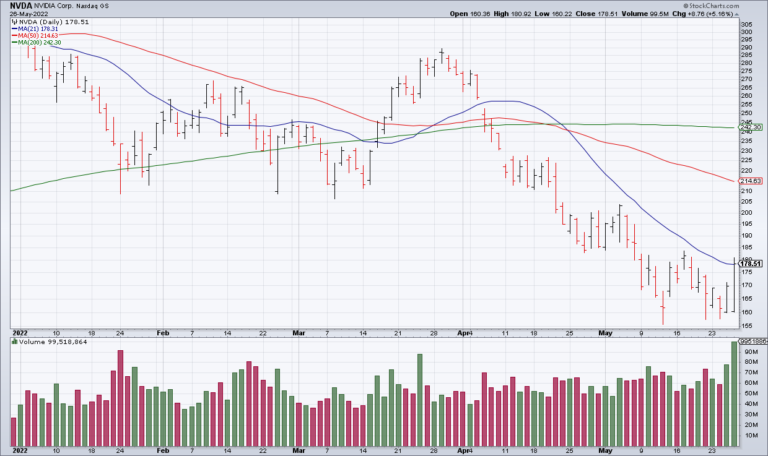

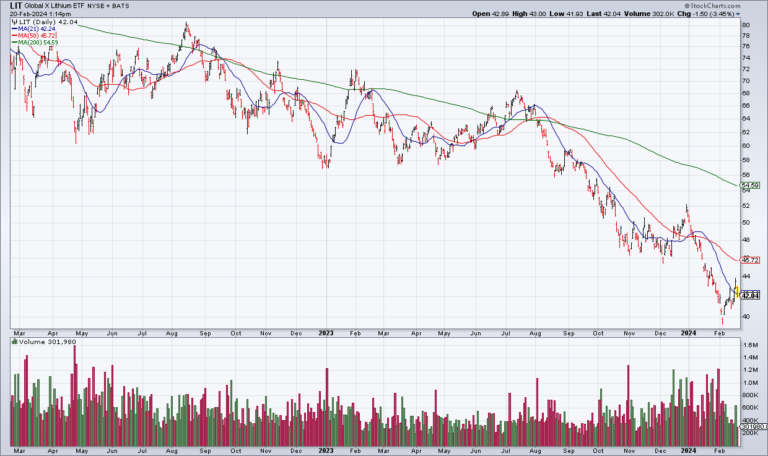

But the stock, one of the hottest performers of 2007, has been completely torched this year (GRMN 2 Year Chart). Sales growth, profit growth and margins are all declining.

Still, the company is highly profitable and has $1 billion, or nearly $5 a share, of cash and and marketable securities on its balance sheet and no debt. When you back out the cash it’s trading for about 8 times this year’s forecast earnings. That’s cheap for a company with the leading product in a hot market that is growing much faster than that.

The stock is almost universally hated at this point with 23 million of 216 million outstanding shares sold short. The chart tells the story here.

It’s starting to get interesting to me. Something doesn’t feel quite right to me which is why I’m not buying yet. It could be that their business is under so much pressure from the economy, competition and saturation that it still has a ways further to fall. But I’m paying attention.

Disclosure: Top Gun has no position in Garmin (GRMN) shares.